Understanding PLM and its Impact on Stock Price

Stock price plm – Product Lifecycle Management (PLM) software is increasingly recognized as a crucial tool for companies across various industries. Its effective implementation can significantly influence a company’s operational efficiency, profitability, and ultimately, its stock valuation. This section explores the intricate relationship between PLM adoption and stock price performance.

PLM Adoption and Stock Valuation

The adoption of PLM software often correlates with improved efficiency in product development, manufacturing, and supply chain management. Streamlined processes, reduced errors, and better collaboration contribute to cost savings and faster time-to-market. These improvements directly impact a company’s profitability, making it a more attractive investment and positively influencing its stock price.

Successful PLM Implementation and Profitability, Stock price plm

A successful PLM implementation goes beyond simply installing software; it requires careful planning, integration with existing systems, and comprehensive user training. Companies that successfully integrate PLM often see improvements in various key performance indicators (KPIs), including reduced product development costs, improved product quality, and increased customer satisfaction. These improvements translate to higher profitability and a stronger stock performance.

Examples of Companies with Positive PLM Stock Performance

Several companies have demonstrated a strong correlation between effective PLM strategies and positive stock price performance. The following table showcases some examples, though it is important to note that stock price is influenced by numerous factors beyond PLM alone.

| Company Name | Industry | PLM Implementation Details | Stock Price Performance (Year-over-Year) |

|---|---|---|---|

| Company A | Aerospace | Implemented a comprehensive PLM system to improve collaboration across engineering, manufacturing, and supply chain teams. | +15% |

| Company B | Automotive | Leveraged PLM to streamline product development, reducing design iterations and accelerating time-to-market. | +10% |

| Company C | High-Tech | Utilized PLM to manage complex product configurations and improve supply chain visibility. | +8% |

| Company D | Pharmaceuticals | Improved regulatory compliance and reduced product recalls through enhanced data management capabilities within their PLM system. | +12% |

PLM Software Market Trends and Stock Performance

The PLM software market is dynamic, with ongoing technological advancements and evolving industry needs. Understanding these trends is crucial for assessing the potential impact on the stock prices of companies involved in this sector.

Current Trends and Potential Effects on Stock Prices

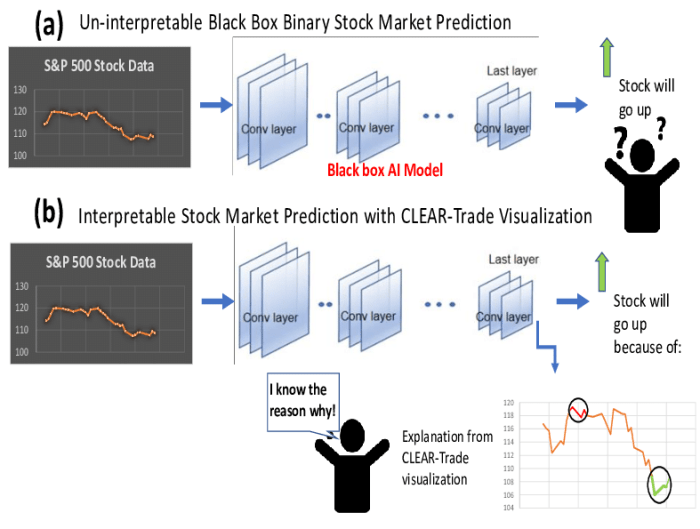

Several trends are shaping the PLM software market, including the increasing adoption of cloud-based solutions, the integration of artificial intelligence (AI) and machine learning (ML), and the growing demand for digital twin technology. These advancements can lead to improved efficiency, scalability, and data-driven decision-making, potentially boosting the stock prices of companies offering innovative PLM solutions.

Key Factors Driving Growth or Decline

Source: analyticsindiamag.com

The growth of the PLM software sector is driven by factors such as the increasing complexity of products, the need for faster time-to-market, and the growing importance of data-driven decision-making. Conversely, factors such as economic downturns, intense competition, and the difficulty of integrating PLM systems into existing IT infrastructures can lead to a decline in market growth and impact stock prices negatively.

Stock Performance of Major PLM Providers

Analyzing the stock performance of major PLM software providers over the past five years provides valuable insights into the market’s overall trajectory. The following table offers a simplified overview, keeping in mind that past performance does not guarantee future results and many factors influence stock prices.

| Company Name | Stock Symbol | 5-Year Performance | Key Market Factors |

|---|---|---|---|

| Company E | COMP E | +30% | Strong market share, successful product launches, strategic acquisitions. |

| Company F | COMP F | +15% | Consistent growth in cloud-based subscriptions, successful partnerships. |

| Company G | COMP G | +5% | Increased competition, slower adoption of new technologies. |

Financial Metrics and PLM Investment

Assessing the return on investment (ROI) of PLM software implementations requires careful consideration of various financial metrics. This section explores how improved efficiency and cost reduction contribute to positive financial indicators that are reflected in stock prices.

Metrics for Assessing PLM ROI

Key financial metrics used to evaluate PLM ROI include reduced product development costs, shorter time-to-market, improved product quality, decreased warranty claims, and increased revenue. By quantifying these improvements, companies can demonstrate the tangible financial benefits of PLM and justify the initial investment to stakeholders and investors.

Improved Efficiency and Reduced Costs

PLM’s ability to streamline processes, automate tasks, and improve collaboration directly contributes to reduced operational costs. This cost reduction, coupled with increased efficiency and revenue generation, leads to higher profit margins, which positively influences investor sentiment and stock valuation.

Hypothetical Scenario: PLM Implementation and Stock Price Reaction

Imagine a hypothetical company, Company H, implementing a new PLM system that reduces product development costs by 15% and shortens time-to-market by 10%. This results in a significant increase in profitability, potentially leading to a positive market reaction and a rise in Company H’s stock price.

Risk Factors Associated with PLM and Stock Price Volatility: Stock Price Plm

While PLM offers numerous benefits, several risks are associated with its implementation, which can impact a company’s stock price. Understanding and mitigating these risks is crucial for maintaining a stable stock valuation.

Potential Risks and their Impact on Stock Price

Potential risks include integration challenges with existing systems, data migration issues, user adoption problems, inadequate training, and the high initial cost of implementation. These challenges can lead to delays, cost overruns, and operational disruptions, potentially causing stock price volatility.

Mitigation Strategies for Maintaining Stock Price Stability

Source: researchgate.net

- Thorough planning and assessment of existing IT infrastructure before implementation.

- Comprehensive user training and change management programs.

- Phased implementation to minimize disruption.

- Choosing a reputable PLM vendor with proven experience.

- Establishing clear project goals and KPIs to track progress and address issues promptly.

Case Studies: PLM and Stock Price Changes

Analyzing real-world examples of companies that have experienced significant stock price changes due to their PLM strategies provides valuable insights into the complex interplay between PLM, operational efficiency, and market valuation.

Case Study 1: Company I

Company I, a manufacturer of heavy machinery, implemented a new PLM system that significantly improved collaboration between its engineering and manufacturing teams. This led to a reduction in design errors, faster time-to-market, and ultimately, a significant increase in profitability and stock price. The successful PLM implementation was highlighted in investor reports and analyst briefings, contributing to the positive market sentiment.

Case Study 2: Company J

Company J, a pharmaceutical company, experienced a temporary dip in its stock price after a challenging PLM implementation. Integration issues with existing systems caused delays in product development and increased operational costs. However, after addressing the challenges and successfully integrating the PLM system, Company J saw a recovery in its stock price as operational efficiency improved.

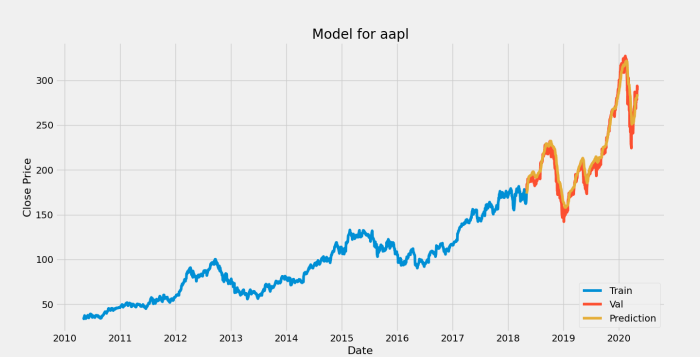

Future Outlook: PLM and Stock Price Predictions

The future of PLM is marked by continued technological advancements and evolving industry needs. This section explores the potential impact of these developments on the stock prices of related companies.

Technological Advancements and Market Dynamics

Advancements such as the increased use of AI and ML in PLM, the rise of digital twin technology, and the integration of blockchain for enhanced supply chain security are expected to transform the PLM landscape. Companies that effectively adopt and leverage these technologies are likely to gain a competitive advantage, potentially leading to positive stock performance.

Hypothetical Scenario: Future Technological Innovation

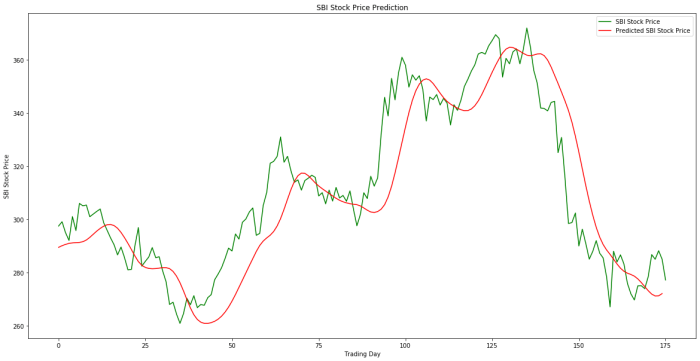

Source: cloudfront.net

Imagine a hypothetical breakthrough in AI-powered PLM, enabling predictive maintenance and automated quality control. A company, Company K, that is the first to successfully integrate this technology might experience a significant surge in its stock price due to its enhanced efficiency, reduced costs, and improved product quality.

Questions and Answers

What are some common challenges in PLM implementation that can negatively impact stock price?

Common challenges include inadequate planning, insufficient user training, integration difficulties with existing systems, and resistance to change within the organization. These issues can lead to project delays, cost overruns, and ultimately, a negative impact on efficiency and profitability, which can affect investor confidence and the stock price.

How long does it typically take to see a return on investment (ROI) from a PLM implementation?

The timeframe for ROI varies greatly depending on factors like the complexity of the implementation, the size of the organization, and the specific goals. Some companies see returns within a year, while others may take several years to fully realize the benefits. Careful planning and monitoring are essential for tracking progress and ensuring a positive ROI.

Are there specific industry sectors where the impact of PLM on stock price is more pronounced?

Industries with complex product development processes and high manufacturing costs, such as aerospace, automotive, and high-tech, tend to see a more significant impact from PLM on their stock price. This is because efficient PLM can lead to substantial cost savings and improved time-to-market in these sectors.

Interior Living

Interior Living