SWKS Technologies: A Comprehensive Stock Analysis

Stock price swks – This analysis delves into the intricacies of SWKS Technologies’ stock performance, examining its historical trends, financial health, and future prospects. We will explore key factors influencing its stock price, analyst predictions, and potential investment strategies, providing a holistic view for informed decision-making.

SWKS Company Overview

SWKS Technologies, Inc. is a designer and manufacturer of precision-engineered components, primarily serving the automotive and industrial sectors. Founded [Insert Founding Year Here], the company has grown to become a significant player in its niche market, known for its high-quality products and innovative solutions. SWKS’s core business revolves around the design and manufacturing of sealing solutions, including O-rings, custom-molded parts, and other specialized components crucial for various applications.

Its market position is characterized by strong customer relationships and a focus on providing specialized products catering to diverse industries. The competitive landscape is relatively fragmented, with several smaller companies and larger multinational corporations vying for market share. SWKS’s key financial metrics generally demonstrate consistent revenue growth and profitability, although fluctuations are common given the cyclical nature of some of its key markets.

Specific financial data, such as revenue figures and profit margins, will be presented in later sections.

Factors Influencing SWKS Stock Price

Several factors significantly impact SWKS’s stock price. Macroeconomic conditions, such as interest rate fluctuations and inflation, influence consumer spending and business investment, indirectly affecting demand for SWKS’s products. Industry trends, particularly within the automotive and industrial sectors, also play a crucial role. For example, increased demand for electric vehicles could positively impact SWKS if it successfully secures contracts to supply components for these vehicles.

SWKS’s performance relative to its competitors is another key factor, with market share gains potentially driving up its stock price. Finally, any news or announcements concerning the company, such as new product launches, major contracts, or changes in management, can have a substantial short-term impact on the stock price.

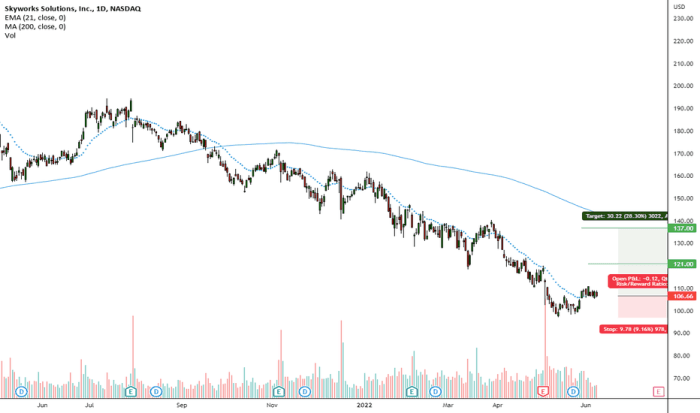

SWKS Stock Price Historical Performance, Stock price swks

Source: tradingview.com

Understanding SWKS’s historical stock price movements is crucial for assessing its future potential. The following table presents a sample of historical data; a comprehensive visual representation would typically involve a line chart showing the price over time.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| [Date 1] | [Open Price 1] | [High Price 1] | [Low Price 1] | [Close Price 1] | [Volume 1] |

| [Date 2] | [Open Price 2] | [High Price 2] | [Low Price 2] | [Close Price 2] | [Volume 2] |

| [Date 3] | [Open Price 3] | [High Price 3] | [Low Price 3] | [Close Price 3] | [Volume 3] |

A visual representation of the stock price over the past year would show [Describe the overall trend: e.g., a general upward trend with periods of consolidation, a significant drop followed by a recovery, etc.]. Key features would include the highest and lowest points reached during the period, highlighting significant price fluctuations. For example, a sudden drop might be linked to a negative news announcement, while a sharp rise might correspond to a successful product launch or a positive earnings report.

SWKS Financial Statements and Performance

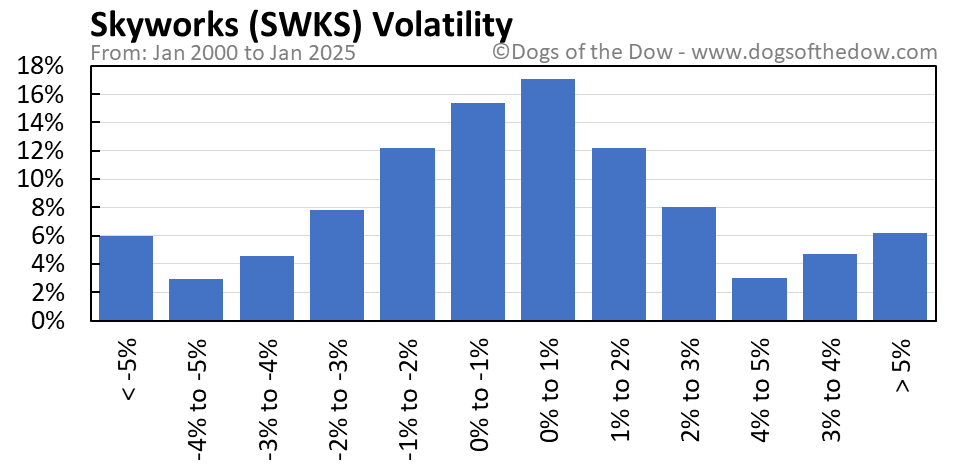

Source: dogsofthedow.com

A thorough assessment of SWKS’s financial health requires a detailed review of its income statement, balance sheet, and cash flow statement. These statements reveal crucial information about the company’s revenue, profitability, debt levels, and overall financial position. The following table provides a simplified comparison of key financial ratios to industry averages; actual figures should be sourced from financial databases.

| Ratio | SWKS | Industry Average |

|---|---|---|

| Return on Equity (ROE) | [Value] | [Value] |

| Debt-to-Equity Ratio | [Value] | [Value] |

| Profit Margin | [Value] | [Value] |

Analysis of these statements would reveal trends in SWKS’s revenue growth, profitability, and debt levels over time. For example, consistent revenue growth combined with increasing profit margins would suggest a healthy and expanding business. Conversely, rising debt levels could indicate potential financial risks.

Analyst Ratings and Price Targets for SWKS

Analyst opinions on SWKS’s future performance are reflected in their ratings and price targets. These provide valuable insights, although it’s crucial to remember that they are predictions, not guarantees. The following table presents a hypothetical summary; actual ratings should be obtained from reputable financial news sources.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| [Analyst Firm 1] | [Rating 1] | [Price Target 1] |

| [Analyst Firm 2] | [Rating 2] | [Price Target 2] |

| [Analyst Firm 3] | [Rating 3] | [Price Target 3] |

Discrepancies in analyst ratings and price targets often stem from differing assessments of SWKS’s growth potential, market share prospects, and competitive landscape. A wide range of price targets indicates significant uncertainty about the stock’s future performance.

SWKS Investment Strategies and Risk Assessment

Source: semimedia.cc

Several investment strategies can be applied to SWKS stock, each carrying different levels of risk. A buy-and-hold strategy involves purchasing shares and holding them for an extended period, aiming to benefit from long-term growth. Day trading, on the other hand, involves frequent buying and selling of shares within a single day, seeking to profit from short-term price fluctuations. This is inherently riskier.

Investing in SWKS stock involves various risks, including market risk (overall market downturns), company-specific risks (e.g., declining sales, production issues), and competitive risks (loss of market share). Positive factors influencing future performance could include successful new product launches, expansion into new markets, and strong demand for its products. Negative factors could involve increased competition, economic slowdowns, or supply chain disruptions.

Answers to Common Questions: Stock Price Swks

What are the major risks associated with investing in SWKS?

Investing in SWKS, like any stock, carries inherent risks including market volatility, competition within the technology sector, and potential changes in consumer demand. Economic downturns can also significantly impact the company’s performance and stock price.

Where can I find real-time SWKS stock price data?

Real-time SWKS stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Your specific brokerage account will also provide access to this information.

How frequently are SWKS financial statements released?

SWKS Technologies, like most publicly traded companies, typically releases its financial statements quarterly (10-Q) and annually (10-K). These filings can be found on the company’s investor relations website and the Securities and Exchange Commission (SEC) website (EDGAR).

What is SWKS’s dividend policy?

Understanding the fluctuations in SWKS stock price requires a multifaceted approach. One helpful comparative analysis involves examining similar market trends, such as those affecting the price of stock price pins , to identify potential correlations. By studying these related market sectors, we can gain valuable insights into the factors influencing SWKS’s performance and potentially predict future price movements.

Information regarding SWKS’s dividend policy, if any, should be found in their investor relations section on their corporate website. This section typically details dividend history and any current dividend payouts.

Interior Living

Interior Living