Market Influences on Tanker Stock Prices

Tanker stock prices are significantly influenced by a complex interplay of global market forces. Understanding these influences is crucial for investors seeking to navigate the volatility inherent in this sector.

Global Oil Prices and Tanker Stock Valuations

Global oil prices have a direct correlation with tanker stock valuations. Higher oil prices generally lead to increased demand for oil transportation, boosting tanker charter rates and subsequently improving the profitability of tanker companies. Conversely, lower oil prices can reduce shipping volumes, negatively impacting tanker stock performance. This relationship is not always linear, however, as other factors such as supply and demand for tankers themselves also play a significant role.

Global Trade Routes and Tanker Stock Performance

Changes in global trade routes significantly impact the demand for tanker services. The opening of new trade lanes or shifts in global economic activity can create new opportunities for tanker companies, increasing demand and positively affecting stock prices. Conversely, disruptions to established trade routes, such as geopolitical instability or port closures, can negatively impact tanker stock performance.

Geopolitical Events and the Tanker Shipping Market

Geopolitical events often cause significant volatility in the tanker shipping market. International conflicts, sanctions, or political instability in key oil-producing or consuming regions can disrupt oil supply chains, leading to fluctuations in tanker demand and subsequent stock price changes. For example, the Suez Canal blockage in 2021 caused temporary but significant disruptions to global trade, impacting tanker stock prices.

Supply and Demand Dynamics in the Tanker Market

The balance between the supply and demand for oil tankers is a critical factor determining stock prices. A shortage of available tankers, driven by factors such as limited newbuilding orders or increased scrapping rates, can lead to higher charter rates and increased profitability for tanker companies. Conversely, an oversupply of tankers can depress charter rates, negatively impacting stock prices.

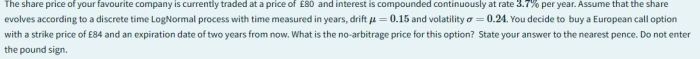

Correlation Between Oil Prices and Tanker Stock Prices

The following table illustrates the correlation between oil prices (Brent Crude) and the stock prices of three major tanker companies (hypothetical data for illustrative purposes):

| Month | Brent Crude Price (USD/barrel) | Company A Stock Price (USD) | Company B Stock Price (USD) | Company C Stock Price (USD) |

|---|---|---|---|---|

| January | 80 | 50 | 60 | 40 |

| February | 85 | 55 | 65 | 45 |

| March | 75 | 45 | 55 | 35 |

| April | 90 | 60 | 70 | 50 |

| May | 88 | 58 | 68 | 48 |

| June | 95 | 65 | 75 | 55 |

| July | 92 | 62 | 72 | 52 |

| August | 82 | 52 | 62 | 42 |

| September | 78 | 48 | 58 | 38 |

| October | 85 | 55 | 65 | 45 |

| November | 90 | 60 | 70 | 50 |

| December | 87 | 57 | 67 | 47 |

Tanker Stock Price Volatility and Forecasting

Tanker stock prices are notoriously volatile, influenced by a multitude of factors. Predicting short-term fluctuations requires a comprehensive understanding of these factors and the use of appropriate forecasting techniques.

Factors Contributing to Tanker Stock Price Volatility

Several factors contribute to the volatility of tanker stock prices. These include fluctuations in oil prices, changes in global trade patterns, geopolitical events, and supply-demand imbalances in the tanker market. Furthermore, investor sentiment and speculation can significantly amplify price swings.

Methods for Predicting Short-Term Fluctuations

Predicting short-term fluctuations in tanker stock prices is challenging but can be approached using various methods. Technical analysis, which examines historical price and volume data to identify patterns and trends, can be useful. Fundamental analysis, which assesses the underlying financial health and prospects of tanker companies, provides another perspective. Combining these approaches with an understanding of macroeconomic factors can improve forecasting accuracy.

Key Economic Indicators for Assessing Future Price Movements

Source: cheggcdn.com

Several key economic indicators can help assess the potential for future price movements in tanker stocks. These include global oil demand forecasts, the Baltic Dry Index (BDI) as a proxy for overall shipping activity, and various macroeconomic indicators reflecting global economic growth or contraction. Monitoring these indicators provides valuable insights into the potential future direction of tanker stock prices.

Hypothetical Scenario: Geopolitical Event Impact

Consider a hypothetical scenario where a major geopolitical event disrupts oil supply from a key producing region. This would likely lead to a sharp increase in oil prices, driving up demand for tanker transportation and consequently boosting tanker stock prices in the short term. However, the long-term impact could be negative if the disruption leads to a prolonged slowdown in global economic activity.

Risks and Opportunities in Tanker Stock Investing

- Risks: High volatility, sensitivity to oil price fluctuations, geopolitical risks, cyclical nature of the industry, environmental regulations.

- Opportunities: Potential for high returns during periods of strong oil demand and tight tanker supply, dividend income from established companies, long-term growth potential driven by global trade.

Company-Specific Factors Affecting Tanker Stock Prices

While market forces play a significant role, company-specific factors also significantly influence tanker stock prices. Understanding these factors is crucial for making informed investment decisions.

Financial Performance Comparison of Tanker Companies

Source: foleon.com

A comparison of the financial performance of three major tanker companies (again, hypothetical data) reveals that companies with strong profitability, efficient operations, and robust balance sheets tend to have higher stock valuations. Companies with high debt levels or declining profitability often see their stock prices depressed.

Impact of Fleet Modernization and Expansion

Investing in fleet modernization and expansion can significantly impact a tanker company’s stock valuation. Modern, fuel-efficient vessels reduce operating costs and improve profitability, making the company more attractive to investors. Expansion of the fleet increases capacity and allows the company to capitalize on periods of high demand.

Debt Levels and Credit Ratings

High debt levels and low credit ratings can negatively impact investor sentiment towards tanker stocks. High debt increases financial risk, making the company more vulnerable to economic downturns. Conversely, strong credit ratings and low debt levels signal financial stability and attract investors.

Management Decisions and Corporate Strategy, Tanker stock price

Effective management decisions and a well-defined corporate strategy are crucial for a tanker company’s success. Strategic acquisitions, efficient fleet management, and effective cost control can all positively influence stock performance. Conversely, poor management decisions can lead to decreased profitability and lower stock prices.

Environmental Regulations and Tanker Stock Prices

Increasingly stringent environmental regulations are impacting the tanker shipping industry. Companies that proactively invest in cleaner technologies and comply with regulations are likely to be viewed more favorably by investors, leading to higher stock valuations. Companies failing to adapt to these regulations face increased costs and potential risks, impacting their stock prices negatively.

Investor Sentiment and Tanker Stocks

Investor sentiment plays a significant role in driving tanker stock price movements. Understanding how investor confidence and market psychology influence prices is vital for navigating the market effectively.

Investor Confidence and Tanker Stock Prices

High investor confidence generally leads to higher tanker stock prices. Positive news, strong financial performance, and favorable industry outlook can boost investor confidence, driving up demand and increasing prices. Conversely, negative news or concerns about the industry’s future can erode investor confidence, leading to lower prices.

News Events Impacting Investor Sentiment

Various news events can significantly impact investor sentiment. Announcements of major contracts, changes in oil prices, geopolitical developments, and environmental regulations can all influence investor perceptions and consequently, stock prices. For example, a sudden spike in oil prices can cause a surge in tanker stock prices due to increased demand for transportation.

Analyst Ratings and Investor Behavior

Analyst ratings and recommendations significantly influence investor behavior. Positive ratings from reputable analysts can attract investors, driving up stock prices. Conversely, negative ratings can lead to selling pressure and lower prices. It’s important to note, however, that analyst opinions are not always accurate and should be considered alongside other information.

Speculation and Market Psychology

Speculation and market psychology play a significant role in driving tanker stock price movements. Market sentiment can sometimes lead to price fluctuations that are not fully justified by underlying fundamentals. Understanding market psychology and identifying speculative bubbles can be crucial for managing investment risk.

Hypothetical News Event and its Impact

Imagine a news report detailing a major breakthrough in fuel-efficient technology for tankers. This positive news would likely boost investor confidence, driving up demand for tanker stocks and leading to a price increase. Conversely, news of a major oil spill caused by a tanker would likely negatively impact investor sentiment and depress stock prices.

Long-Term Trends and Outlook for Tanker Stocks: Tanker Stock Price

The long-term outlook for tanker stocks depends on several factors, including technological advancements, regulatory changes, and the overall health of the global economy. A comprehensive understanding of these trends is crucial for long-term investment strategies.

Long-Term Prospects for the Tanker Shipping Industry

The long-term prospects for the tanker shipping industry are tied to global oil demand and trade. While the transition to renewable energy sources poses a long-term challenge, the industry is expected to remain relevant for decades to come, driven by continued global demand for oil and petroleum products. This translates to continued, albeit potentially fluctuating, demand for tanker services.

Impact of Technological Advancements

Technological advancements, such as the development of more fuel-efficient vessels and improved navigation systems, are continuously shaping the tanker shipping industry. These advancements can reduce operating costs and increase efficiency, potentially improving the profitability and attractiveness of tanker companies to investors.

Tanker stock prices often fluctuate based on global events and oil demand. Understanding these shifts requires looking at broader market trends, and a comparison with other tech sectors can be insightful. For instance, checking the current performance of companies like Synaptics provides a contrasting perspective; you can see the synaptics stock price today to get a sense of the tech market’s overall health.

This, in turn, can inform your analysis of tanker stock price volatility, offering a more comprehensive view of the investment landscape.

Increased Regulation and Long-Term Investment Strategies

Increased environmental regulations and stricter safety standards are shaping the future of the tanker shipping industry. Companies that proactively adapt to these regulations and invest in cleaner technologies will be better positioned for long-term success. Investors need to consider the impact of these regulations when formulating their investment strategies.

Sustainability and Future Viability of the Tanker Shipping Industry

The sustainability and future viability of the tanker shipping industry are subject to ongoing debate. While the transition to renewable energy sources presents a significant challenge, the industry’s adaptability and its role in transporting essential goods suggest a continued, albeit evolving, role in the global economy. The industry’s long-term viability hinges on its ability to adapt to changing environmental and economic conditions.

Key Factors Influencing the Long-Term Outlook

- Global oil demand and consumption patterns

- Technological advancements in vessel design and efficiency

- Stringency of environmental regulations and compliance costs

- Geopolitical stability and global trade patterns

- Economic growth and global trade volumes

FAQs

What are the main risks associated with investing in tanker stocks?

Key risks include oil price volatility, geopolitical instability, changes in global trade patterns, and oversupply of tankers. Company-specific risks such as debt levels and operational inefficiencies also pose challenges.

How often do tanker stock prices typically fluctuate?

Tanker stock prices can exhibit significant daily, weekly, and monthly fluctuations due to their sensitivity to global events and market sentiment. Volatility is a defining characteristic of this investment.

Are there any ethical considerations when investing in tanker stocks?

Ethical considerations include environmental impact (oil spills, emissions), labor practices within the shipping industry, and the potential for involvement in activities that may conflict with investor values.

What are some alternative investments to consider alongside tanker stocks?

Alternative investments might include other shipping sectors (e.g., container shipping), energy-related stocks (e.g., renewable energy), or broader market indices offering diversification.

Interior Living

Interior Living