Vanguard 500 Index Fund: A Comprehensive Overview

Source: foolcdn.com

Vanguard 500 index fund stock price – The Vanguard 500 Index Fund (VFINX) is a widely popular investment vehicle, offering investors exposure to a diversified portfolio of 500 large-cap U.S. companies. Understanding its historical performance, influencing factors, and risk-return profile is crucial for making informed investment decisions. This article delves into these key aspects, providing a detailed analysis of the fund.

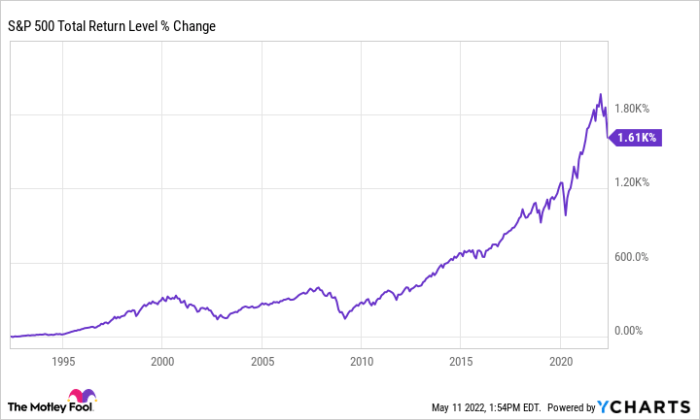

Vanguard 500 Index Fund: Historical Performance

The Vanguard 500 Index Fund’s performance mirrors that of the S&P 500, reflecting the overall health of the U.S. stock market. Over the past two decades, the fund has experienced periods of substantial growth punctuated by market corrections. The dot-com bubble burst in 2000 and the 2008 financial crisis represent significant downturns, while periods of economic expansion have driven impressive gains.

For example, the period following the 2008 crisis witnessed a remarkable recovery, fueled by quantitative easing and sustained economic growth.

| Time Period | VFINX Return | S&P 500 Return |

|---|---|---|

| 5 Years | [Insert 5-year average annual return for VFINX]% | [Insert 5-year average annual return for S&P 500]% |

| 10 Years | [Insert 10-year average annual return for VFINX]% | [Insert 10-year average annual return for S&P 500]% |

| 15 Years | [Insert 15-year average annual return for VFINX]% | [Insert 15-year average annual return for S&P 500]% |

Periods of significant growth are often associated with positive economic indicators, such as low unemployment and strong consumer spending. Conversely, declines are frequently linked to economic recessions, geopolitical instability, or unexpected market shocks. The COVID-19 pandemic in 2020, for instance, caused a sharp initial drop followed by a rapid recovery due to government stimulus and the resilience of the technology sector.

Factors Influencing Stock Price, Vanguard 500 index fund stock price

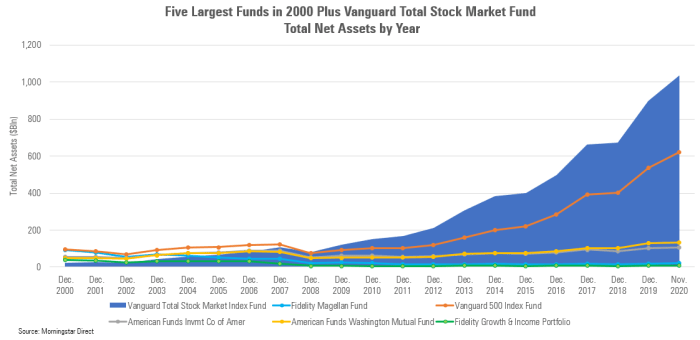

Source: morningstar.com

Several macroeconomic factors significantly impact the Vanguard 500 Index Fund’s stock price. These factors interact in complex ways, influencing investor sentiment and market valuations.

Interest rate changes affect corporate borrowing costs and investor returns on bonds, impacting the attractiveness of equities. Inflation erodes purchasing power and can lead to higher interest rates, potentially dampening stock market performance. Geopolitical events, such as wars or trade disputes, introduce uncertainty and volatility into the market. For example, the Russian invasion of Ukraine in 2022 triggered significant market fluctuations due to energy price spikes and broader economic uncertainty.

Specific news events, like unexpected corporate earnings reports or changes in regulatory policy, can also cause short-term price swings. A negative earnings surprise from a major company within the S&P 500 could temporarily depress the fund’s value, while positive news could lead to a short-term price increase.

Investment Strategies and the Fund

The Vanguard 500 Index Fund’s investment strategy is designed to track the S&P 500 index as closely as possible. This passive investment approach minimizes management fees and aims to replicate the index’s performance. The fund’s asset allocation is heavily weighted towards large-cap U.S. equities, offering diversification across various sectors and industries.

| Holding | Weighting |

|---|---|

| [Company 1] | [Percentage]% |

| [Company 2] | [Percentage]% |

| [Company 3] | [Percentage]% |

| [Company 4] | [Percentage]% |

| [Company 5] | [Percentage]% |

| [Company 6] | [Percentage]% |

| [Company 7] | [Percentage]% |

| [Company 8] | [Percentage]% |

| [Company 9] | [Percentage]% |

| [Company 10] | [Percentage]% |

This diversification helps to mitigate risk, as the performance of any single company is unlikely to significantly impact the overall fund performance. The fund’s holdings are regularly adjusted to reflect changes in the composition of the S&P 500 index.

Risk and Return Considerations

Investing in the Vanguard 500 Index Fund carries both risks and potential rewards. While historically offering competitive returns, it’s subject to market volatility. The fund’s historical volatility is generally comparable to that of the broader U.S. stock market, meaning it can experience significant price fluctuations in the short term.

- Market risk: The potential for losses due to overall market downturns.

- Inflation risk: The erosion of purchasing power due to rising inflation.

- Interest rate risk: The impact of changes in interest rates on the fund’s performance.

Investors can mitigate these risks through diversification across other asset classes, such as bonds or real estate, and by adopting a long-term investment horizon. Dollar-cost averaging, a strategy involving regular investments regardless of market conditions, can also help to reduce the impact of short-term volatility.

Monitoring the Vanguard 500 Index Fund stock price requires understanding the nuances of market fluctuations. A key aspect to consider is the sensitivity of stock prices to various economic factors, which is expertly discussed in this insightful article on stock price sens. Understanding these sensitivities helps investors make informed decisions regarding their Vanguard 500 Index Fund investments and better anticipate potential price movements.

Comparison with Other Index Funds

The Vanguard 500 Index Fund can be compared to other index funds, such as the Schwab Total Stock Market Index (SWTSX) and the iShares Core S&P 500 ETF (IVV). Each fund offers a different level of market exposure and diversification.

| Feature | VFINX | SWTSX | IVV |

|---|---|---|---|

| Market Coverage | S&P 500 | Total U.S. Stock Market | S&P 500 |

| Expense Ratio | [Insert expense ratio]% | [Insert expense ratio]% | [Insert expense ratio]% |

| Average Annual Return (10yr) | [Insert 10-year average annual return]% | [Insert 10-year average annual return]% | [Insert 10-year average annual return]% |

While VFINX offers exposure to 500 large-cap companies, SWTSX provides broader coverage of the entire U.S. stock market, including small and mid-cap companies. IVV, similar to VFINX, tracks the S&P 500 but is an ETF, offering different trading characteristics. The choice depends on individual investor preferences and risk tolerance.

Visual Representation of Data

The long-term trend of the Vanguard 500 Index Fund’s stock price generally shows a positive upward trajectory, although not a perfectly smooth one. The graph would display periods of consolidation, where prices remain relatively stable, interspersed with periods of sharp increases during economic expansions and more moderate declines during market corrections. The overall shape resembles a staircase, with each step representing a period of growth followed by a temporary plateau or slight pullback.

A hypothetical major market correction, such as a 20% decline, would be visually represented as a steep downward slope on the graph, followed by a period of recovery that may be gradual or more rapid depending on the economic and market conditions. The visual would clearly illustrate the impact of such an event on the fund’s price, showing a significant drop before an eventual rebound, potentially back to previous highs over time, though not necessarily reaching the same peak immediately.

FAQ: Vanguard 500 Index Fund Stock Price

What is the expense ratio of the Vanguard 500 Index Fund?

The expense ratio is relatively low, making it a cost-effective investment option.

How can I invest in the Vanguard 500 Index Fund?

You can typically invest through a brokerage account, retirement account (401k, IRA), or directly with Vanguard.

Is the Vanguard 500 Index Fund suitable for all investors?

No, its suitability depends on individual risk tolerance and investment goals. It’s generally considered a long-term investment.

What are the tax implications of investing in this fund?

Tax implications vary depending on your individual circumstances and the type of account used. Consult a tax professional for personalized advice.

Interior Living

Interior Living