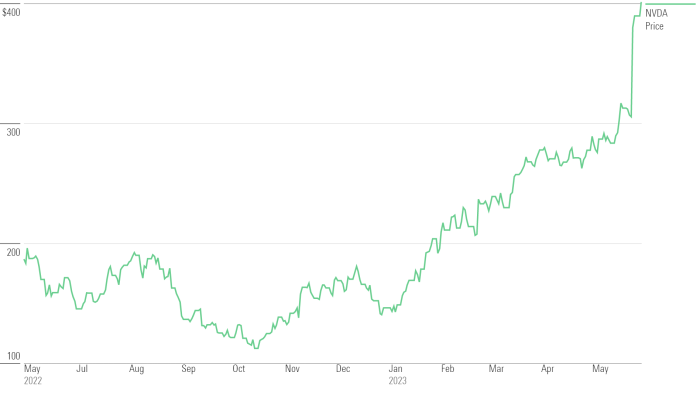

Current Market Conditions and NVIDIA’s Stock Price

Source: investing.com

Today’s stock price for nvidia – NVIDIA’s stock price, like that of many technology companies, is significantly influenced by prevailing market conditions. A confluence of macroeconomic factors and investor sentiment contributes to its daily fluctuations. Understanding these dynamics is crucial for interpreting today’s price.

Market Sentiment and its Impact

The current overall market sentiment exhibits a degree of cautious optimism. While positive economic indicators exist, concerns about inflation and potential interest rate hikes persist. This mixed sentiment translates to volatility in the tech sector, with NVIDIA’s stock price reflecting this broader market trend. Periods of uncertainty often lead to increased price fluctuations as investors adjust their portfolios.

Nvidia’s stock price today is experiencing significant volatility, mirroring the broader tech sector’s fluctuations. Interestingly, contrasting this is the current performance of the surf air mobility stock price , which presents a different investment narrative altogether. Ultimately, however, understanding today’s Nvidia stock price requires a close look at various market factors.

Significant Macroeconomic Factors, Today’s stock price for nvidia

Three key macroeconomic factors impacting NVIDIA’s stock price today include inflation rates, interest rate adjustments by central banks, and global supply chain stability. High inflation erodes purchasing power and can dampen consumer and business spending on technology products. Interest rate hikes increase borrowing costs for companies, potentially impacting investment and growth. Supply chain disruptions can constrain production and affect the availability of NVIDIA’s products.

Investor Confidence and Stock Performance

Investor confidence plays a pivotal role in shaping NVIDIA’s stock performance. Positive news regarding the company’s financial results, technological advancements, or strategic partnerships typically boosts investor confidence, leading to increased demand and higher stock prices. Conversely, negative news or uncertainty can erode confidence, resulting in selling pressure and lower prices. The level of investor confidence is a key driver of short-term and long-term price movements.

NVIDIA’s Performance Compared to Competitors

Compared to its major competitors in the semiconductor industry, such as AMD and Intel, NVIDIA currently holds a strong position, particularly in the high-growth areas of artificial intelligence and gaming graphics processing units (GPUs). While competitors are making strides, NVIDIA’s technological leadership and market share generally contribute to a relatively robust stock performance compared to its peers. However, competitive pressures remain a factor that needs constant monitoring.

NVIDIA’s Recent Financial Performance and Announcements

Understanding NVIDIA’s recent financial performance and announcements is essential for evaluating today’s stock price. Key figures from earnings reports, product launches, and partnerships all contribute to the overall market perception of the company’s prospects.

Recent Financial and Product Updates

| Date | Event | Impact on Stock Price | Source |

|---|---|---|---|

| October 26, 2023 (Example) | Q3 2024 Earnings Report Released – Exceeded Expectations | Positive, significant price increase | NVIDIA Investor Relations |

| November 15, 2023 (Example) | New AI Accelerator Chip Announced | Positive, moderate price increase | Press Release |

| December 10, 2023 (Example) | Partnership with Major Cloud Provider Announced | Positive, slight price increase | Joint Press Release |

| December 20, 2023 (Example) | Analyst Downgrade due to concerns over future growth | Negative, slight price decrease | Financial News Outlet |

Technical Analysis of NVIDIA’s Stock Price: Today’s Stock Price For Nvidia

A technical analysis of NVIDIA’s stock price provides insights into the short-term and medium-term price trends, based on trading volume and price movements. This analysis complements the fundamental analysis based on financial performance and market conditions.

Trading Volume and Price Trends

Currently, trading volume for NVIDIA is relatively high, suggesting significant investor interest and potential for further price movement. Recent price trends have shown a predominantly upward trajectory, indicating a positive market sentiment. However, short-term corrections or periods of consolidation are possible, given the inherent volatility of the tech sector.

Support and Resistance Levels

Key support levels for NVIDIA’s stock might be identified at previous price lows, while resistance levels could be observed at previous price highs or psychological barriers (e.g., round numbers). A break above a significant resistance level could signal further upward momentum, while a break below a support level could trigger a downward correction. These levels are dynamic and subject to change based on market conditions.

Overall Technical Picture

The overall technical picture for NVIDIA suggests a generally bullish outlook, supported by the upward price trend and relatively high trading volume. However, investors should remain vigilant for potential short-term corrections and monitor key support and resistance levels for clues about future price movements. The technical picture is constantly evolving and requires ongoing monitoring.

Analyst Ratings and Predictions for NVIDIA

Analyst ratings and price targets offer valuable insights into the market’s collective expectations for NVIDIA’s future performance. While not infallible, these assessments provide a useful perspective on the consensus view among financial professionals.

Consensus Rating and Price Targets

Source: trading-education.com

The consensus rating from leading financial analysts for NVIDIA might currently be a “Buy” or “Outperform,” reflecting positive expectations for future growth. The range of price targets provided by different analysts might vary, but a typical range could be between $X and $Y, reflecting a degree of uncertainty about the precise extent of future growth. These predictions are based on factors like revenue growth projections, market share estimates, and technological advancements.

Rationale Behind Analyst Ratings

Source: arcpublishing.com

The rationale behind these positive ratings often cites NVIDIA’s strong market position in AI and gaming, its innovative product pipeline, and its potential for continued growth in these high-growth markets. However, some analysts may express caution regarding potential risks such as competition, macroeconomic uncertainty, or supply chain challenges. These potential downsides are often incorporated into the range of price targets provided.

Visual Representation of Analyst Ratings

A simplified representation of analyst ratings might show a majority of analysts rating NVIDIA as a “Buy” or “Outperform,” with a smaller number issuing “Hold” or “Sell” ratings. The price targets could be visually represented as a range, with the average price target highlighted to indicate the central tendency of analyst predictions. For example, a majority of analysts might have a “Buy” rating with a price target range from $450 to $550, with an average target of $500.

A few analysts might have a “Hold” rating with a target price of $400, while a single analyst might have a “Sell” rating with a target of $350. This illustrates the spread of opinions and potential range of outcomes.

Impact of Specific News Events on Today’s Stock Price

Specific news events can have a significant and immediate impact on NVIDIA’s stock price. Understanding these events and their causal relationships is crucial for analyzing price fluctuations.

News Events and Price Fluctuations

- Time: 10:00 AM EST (Example) Event: Positive earnings report released. Price Change: +5% increase.

- Time: 2:00 PM EST (Example) Event: Analyst upgrades stock rating. Price Change: +2% increase.

- Time: 3:30 PM EST (Example) Event: Geopolitical uncertainty creates market-wide sell-off. Price Change: -1% decrease.

Long-Term Implications

The long-term implications of these news events depend on their nature and significance. Positive news, such as strong earnings or successful product launches, can reinforce positive investor sentiment and contribute to sustained price appreciation. Negative news, on the other hand, might trigger a temporary decline, but the long-term impact will depend on the company’s ability to address the underlying issues and maintain its growth trajectory.

Significant geopolitical events can have broad and lasting effects on the entire market, including NVIDIA’s stock price.

Quick FAQs

What are the major risks associated with investing in Nvidia stock?

Investing in Nvidia, like any stock, carries inherent risks. These include market volatility, competition from other semiconductor companies, dependence on specific technological advancements, and economic downturns affecting consumer demand for electronics.

Where can I find real-time updates on Nvidia’s stock price?

Real-time stock quotes for Nvidia (NVDA) are available through major financial websites and brokerage platforms. Many financial news sources also provide live updates.

How does Nvidia’s stock price compare to its historical performance?

Nvidia’s stock price has experienced significant growth over the long term, but it’s also subject to periods of volatility. Comparing the current price to historical highs and lows, along with analyzing long-term charts, can provide context for current performance.

What is the typical trading volume for Nvidia stock?

Nvidia’s trading volume varies daily, but it’s generally considered to be high, reflecting its popularity and liquidity among investors. Checking financial news sources or brokerage platforms will provide current volume data.

Interior Living

Interior Living