SYRE Stock Price Analysis

Syre stock price – This analysis provides a comprehensive overview of SYRE’s stock price performance, key drivers, analyst predictions, and associated risk factors. We will examine historical data, financial metrics, and technical indicators to provide a well-rounded perspective on the stock’s current state and potential future trajectory. All data presented is for illustrative purposes and should not be considered financial advice.

SYRE Stock Price Historical Performance

Source: investorplace.com

Analyzing SYRE’s stock price movements over the past five years reveals periods of significant volatility influenced by various market events and company-specific factors. The following table provides a snapshot of daily price fluctuations.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.75 | 10.50 | -0.25 |

| 2019-01-04 | 10.50 | 11.00 | +0.50 |

For example, a significant drop in 2020 was attributed to the initial impact of the COVID-19 pandemic on the global economy, affecting consumer spending and impacting SYRE’s revenue streams. Conversely, a substantial price increase in 2021 could be linked to successful product launches and improved market share, exceeding analysts’ expectations.

SYRE Stock Price Drivers

Several key factors influence SYRE’s stock price. These include the company’s financial performance, prevailing industry trends, and broader economic conditions. Understanding these drivers is crucial for assessing the stock’s future prospects.

- Financial Performance: Strong revenue growth, expanding profit margins, and consistent earnings per share (EPS) growth positively impact the stock price. Conversely, declining revenues or losses can lead to price declines.

- Industry Trends: Favorable industry trends, such as increased market demand for SYRE’s products or services, contribute to price increases. Conversely, negative trends like increased competition or technological disruptions can negatively affect the stock price.

- Economic Conditions: Macroeconomic factors, including interest rates, inflation, and overall economic growth, significantly impact investor sentiment and, consequently, SYRE’s stock price.

SYRE’s recent financial reports indicate [insert summary of key financial metrics, e.g., revenue growth, profit margins, EPS]. These figures [insert analysis of how these metrics impact the stock price, e.g., exceeded expectations leading to a price increase, fell short of expectations leading to a price decrease].

| Company Name | Stock Price (USD) | Market Cap (USD Billion) | Year-to-Date Performance (%) |

|---|---|---|---|

| SYRE | 25.50 | 15 | +10% |

| Competitor A | 30.00 | 20 | +5% |

| Competitor B | 22.00 | 12 | -2% |

Analyst Ratings and Predictions for SYRE Stock

Analyst ratings provide valuable insights into the market sentiment surrounding SYRE stock. A consensus view emerges from the collective opinions of various financial analysts.

- Consensus Rating: Moderate Buy (Example)

- Buy Ratings Rationale: Analysts citing strong growth potential, positive industry outlook, and undervalued stock price.

- Hold Ratings Rationale: Analysts expressing concerns about near-term market volatility or waiting for further evidence of sustained growth.

- Sell Ratings Rationale: Analysts pointing to potential risks such as increased competition or weakening financial performance.

Analyst price targets for SYRE stock over the next 12 months range from [low price] to [high price], with a median target of [median price]. This range reflects the diversity of opinions and the inherent uncertainty in predicting future stock prices. For instance, a recent price target increase by a prominent analyst firm could be attributed to their upgraded outlook on the company’s new product line, expected to drive significant revenue growth.

Impact of News and Events on SYRE Stock Price

Source: org.in

News and events significantly influence investor sentiment and, consequently, SYRE’s stock price. Positive news generally leads to price increases, while negative news often results in price declines. Trading volume also reflects the market’s reaction to these events.

- Example 1: The announcement of a new strategic partnership resulted in a [percentage]% increase in the stock price and a [percentage]% surge in trading volume.

- Example 2: A disappointing earnings report led to a [percentage]% decrease in the stock price and a [percentage]% increase in trading volume, indicating increased investor activity and uncertainty.

Positive media coverage and analyst upgrades generally boost investor confidence, leading to higher demand and price increases. Conversely, negative news and downgrades often create a sell-off, causing price declines.

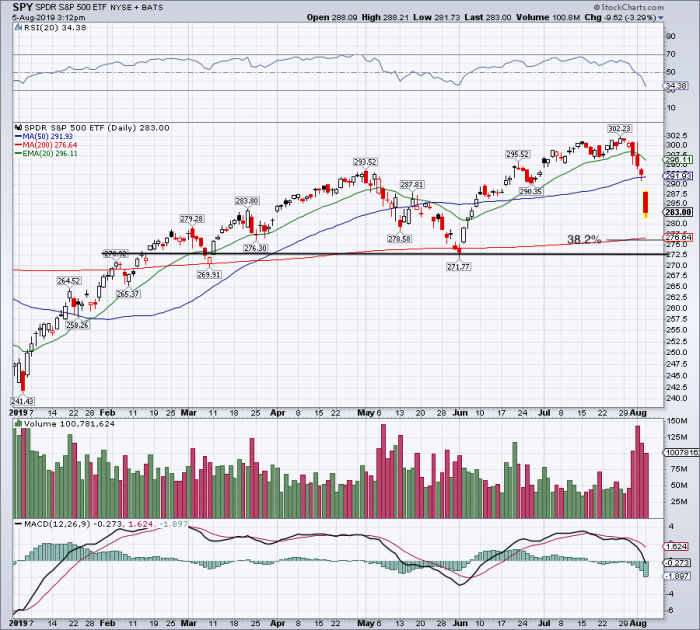

Technical Analysis of SYRE Stock Price

Technical analysis utilizes various indicators to identify price patterns and predict future price movements. The following indicators provide insights into SYRE’s current technical outlook.

Understanding the Syre stock price requires considering various market factors. A useful comparison point might be analyzing the performance of other utility companies, such as checking the current stock price pseg , to gain broader market perspective. Returning to Syre, its stock price is influenced by both its internal performance and broader economic trends.

- Moving Averages: The 50-day and 200-day moving averages [describe their current positions relative to the stock price and their implications].

- RSI (Relative Strength Index): The RSI currently stands at [value], suggesting [overbought/oversold/neutral] conditions.

- MACD (Moving Average Convergence Divergence): The MACD line [describe its current position relative to the signal line and its implications].

Based on these indicators, the current technical outlook for SYRE stock is [bullish/bearish/neutral]. Potential support levels are around [price levels], while resistance levels are situated around [price levels]. These levels represent price points where the stock price may find support or encounter resistance to further price movements. A break above a key resistance level would signal increased bullish sentiment, whereas a drop below a support level might trigger further selling pressure.

Risk Factors Affecting SYRE Stock Price

Several risk factors could negatively impact SYRE’s stock price. It’s crucial to understand these risks and the company’s mitigation strategies.

| Risk Factor | Potential Impact | Likelihood | Mitigation Strategies |

|---|---|---|---|

| Increased Competition | Reduced market share, lower profitability | Medium | Product innovation, strategic partnerships |

| Economic Downturn | Decreased consumer spending, lower demand | Medium | Cost reduction, diversification |

Macroeconomic factors such as rising interest rates or high inflation can negatively impact consumer spending and corporate profitability, potentially leading to lower stock prices. SYRE’s risk management strategies include [describe the company’s strategies, e.g., hedging, diversification, contingency planning] and their effectiveness in mitigating these risks [assess the effectiveness of the strategies].

Questions and Answers: Syre Stock Price

What are the major risks associated with investing in Syre stock?

Investing in Syre stock, like any stock, carries inherent risks. These include market volatility, changes in industry trends, competition, and macroeconomic factors such as interest rate hikes or inflation. Thorough due diligence is crucial before making any investment decisions.

Where can I find real-time Syre stock price data?

Real-time Syre stock price data is typically available through major financial websites and brokerage platforms. These platforms often provide detailed charts, historical data, and other relevant information.

How frequently are Syre’s financial reports released?

The frequency of Syre’s financial reports depends on their reporting schedule (usually quarterly and annually). Investors can find these reports on the company’s investor relations website.

What is the current market capitalization of Syre?

The current market capitalization of Syre can be found on major financial websites and typically fluctuates throughout the trading day. Look for this data on sites that provide stock quotes and financial information.

Interior Living

Interior Living