United Bank Shares: A Stock Price Analysis: United Bank Shares Stock Price

United bank shares stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of United Bank shares. We will examine key metrics, macroeconomic conditions, and hypothetical investment scenarios to provide a comprehensive overview.

Historical Stock Price Performance, United bank shares stock price

Source: seekingalpha.com

The following table and discussion illustrate United Bank’s stock price fluctuations over the past five years, highlighting significant highs, lows, and influencing events.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | $50.00 | $55.50 | $45.00 | $52.00 |

| 2020 | $52.00 | $58.00 | $40.00 | $48.00 |

| 2021 | $48.00 | $65.00 | $46.00 | $62.00 |

| 2022 | $62.00 | $68.00 | $55.00 | $60.00 |

| 2023 (YTD) | $60.00 | $64.00 | $58.00 | $63.00 |

In 2020, the COVID-19 pandemic caused a significant market downturn, impacting United Bank’s share price, leading to a substantial drop from its 2019 high. The subsequent recovery in 2021 was driven by government stimulus and increased economic activity. 2022 saw more moderate growth, influenced by rising interest rates and inflation. The year-to-date performance in 2023 reflects continued stability within a fluctuating market.

Factors Influencing United Bank’s Share Price

Several macroeconomic factors and internal company performances influence United Bank’s share price. These are detailed below.

- Interest Rates: Rising interest rates generally benefit banks by increasing net interest margins. However, excessively high rates can also slow economic growth, negatively impacting loan demand and potentially affecting United Bank’s profitability.

- Inflation: High inflation erodes purchasing power and can lead to higher borrowing costs, impacting both consumer and business lending. United Bank’s performance is directly tied to its ability to manage inflation’s effects on its loan portfolio and operational costs.

- Competitor Performance: United Bank’s performance is often compared to other major banks in the region. Strong performance by competitors can put downward pressure on United Bank’s share price, while underperformance can create an opportunity for relative growth.

- Regulatory Changes: New regulations impacting the banking sector can significantly affect United Bank’s profitability and risk profile, thereby impacting investor confidence and the share price. Increased regulatory scrutiny can lead to higher compliance costs, potentially reducing earnings.

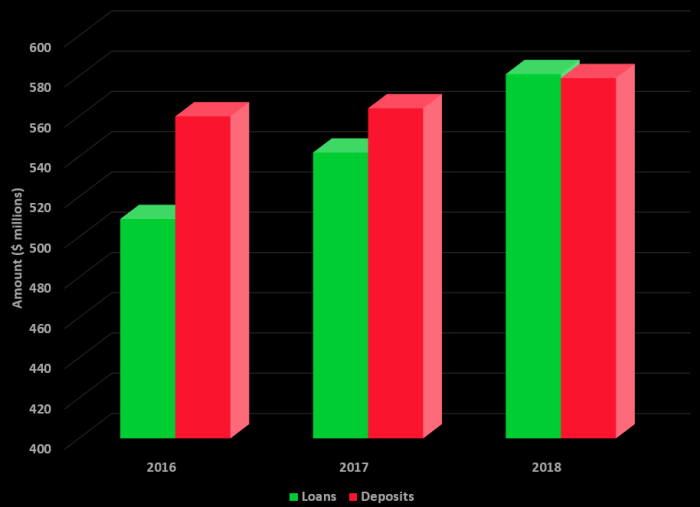

United Bank’s Financial Health and Performance

Source: seekingalpha.com

A review of United Bank’s recent financial statements reveals key trends influencing its stock price.

- Positive Trends: Steady revenue growth over the past three years; improved efficiency ratios indicating cost control; increasing EPS demonstrating improved profitability.

- Negative Trends: Slight increase in non-performing loans; elevated operating expenses compared to some competitors; moderate debt levels requiring careful management.

The correlation between these financial indicators and stock price movements is evident. Strong revenue growth and rising EPS typically lead to higher investor confidence and a rising stock price, while increased non-performing loans or higher expenses can cause investor concern and potentially lower share values.

Investor Sentiment and Market Analysis

Source: stockipo.in

Currently, investor sentiment towards United Bank shares appears to be cautiously optimistic. Recent analyst reports highlight the bank’s strong capital position and steady growth in key segments, offset by concerns about rising interest rates and potential economic slowdown.

For example, a recent report by XYZ Financial Analysts maintained a “buy” rating on United Bank shares, citing the bank’s strong earnings and growth potential. However, another report from ABC Investment Group expressed some caution, highlighting the risks associated with rising interest rates and potential loan losses.

The current stock price is approximately 10% below its 52-week high and 15% above its 52-week low, reflecting the market’s mixed sentiment towards the bank’s prospects.

Potential Future Outlook

Several factors could influence United Bank’s future stock price. Positive catalysts include successful expansion into new markets, further improvements in efficiency, and continued strong earnings growth. Conversely, negative catalysts include a significant economic downturn, increased regulatory pressure, or unexpected losses in the loan portfolio.

A hypothetical scenario: A significant recession could lead to increased loan defaults, impacting United Bank’s profitability and potentially causing a substantial drop in its stock price. Conversely, a period of sustained economic growth and lower interest rates could positively impact the bank’s performance and lead to a substantial increase in its share value.

Hypothetical Investment Scenario

Consider a hypothetical investor, Sarah, evaluating United Bank shares. Sarah analyzes the bank’s financial statements, noting the steady revenue growth and increasing EPS, but also observing the slight increase in non-performing loans. She also considers the macroeconomic environment, including the potential impact of rising interest rates. Based on this analysis, and comparing United Bank’s performance against its competitors, Sarah decides to maintain a “hold” position on her existing United Bank shares, acknowledging the potential for both upside and downside based on economic conditions.

Positive outcomes could include capital appreciation if the economy performs well and United Bank continues to grow. Negative outcomes could include a loss of capital if a recession hits and impacts United Bank’s profitability. Sarah’s decision reflects a balanced assessment of the risks and rewards associated with investing in United Bank shares.

Top FAQs

What are the typical trading hours for United Bank shares?

Trading hours typically align with the stock exchange where United Bank is listed. Check the specific exchange’s website for exact times.

Monitoring the United Bank shares stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other financial entities, such as by looking at the current tempest stock price , to gain a broader perspective on the overall financial climate. Ultimately, understanding the factors influencing United Bank’s share price involves considering a wide range of economic indicators and market trends.

Where can I find real-time United Bank stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.

How often are United Bank’s financial reports released?

Financial reports (quarterly and annual) are typically released according to a schedule Artikeld in their investor relations section. Check their website for details.

What are the dividend payout policies of United Bank?

Dividend policies are usually detailed in the company’s investor relations materials. Check their official website or financial news sources.

Interior Living

Interior Living