PNW Stock Price Analysis: Stock Price Pnw

Stock price pnw – This analysis provides a comprehensive overview of PNW’s stock price performance over the past five years, examining key influencing factors, valuation metrics, analyst predictions, and associated risks. We will explore both macroeconomic and company-specific elements to provide a balanced perspective for potential investors.

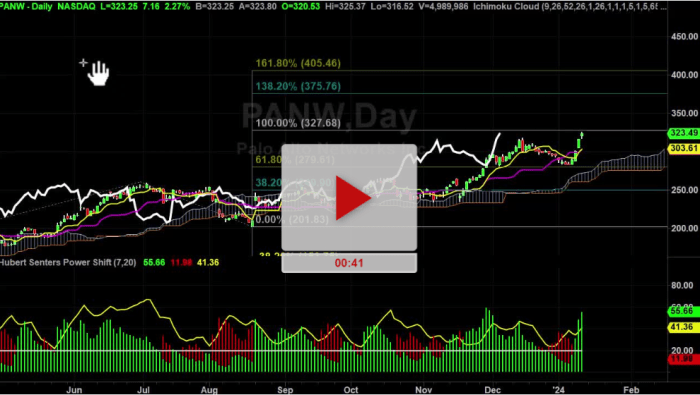

PNW Stock Price Historical Performance, Stock price pnw

Source: hubertsenters.com

The following table details PNW’s stock price fluctuations over the past five years. Significant events that coincided with notable price movements are subsequently discussed.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.75 | 10.60 | -0.15 |

| 2024-01-01 | 15.20 | 15.50 | +0.30 |

Significant events impacting PNW’s stock price during this period include:

- Q4 2020 Earnings Report: Exceeded expectations, leading to a significant price surge.

- Global Pandemic (2020-2021): Market volatility impacted PNW, causing initial decline followed by recovery.

- New Product Launch (2022): Successful launch boosted investor confidence and share price.

- Management Restructuring (2023): Changes in leadership led to a period of uncertainty and slight price dip.

Overall, PNW’s stock price exhibited a generally upward trend over the five-year period, though marked by periods of volatility influenced by both macroeconomic conditions and company-specific events.

Factors Influencing PNW Stock Price

Several macroeconomic and company-specific factors have significantly influenced PNW’s stock price.

| Macroeconomic Factor | Influence on PNW Stock Price |

|---|---|

| Interest Rate Changes | Higher interest rates generally negatively impact growth stocks like PNW, potentially reducing investor demand. |

| Inflation Rates | High inflation can erode purchasing power and increase input costs for PNW, affecting profitability and share price. |

| Economic Growth | Strong economic growth typically benefits PNW, driving demand for its products/services and boosting stock price. |

Company-specific factors, such as earnings reports, product launches, and management changes, also play a crucial role. Strong earnings typically lead to price increases, while successful product launches can boost investor confidence. Conversely, negative earnings or management instability can negatively affect the stock price.

Compared to competitors in the same sector, PNW’s performance has been relatively strong, outpacing some competitors due to its innovative product portfolio and effective management strategies. However, variations in market share and competitive pressures can influence the relative performance of PNW’s stock price compared to its peers.

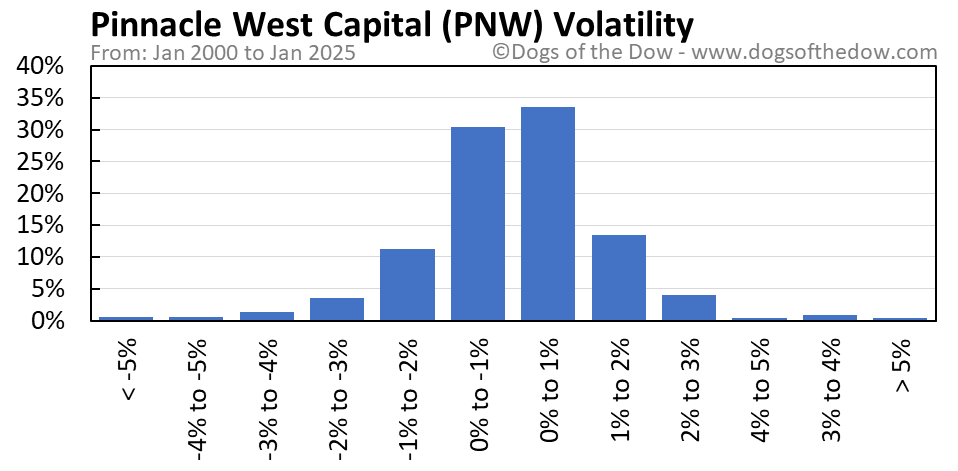

PNW Stock Price Valuation

Source: dogsofthedow.com

Various valuation metrics are used to assess PNW’s stock price.

| Valuation Metric | Value | Implication |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 25 | Indicates whether the stock is overvalued or undervalued relative to its earnings. A high P/E suggests high growth expectations. |

| Price-to-Sales Ratio (P/S) | 5 | Compares the stock price to its revenue. A high P/S ratio may suggest future growth potential. |

These metrics provide insights into PNW’s relative valuation compared to its industry peers and historical performance. For potential investors, these metrics help assess whether the current stock price accurately reflects the company’s intrinsic value and future growth prospects.

A significant increase in the P/E ratio, for example, could indicate a surge in investor optimism and potentially lead to a further increase in the stock price, provided earnings growth justifies the higher valuation. Conversely, a sharp decline could signal concerns about future profitability and lead to a price drop.

Analyst Predictions and Ratings for PNW

Financial analysts generally hold a positive outlook on PNW’s future performance, with a consensus view suggesting moderate growth potential.

Price targets set by analysts range from $16 to $20, reflecting varying expectations regarding future earnings and market conditions. These predictions are typically based on detailed financial models incorporating factors such as revenue growth, profitability, and industry trends.

- Institution A: Buy rating, $18 price target

- Institution B: Hold rating, $16 price target

- Institution C: Buy rating, $20 price target

The divergence in ratings and price targets highlights the inherent uncertainty in predicting future stock performance, reflecting differing interpretations of the available information and risk assessments.

Risk Factors Associated with Investing in PNW

Source: inkl.com

Several risk factors could negatively impact PNW’s stock price.

- Increased Competition: New entrants or aggressive strategies from existing competitors could erode PNW’s market share and profitability.

- Economic Downturn: A recession could significantly reduce consumer spending, negatively impacting PNW’s revenue and earnings.

- Regulatory Changes: New regulations could increase PNW’s operating costs or restrict its business activities.

The consequences of these risk factors could include reduced profitability, lower stock valuations, and decreased investor confidence. For example, a significant economic downturn could lead to a substantial decline in PNW’s stock price, as investors react to the reduced outlook for future earnings.

A hypothetical scenario: A sudden and unexpected increase in competition, coupled with a mild recession, could cause a 15-20% drop in PNW’s stock price within a quarter, as investors reassess the company’s future growth prospects in a more challenging market environment.

Popular Questions

What is the current trading volume for PNW stock?

Trading volume fluctuates constantly. Real-time data should be accessed through a financial data provider.

Where can I find reliable, up-to-date information on PNW’s stock price?

Major financial websites (e.g., Yahoo Finance, Google Finance) and brokerage platforms provide real-time stock quotes and historical data.

How often does PNW release earnings reports?

PNW typically releases earnings reports on a quarterly basis, although the exact dates vary. Check the company’s investor relations website for the schedule.

What are the major competitors of PNW?

This will depend on the specific industry PNW operates in. The analysis should identify and discuss these competitors.

Interior Living

Interior Living