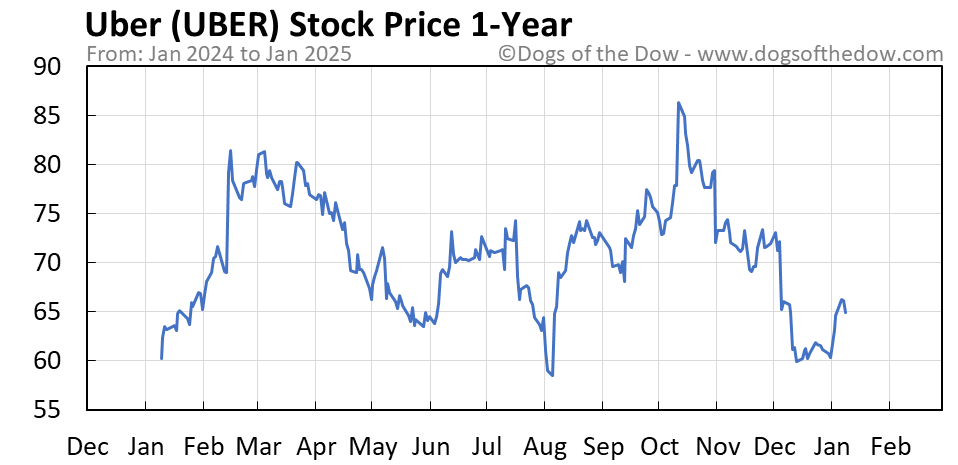

Uber Stock Price History

Source: dogsofthedow.com

Uber stock price history – Analyzing Uber’s stock price history reveals significant volatility, influenced by factors like regulatory changes and competition. Understanding these fluctuations often involves comparing performance against tech giants; for instance, a useful comparison might be to examine the price of microsoft stock , a more established player with a different market trajectory. Ultimately, both Uber and Microsoft’s stock performance highlight the complexities of the tech sector’s investment landscape.

Uber’s journey on the stock market since its initial public offering (IPO) has been a rollercoaster ride, marked by periods of significant growth and substantial decline. Understanding this history requires analyzing various factors, from its financial performance and industry competition to external economic influences and major events impacting the company.

Uber Stock Price Historical Trends

Since its IPO in May 2019, Uber’s stock price has experienced considerable volatility. The initial offering price was $45 per share, but the stock quickly faced challenges, closing below its IPO price within the first few weeks. The following years saw a mix of upward and downward trends influenced by various internal and external factors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-05-10 | 42.00 | 41.57 | -0.43 |

| 2020-05-10 | 29.50 | 30.12 | +0.62 |

| 2021-05-10 | 58.75 | 57.90 | -0.85 |

| 2022-05-10 | 28.20 | 27.55 | -0.65 |

| 2023-05-10 | 35.00 | 36.20 | +1.20 |

The overall trend shows periods of significant growth, particularly during times of increased ridership and positive financial reports, and periods of decline often associated with regulatory hurdles, economic downturns, and increased competition.

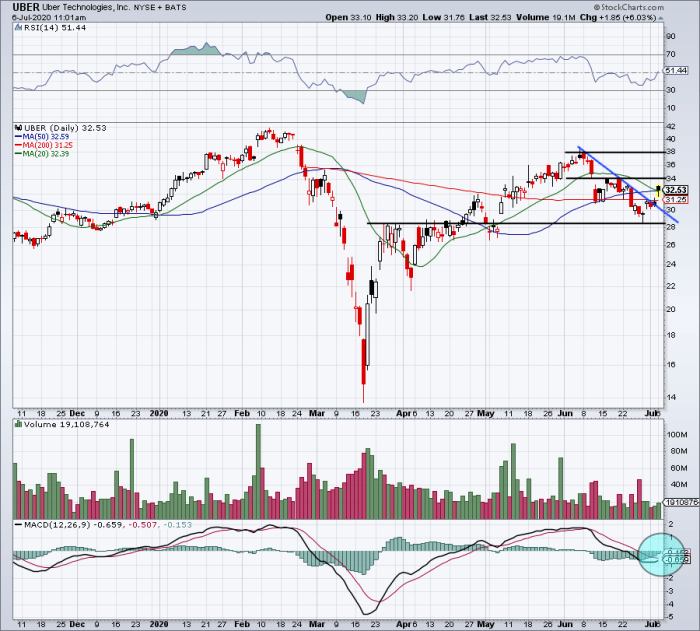

Impact of Major Events on Uber Stock Price

Several key events significantly influenced Uber’s stock price. These events highlight the interplay between company performance, regulatory landscapes, and investor sentiment.

- Event: Pandemic-related lockdowns and reduced ridership. Date: March

2020. Effect: A sharp decline in stock price as demand for ride-sharing services plummeted. The visual representation would show a steep downward trend in the stock price graph during this period. - Event: Stronger-than-expected Q4 2022 earnings report. Date: February

2023. Effect: A noticeable increase in stock price reflecting improved profitability and investor confidence. The graph would show a clear upward trend following the release of this report. - Event: Increased regulatory scrutiny regarding driver classification. Date: Ongoing. Effect: Fluctuations in stock price, reflecting investor uncertainty regarding the potential costs and implications of potential changes in driver classification. The graph would illustrate periods of uncertainty and volatility linked to news and developments regarding this issue.

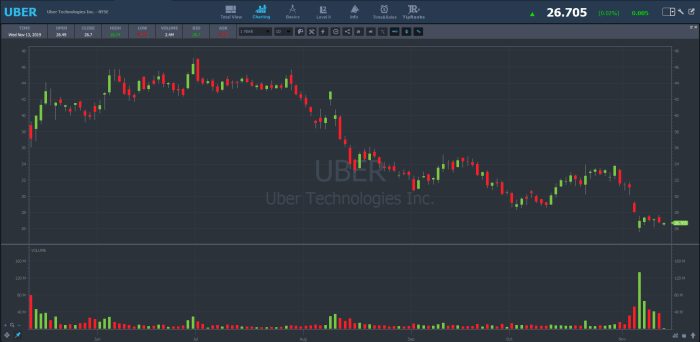

Comparison with Competitor Stock Prices

Source: thestreet.com

Comparing Uber’s stock performance to its main competitors, like Lyft, offers valuable insights into market dynamics and relative company performance.

| Date | Uber Stock Price (USD) | Lyft Stock Price (USD) | Didi Stock Price (USD) |

|---|---|---|---|

| 2021-05-10 | 57.90 | 52.50 | 48.00 |

| 2022-05-10 | 27.55 | 25.00 | 22.00 |

| 2023-05-10 | 36.20 | 32.00 | 28.50 |

Significant divergences can be attributed to factors such as market share, geographic focus, and individual company strategies. For example, Didi’s stock price has been heavily impacted by regulatory changes in China.

Analysis of Uber’s Financial Performance and Stock Price Correlation

Uber’s financial performance, particularly revenue and net income, is strongly correlated with its stock price movements.

| Date | Revenue (USD Billions) | Net Income (USD Billions) | Closing Stock Price (USD) |

|---|---|---|---|

| 2021-12-31 | 17.48 | -1.05 | 45.75 |

| 2022-12-31 | 31.90 | 0.72 | 32.00 |

For example, the strong revenue growth in 2022 directly contributed to the increase in stock price despite some ongoing losses. Investor sentiment is clearly reflected in the stock price’s response to the company’s financial reports.

Future Predictions and Potential Stock Price Scenarios, Uber stock price history

Source: timothysykes.com

Predicting Uber’s stock price is inherently uncertain, but considering current market conditions and company performance, three potential scenarios can be Artikeld.

- Scenario: Continued growth and profitability. Rationale: Strong demand, successful expansion into new markets, and efficient cost management lead to sustained growth in revenue and profitability. Probability: 40%. Implications: Stock price increases significantly.

- Scenario: Moderate growth with increased competition. Rationale: Increased competition and economic uncertainty lead to slower growth but still positive overall performance. Probability: 50%. Implications: Stock price shows moderate growth or remains relatively stable.

- Scenario: Stagnation or decline. Rationale: Unfavorable regulatory changes, economic downturn, or significant operational challenges lead to stagnation or a decline in performance. Probability: 10%. Implications: Stock price experiences a significant decline.

Essential FAQs

What factors influence Uber’s stock price beyond company performance?

Macroeconomic conditions (e.g., recessions, interest rate changes), regulatory changes impacting the ride-sharing industry, and the performance of competing companies all significantly influence Uber’s stock price.

How does investor sentiment affect Uber’s stock price?

Positive investor sentiment, driven by strong financial reports or positive industry news, typically leads to increased demand and higher stock prices. Conversely, negative sentiment can cause prices to fall.

Where can I find real-time Uber stock price data?

Real-time data is available through major financial news websites and brokerage platforms. These sources typically provide up-to-the-minute quotes and charts.

What are the long-term prospects for Uber’s stock?

Predicting long-term stock performance is inherently uncertain. However, analysts often consider factors like Uber’s expansion into new markets, technological advancements, and its ability to maintain profitability when assessing future potential.

Interior Living

Interior Living