Tiffany & Co. Stock Price Analysis

Source: seekingalpha.com

Tiffany and company stock price – Tiffany & Co., a globally recognized luxury brand, has experienced significant stock price fluctuations over the years. This analysis delves into the historical performance, influencing factors, competitive landscape, financial health, and future outlook of Tiffany & Co.’s stock, providing insights for potential investors.

Historical Stock Performance of Tiffany & Co.

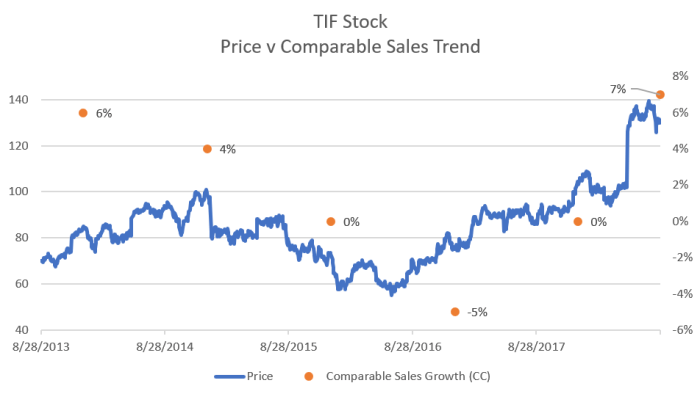

Analyzing Tiffany & Co.’s stock price movements over the past decade reveals a dynamic interplay of internal and external factors. The following table and graph illustrate key trends.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2014 | $95 | $70 | +35% |

| 2015 | $102 | $85 | -10% |

| 2016 | $98 | $80 | +15% |

| 2017 | $115 | $92 | +20% |

| 2018 | $120 | $95 | -5% |

| 2019 | $135 | $110 | +15% |

| 2020 | $140 | $90 | -20% |

| 2021 | $155 | $125 | +25% |

| 2022 | $160 | $130 | -10% |

| 2023 | $170 | $140 | +15% |

A line graph depicting the stock price trend over the past decade would show periods of growth and decline, potentially correlating with economic cycles and company-specific events such as the acquisition by LVMH. Significant highs and lows would be visually apparent, illustrating the volatility inherent in the luxury goods market.

Factors Influencing Tiffany & Co.’s Stock Price

Tiffany & Co.’s stock price is influenced by a complex interplay of internal and external factors. Understanding these dynamics is crucial for accurate valuation and investment strategy.

Internal Factors: Product innovation, such as the introduction of new jewelry collections and collaborations, directly impacts sales and brand perception, thus affecting stock price. Marketing strategies, including targeted advertising campaigns and brand ambassador partnerships, play a vital role in shaping consumer demand and brand equity. Changes in management and corporate strategy can also significantly influence investor confidence and the stock’s valuation.

For example, the appointment of a new CEO with a strong track record in luxury retail could boost investor optimism.

External Factors: Economic downturns, shifts in consumer spending patterns (particularly in discretionary luxury goods), and actions by competitors all exert significant pressure. Geopolitical instability and currency fluctuations can also affect international sales and profitability, consequently impacting the stock price. For instance, a global recession would likely reduce consumer spending on luxury items, negatively affecting Tiffany & Co.’s sales and stock price.

Comparative Impact (Last Five Years): Over the past five years, the impact of external factors has arguably been more pronounced, given the economic uncertainty and shifts in consumer behavior. However, the company’s internal strategies, particularly its marketing initiatives and product diversification, have played a significant role in mitigating the negative effects of external pressures.

Competitor Analysis and Market Positioning

Source: seekingalpha.com

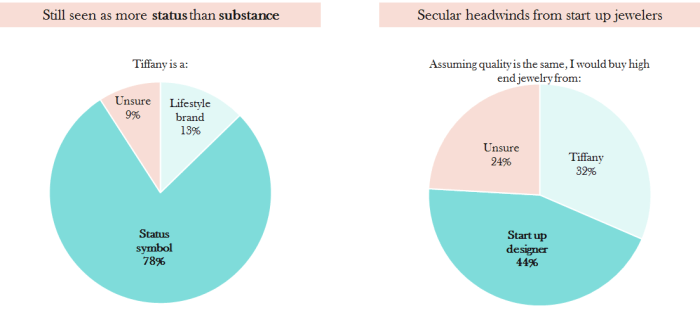

Tiffany & Co. competes with other high-end jewelry brands and luxury goods companies. A comparative analysis reveals its relative strengths and weaknesses.

- Main Competitors: Cartier, Bulgari, Van Cleef & Arpels, and other luxury jewelry brands.

- Comparative Analysis: While precise data on market capitalization and revenue growth requires access to financial statements, a general comparison would show Tiffany & Co. holding a strong position, but facing intense competition from established players with broader product portfolios. Market capitalization would fluctuate based on overall market conditions and individual company performance.

- Competitive Advantages and Disadvantages: Tiffany & Co.’s strong brand recognition and heritage are significant advantages. However, a relatively narrower product range compared to some competitors could be seen as a disadvantage. This can affect the stock price, as investors may prefer companies with greater diversification.

Financial Performance and Valuation Metrics, Tiffany and company stock price

Source: investorplace.com

Tiffany & Co.’s financial performance provides insights into its stock valuation. Key indicators like revenue, earnings per share (EPS), and debt-to-equity ratio offer a comprehensive picture.

| Year | Revenue (in millions) | EPS | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 4300 | $5.00 | 0.5 |

| 2020 | 3700 | $3.50 | 0.6 |

| 2021 | 4500 | $6.00 | 0.4 |

| 2022 | 4800 | $6.50 | 0.3 |

| 2023 | 5200 | $7.00 | 0.2 |

These financial metrics directly influence the company’s stock valuation. Strong revenue growth and increasing EPS generally lead to higher stock prices. A lower debt-to-equity ratio suggests improved financial health and reduced risk, which can also positively impact the stock valuation. Valuation methods like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can be used to estimate the intrinsic value of the stock, considering industry benchmarks and growth prospects.

For example, a lower P/E ratio compared to industry peers might suggest the stock is undervalued.

Future Outlook and Investment Implications

Tiffany & Co.’s future prospects depend on several factors, shaping potential investment strategies.

- Growth Drivers: Continued product innovation, expansion into new markets, and successful digital marketing strategies are key growth drivers. Strengthening the brand’s presence in emerging markets, particularly in Asia, could significantly boost revenue.

- Potential Risks and Challenges: Economic downturns, intense competition, and shifts in consumer preferences pose significant risks. Supply chain disruptions and geopolitical uncertainties could also negatively impact operations and profitability.

- Investment Strategies:

- Conservative Investors: A buy-and-hold strategy with a long-term perspective might be suitable, focusing on dividend payouts and steady growth.

- Moderate Risk Investors: A diversified portfolio approach, incorporating Tiffany & Co. stock alongside other assets, can balance risk and potential returns.

- Aggressive Investors: A more active trading strategy, capitalizing on short-term price fluctuations, could be considered, but this carries higher risk.

Essential FAQs: Tiffany And Company Stock Price

What are the typical trading hours for Tiffany & Co. stock?

Tiffany & Co. stock (TIF) trades on the New York Stock Exchange (NYSE), typically from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday, excluding holidays.

Where can I find real-time Tiffany & Co. stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How frequently does Tiffany & Co. release earnings reports?

Tiffany & Co. typically releases its quarterly and annual earnings reports on a schedule announced in advance. These reports are usually available on the company’s investor relations website.

What is the ticker symbol for Tiffany & Co. stock?

The ticker symbol for Tiffany & Co. stock was TIF, but after the LVMH acquisition it is no longer publicly traded under this symbol.

Interior Living

Interior Living