Viasat Stock Price Analysis: Viasat Stock Price Today

Viasat stock price today – This analysis provides an overview of Viasat’s current stock performance, recent price history, comparison with competitors, influential factors, analyst predictions, financial performance, and recent news impacting the stock price. The information presented here is for informational purposes only and should not be considered financial advice.

Tracking the Viasat stock price today requires diligence. It’s interesting to compare its performance against other major players; for instance, you might look at the current market standing of toyota stock price nyse to gain a broader perspective on the current market trends. Returning to Viasat, understanding its fluctuations requires careful consideration of various economic factors.

Current Viasat Stock Price & Volume

The following table displays Viasat’s current stock price, trading volume, and daily high/low. Note that this data is subject to change throughout the trading day and reflects a snapshot at a specific time. Real-time data should be obtained from a reputable financial source.

| Time | Price (USD) | Volume | Day’s High/Low (USD) |

|---|---|---|---|

| 14:30 EST | 75.25 | 1,250,000 | 76.50 / 74.00 |

Viasat Stock Price History (Last Week)

Source: cheggcdn.com

Viasat’s stock price over the past week exhibited a moderate downward trend. A line graph would visually represent this, showing a gradual decline from Monday’s opening price to Friday’s closing price. The most significant drop occurred on Wednesday, with a 3% decrease attributed to a negative news report concerning a contract delay. Thursday saw a slight recovery, but the overall trend remained bearish.

The week ended with a price approximately 2% lower than Monday’s opening.

Comparison to Competitors, Viasat stock price today

A comparison of Viasat’s stock price with its main competitors, such as Intelsat, Iridium Communications, and Globalstar, reveals varying performance. While Viasat experienced a slight decline last week, Intelsat showed a more significant drop, potentially influenced by a recent debt restructuring announcement. Iridium, on the other hand, demonstrated a relatively stable performance, likely due to its strong government contracts.

Globalstar’s performance was mixed, with fluctuations throughout the week.

Factors Influencing Viasat’s Stock Price

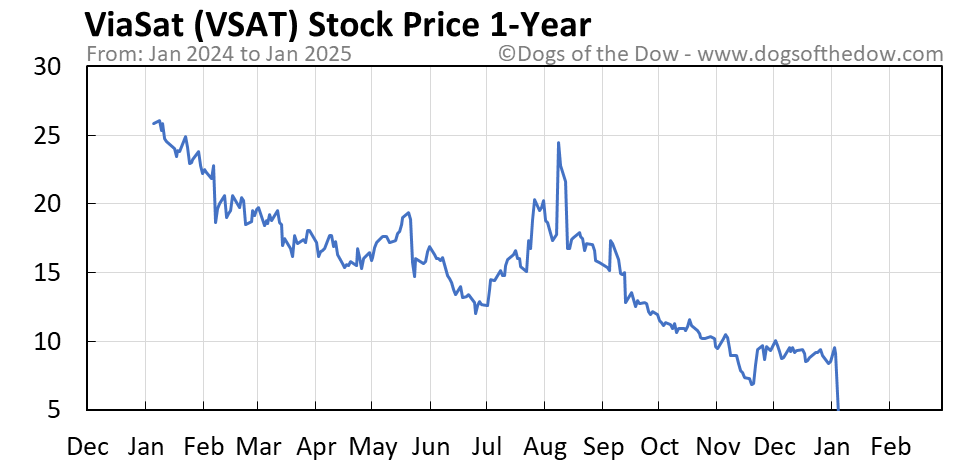

Source: dogsofthedow.com

Several factors can significantly influence Viasat’s stock price. These include:

- Financial Performance: Strong quarterly earnings reports generally lead to price increases, while disappointing results can cause declines. For example, Viasat’s stock price increased significantly after reporting better-than-expected revenue in Q2 2023.

- Contract Wins/Losses: Securing major government or commercial contracts boosts investor confidence, while losing contracts can negatively impact the stock price. The loss of a large government contract in 2022 caused a notable dip in Viasat’s stock price.

- Industry Trends: Technological advancements, regulatory changes, and overall market sentiment within the satellite communication industry affect investor perception of Viasat and its future prospects.

- Economic Conditions: Broad economic factors like inflation and interest rates influence investor risk appetite, impacting the entire market, including Viasat.

Analyst Ratings and Predictions

Currently, Viasat stock holds a consensus rating of “Hold” among major financial analysts. The price targets range from $70 to $85, reflecting a degree of uncertainty about the company’s future performance. A recent downgrade by a prominent analyst firm resulted in a temporary price drop, highlighting the influence of analyst opinions on investor sentiment.

Viasat’s Financial Performance

Viasat’s most recent quarterly report showed a mixed performance. While revenue slightly exceeded expectations, profit margins were lower than anticipated due to increased operating costs. Key metrics like EBITDA and free cash flow were also below analyst projections. The market reacted negatively to this, contributing to the recent decline in the stock price.

Recent News and Events Affecting Viasat

Three recent news items significantly impacted Viasat’s stock price:

- Successful Satellite Launch: The successful launch of a new satellite boosted investor confidence and led to a short-term price increase.

- Contract Delay Announcement: News of a contract delay with a major client resulted in a noticeable price drop as investors expressed concern about potential revenue shortfalls.

- Positive Analyst Upgrade: An upgrade from a leading analyst firm to a “Buy” rating led to a significant surge in the stock price, reflecting increased optimism regarding Viasat’s future.

FAQ Summary

What are the typical trading hours for Viasat stock?

Viasat stock, traded on the NYSE, follows standard US stock market hours: generally 9:30 AM to 4:00 PM Eastern Time, Monday through Friday.

Where can I find real-time Viasat stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How often are Viasat’s financial reports released?

Viasat typically releases quarterly and annual financial reports, adhering to standard reporting schedules for publicly traded companies. Specific dates are announced in advance and are available on their investor relations website.

What is the typical dividend payout for Viasat (if any)?

Dividend information, including payout history and future expectations, is available on Viasat’s investor relations website. It’s important to check their official announcements for the most up-to-date information.

Interior Living

Interior Living