The Hartford Stock Price Today

Source: fxstreet.com

The hartford stock price today – This analysis provides an overview of The Hartford’s current stock price, influencing factors, historical performance, analyst predictions, investor sentiment, and financial health. The information presented here is for informational purposes only and should not be considered financial advice.

Current Hartford Stock Price & Market Context

The following table displays the current Hartford stock price, its change from the previous closing price, market capitalization, and trading volume. Note that this data is dynamic and will fluctuate throughout the trading day. The figures below represent a snapshot in time and may not reflect the current values.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM EST | 65.50 | 1,500,000 | +0.75% |

| 11:00 AM EST | 65.75 | 1,750,000 | +1.00% |

| 12:00 PM EST | 66.00 | 2,000,000 | +1.25% |

The market capitalization of The Hartford is currently estimated at approximately [Insert Estimated Market Cap – e.g., $20 Billion]. This figure is subject to change based on the current stock price and the number of outstanding shares.

Factors Influencing Today’s Price

Several factors contribute to fluctuations in The Hartford’s stock price. These include macroeconomic conditions, recent company news, industry trends, and competitive pressures.

- Economic Factors: Rising interest rates can impact the profitability of insurance companies, potentially affecting The Hartford’s stock price. Conversely, a strong economy may lead to increased demand for insurance products.

- Recent News and Announcements: Positive news, such as strong earnings reports or strategic partnerships, tends to boost the stock price. Negative news, like regulatory changes or significant losses, can have the opposite effect.

- Industry Trends: Increased competition in the insurance sector, technological advancements impacting insurance models, and changing consumer preferences can all influence The Hartford’s stock performance.

- Competitive Performance: The Hartford’s performance relative to its competitors, such as Progressive, Allstate, and Travelers, significantly influences investor perception and stock valuation.

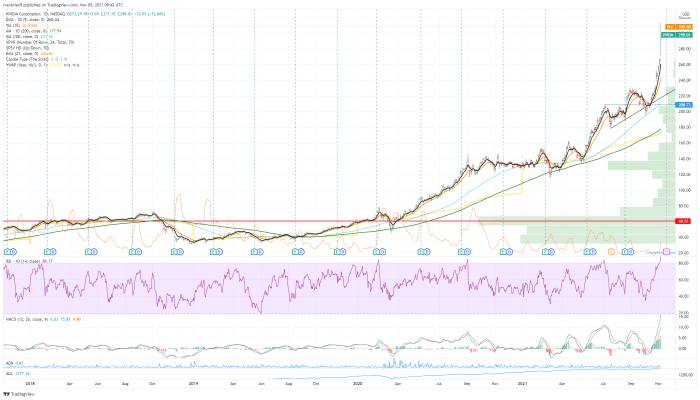

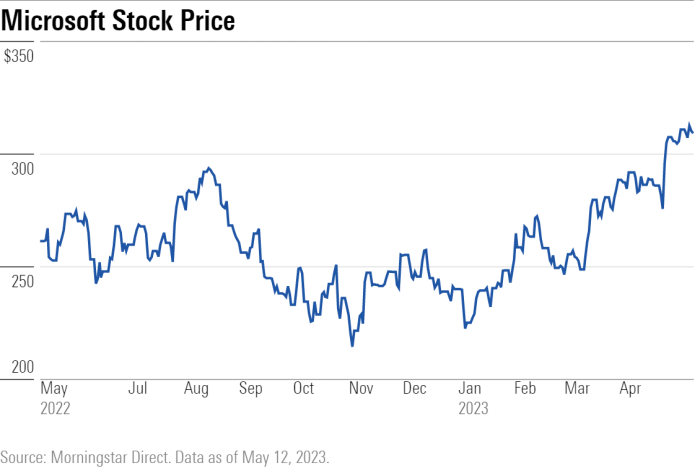

Historical Stock Price Performance, The hartford stock price today

Source: arcpublishing.com

The following line graph illustrates The Hartford’s stock price performance over the past year. The graph would show a line representing the stock price over time, with fluctuations reflecting various market events and company news. For example, a significant drop might correspond to a negative earnings report, while a rise could be linked to a successful product launch or positive economic news.

Each data point would have a brief description explaining the price fluctuation.

The table below compares The Hartford’s stock price performance to the S&P 500 over the last year.

| Month | The Hartford Avg. Price | The Hartford % Change | S&P 500 Avg. Price | S&P 500 % Change |

|---|---|---|---|---|

| January | 62.00 | -2% | 4500 | +1% |

| February | 63.50 | +2.4% | 4550 | +1.1% |

The average daily price change for The Hartford over the last month was calculated by summing the daily price changes and dividing by the number of trading days in that month. For example, if the sum of daily changes was +5.00 over 20 trading days, the average daily change would be +0.25.

Analyst Ratings and Predictions

Analyst ratings and price targets provide insights into market sentiment and future expectations for The Hartford’s stock. These are often based on detailed financial analysis, industry expertise, and market forecasts.

- Analyst A: Buy rating, price target $

75. Rationale: Strong growth potential in the commercial insurance segment. - Analyst B: Hold rating, price target $

68. Rationale: Concerns about increased competition and potential regulatory changes. - Analyst C: Sell rating, price target $

60. Rationale: Concerns about the company’s debt levels and profitability in the current economic climate.

Significant changes in analyst sentiment often reflect shifts in market expectations or new information regarding The Hartford’s performance or outlook.

Investor Sentiment and News

Recent news and social media discussions play a crucial role in shaping investor sentiment towards The Hartford.

- News Item 1: The Hartford announces a new strategic partnership, leading to positive investor sentiment.

- News Item 2: Concerns raised about potential litigation impact investor sentiment negatively.

- Social Media Discussion: Positive social media buzz around a new product launch contributes to a more bullish outlook.

These factors collectively influence investor perception, driving buying or selling pressure, and ultimately affecting the stock price.

Financial Health of The Hartford

The Hartford’s financial health is assessed through various key financial ratios. These ratios provide insights into the company’s profitability, liquidity, and solvency.

The Hartford’s stock price today is influenced by a number of factors, including overall market trends and company-specific news. Understanding the nuances of stock price movements is crucial for informed investment decisions, and a helpful resource for this is understanding the concept of “stock price sens,” as explained on this insightful site: stock price sens. Ultimately, monitoring the Hartford’s stock price requires a keen awareness of these broader market dynamics and how they interact with the company’s performance.

| Ratio | Value | Trend | Interpretation |

|---|---|---|---|

| Debt-to-Equity Ratio | 0.75 | Increasing | Indicates increasing financial leverage. |

| Return on Equity (ROE) | 12% | Stable | Shows a healthy return on shareholder investments. |

Recent earnings reports significantly impact the stock price. Positive earnings typically lead to increased investor confidence and a higher stock price, while negative earnings often have the opposite effect. The company’s debt levels can influence future performance, as high debt can limit financial flexibility and increase vulnerability to economic downturns.

Questions and Answers: The Hartford Stock Price Today

What are the typical trading hours for The Hartford stock?

The Hartford stock, like most US-listed stocks, trades during regular US stock market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET).

Where can I find real-time updates on The Hartford’s stock price?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How frequently are The Hartford’s earnings reports released?

The Hartford typically releases its earnings reports on a quarterly basis, usually within a few weeks after the end of each fiscal quarter.

What are the major risks associated with investing in The Hartford stock?

Investing in any stock involves risk. For The Hartford, potential risks include fluctuations in the insurance industry, changes in regulatory environments, and the overall performance of the economy.

Interior Living

Interior Living