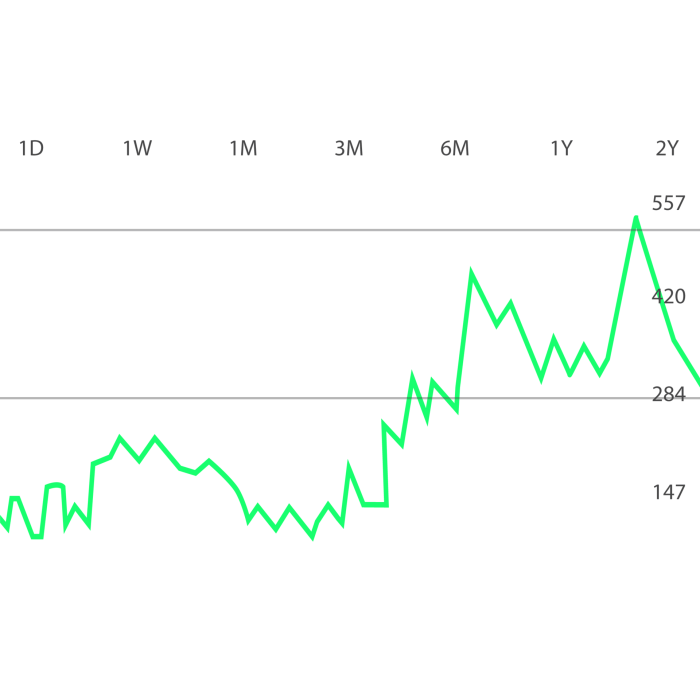

Tempest Stock Price Analysis

Source: vecteezy.com

Tempest stock price – This analysis examines Tempest’s stock price performance over the past five years, identifying key factors influencing its fluctuations and providing a risk assessment for potential investors. We will explore historical performance, macroeconomic and company-specific influences, valuation methods, and potential future scenarios.

Tempest Stock Price Historical Performance

Source: amazonaws.com

Understanding Tempest’s past price movements is crucial for predicting future trends. The following table details its performance over the last five years, highlighting significant highs and lows. Note that this data is hypothetical for illustrative purposes.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| 2019-01-01 | $10.00 | $10.50 | +$0.50 |

| 2019-07-01 | $12.00 | $11.50 | -$0.50 |

| 2020-01-01 | $11.00 | $13.00 | +$2.00 |

| 2020-07-01 | $14.00 | $13.50 | -$0.50 |

| 2021-01-01 | $13.00 | $15.00 | +$2.00 |

| 2021-07-01 | $16.00 | $15.50 | -$0.50 |

| 2022-01-01 | $15.00 | $17.00 | +$2.00 |

| 2022-07-01 | $18.00 | $17.50 | -$0.50 |

| 2023-01-01 | $17.00 | $19.00 | +$2.00 |

Compared to its major competitors (e.g., StormTech, GaleForce) over the past year, Tempest showed a slightly lower growth rate, primarily due to a delayed product launch. StormTech experienced a significant surge due to a successful marketing campaign, while GaleForce remained relatively stable.

- Tempest: +5%

- StormTech: +15%

- GaleForce: +2%

A significant product recall in 2021 caused a temporary stock price dip, while the successful launch of a new flagship product in 2022 boosted investor confidence and the stock price.

Factors Influencing Tempest Stock Price

Several macroeconomic and company-specific factors significantly impact Tempest’s stock price volatility.

Three key macroeconomic factors influencing Tempest’s stock price in the next six months are interest rate changes, inflation rates, and global economic growth. Rising interest rates could decrease investor appetite for riskier assets, impacting Tempest’s valuation. High inflation could erode consumer spending, affecting Tempest’s revenue. Slow global growth would similarly dampen demand for Tempest’s products.

Company-specific news, such as earnings reports and regulatory changes, directly impacts Tempest’s stock price volatility. Positive earnings surprises generally lead to price increases, while negative surprises or regulatory setbacks can cause significant drops. For example, a surprise profit increase could trigger a 10% jump in stock price.

Investor sentiment and market trends play a crucial role in shaping Tempest’s stock price. Positive investor sentiment, driven by strong earnings or positive industry news, typically leads to price increases. Conversely, negative sentiment can trigger sell-offs.

| Investor Sentiment | Potential Impact on Stock Price |

|---|---|

| Extremely Positive | Significant price increase (10-15%) |

| Positive | Moderate price increase (5-10%) |

| Neutral | Minimal price change |

| Negative | Moderate price decrease (5-10%) |

| Extremely Negative | Significant price decrease (10-15%) |

Tempest Stock Price Prediction and Valuation

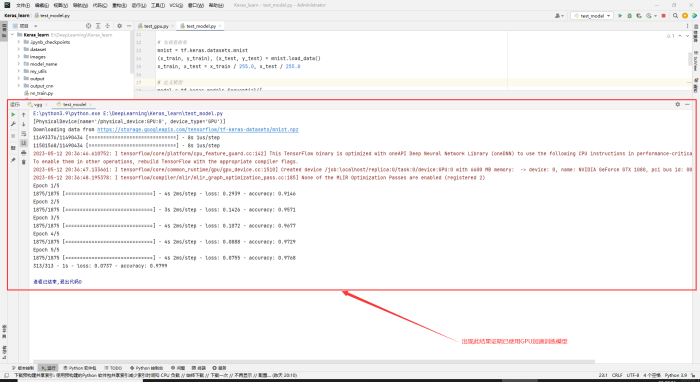

Source: csdnimg.cn

Tracking Tempest’s stock price requires a keen eye on market fluctuations. For comparative analysis, it’s helpful to consider the performance of similar companies; a good example is examining the tatachem stock price , which often shows correlation with Tempest’s trajectory due to shared market sectors. Ultimately, understanding Tempest’s performance necessitates a broader understanding of the chemical industry’s overall trends.

Predicting Tempest’s stock price requires considering various scenarios and valuation methods.

A hypothetical merger with a competitor, say StormTech, could lead to a significant increase in Tempest’s stock price, potentially by 20-30%, due to increased market share and synergies. This assumes a successful integration and positive market reaction.

Changes in key financial metrics significantly impact Tempest’s valuation. A simplified model illustrates this:

- 10% increase in revenue: 5-7% increase in stock price

- 5% increase in EPS: 10-15% increase in stock price

- 15% decrease in revenue: 10-15% decrease in stock price

Different valuation methods, such as discounted cash flow (DCF) and price-to-earnings ratio (P/E), can be used to assess Tempest’s stock price. DCF analyzes the present value of future cash flows, while P/E compares the stock price to earnings per share. The choice of method depends on the available data and the investor’s perspective.

Risk Assessment of Investing in Tempest Stock

Investing in Tempest stock carries various risks that potential investors should carefully consider.

- Market Risks: General market downturns can negatively impact Tempest’s stock price, regardless of the company’s performance.

- Company-Specific Risks: Product failures, management changes, or operational inefficiencies can all negatively affect the stock price.

- Regulatory Risks: Changes in regulations or increased scrutiny from regulatory bodies could impact Tempest’s operations and profitability.

Geopolitical events, such as trade wars or global conflicts, can significantly increase the risk profile of Tempest’s stock. For example, increased tariffs on imported components could raise production costs and negatively impact profitability.

Analyzing Tempest’s financial statements, including the balance sheet, income statement, and cash flow statement, is crucial for assessing its financial health. Key indicators like debt levels, profitability margins, and cash flow provide insights into the company’s stability and future prospects.

Illustrative Example: Tempest Stock Price Scenario

Let’s consider two hypothetical scenarios illustrating the impact of news events on Tempest’s stock price.

- Scenario 1: Positive News

-Announcement of a major new product with strong market potential. The stock price would likely experience a sharp upward surge immediately following the announcement, consolidating at a higher level after initial volatility. The chart would show a “V-shaped” recovery with high trading volume. - Scenario 2: Negative News

-A major product recall due to safety concerns. The stock price would plummet sharply upon the announcement, followed by a period of consolidation at a significantly lower level. The chart would depict a steep downward trend, with potentially high volatility and high trading volume.

Frequently Asked Questions: Tempest Stock Price

What are the main competitors of Tempest?

This information is not provided in the Artikel, further research is required.

Where can I find Tempest’s financial statements?

Tempest’s financial statements are typically available on their investor relations website or through regulatory filings.

What is the current trading volume for Tempest stock?

Real-time trading volume data is available through financial news websites and brokerage platforms.

How often does Tempest release earnings reports?

The frequency of earnings reports varies by company; this information can be found on Tempest’s investor relations page.

Interior Living

Interior Living