Understanding Stock Price Fluctuations

The term “stock price tost,” while not a standard financial term, likely refers to the significant and often rapid changes in a stock’s price. It implies a noticeable shift, either upward or downward, and suggests a level of volatility. Variations in spelling might include “toast,” suggesting a celebratory rise, or other similar phonetic variations. The origins are unclear, but its use likely stems from informal discussions within trading communities, where concise and evocative language is preferred.

Potential Meanings and Interpretations of “Stock Price Tost”

The phrase “stock price tost” can be interpreted in several ways, depending on the context. A positive interpretation suggests a rapid and substantial increase in a stock’s price, often driven by positive news or market sentiment. Conversely, a negative interpretation might indicate a sharp and sudden decline, perhaps due to negative news or a market correction. The term lacks precision, highlighting the inherent uncertainty in stock market movements.

Possible Origins and Usage Across Financial Communities

The exact origins of “stock price tost” are difficult to pinpoint. It’s likely a colloquialism that emerged within informal financial discussions, possibly within online forums or trading groups. Its usage isn’t widespread in formal financial analysis but might be found in informal communication among traders or investors.

Examples of “Stock Price Tost” in Various Financial Contexts

Imagine a scenario where a tech company announces a groundbreaking new product. This positive news could trigger a “stock price tost,” causing a rapid increase in the stock’s value. Conversely, if the same company announces disappointing earnings, the stock might experience a negative “stock price tost,” leading to a sharp price drop.

Impact of Market Factors

Macroeconomic factors, industry trends, and market events significantly influence stock prices. Understanding these influences is crucial for interpreting any “stock price tost.”

Influence of Macroeconomic Factors

Inflation, interest rates, and economic growth directly affect stock valuations. High inflation might erode corporate profits, leading to lower stock prices, potentially resulting in a negative “stock price tost.” Conversely, lower interest rates can stimulate borrowing and investment, potentially causing a positive “stock price tost.”

Role of Industry-Specific Trends and News

Industry-specific news and trends have a significant impact. A positive development within a particular sector, like a technological breakthrough, might lead to a positive “stock price tost” for companies within that sector. Negative news, such as increased regulation, could trigger the opposite.

Effects of Different Market Events

Economic downturns and geopolitical instability often lead to market volatility, impacting stock prices. A global recession might trigger a widespread negative “stock price tost” across various sectors. Geopolitical events, like wars or trade disputes, can also create uncertainty, leading to significant price fluctuations.

Hypothetical Scenario Illustrating Market Force Interactions

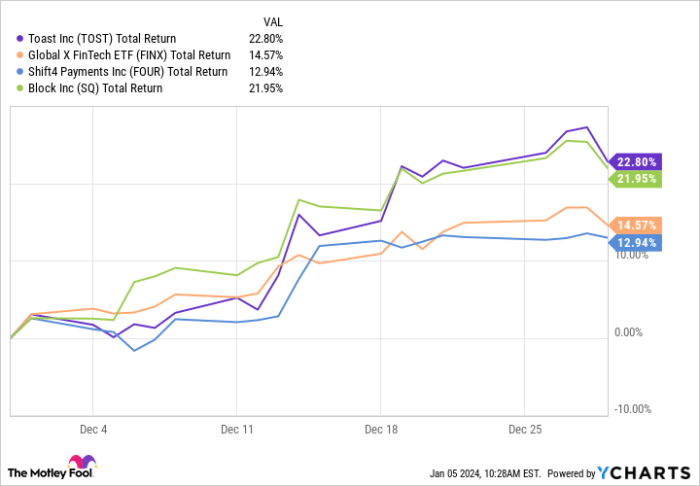

Source: zenfs.com

Consider a hypothetical scenario where a company in the renewable energy sector announces strong earnings amidst rising global concerns about climate change and government incentives for green energy. The combination of positive company news and favorable macroeconomic conditions could result in a significant positive “stock price tost” for the company’s stock.

Analyzing stock price fluctuations requires a multifaceted approach. Understanding the factors influencing a company like Shake Shack, for instance, can offer valuable insights. To better grasp this, examining the performance of its competitor’s stock price, such as the current stock price shake shack , provides a useful benchmark. This comparative analysis can then inform a more comprehensive understanding of the dynamics affecting the stock price tost, ultimately leading to better informed investment decisions.

Company-Specific Influences

A company’s financial performance and actions are primary drivers of its stock price. Key metrics and announcements significantly impact the likelihood of a “stock price tost”.

Key Financial Metrics Impacting Stock Price

Earnings, revenue growth, debt levels, and profit margins are crucial indicators of a company’s financial health. Strong earnings and revenue growth often lead to positive “stock price tosts,” while high debt levels or declining profits might result in negative ones.

Examples of Company Announcements Causing Stock Price Shifts

Announcements of new product launches, mergers and acquisitions, or changes in management can all significantly impact stock prices. A successful product launch might create a positive “stock price tost,” while a failed merger could trigger a negative one.

Comparison of Positive and Negative Company News Effects

| Positive Company News | Negative Company News |

|---|---|

| Strong earnings report | Disappointing earnings report |

| Successful product launch | Product recall |

| Strategic partnership announcement | Lawsuit announcement |

| Increased market share | Decreased market share |

Investor Sentiment and Behavior

Investor sentiment and trading strategies play a vital role in shaping stock price movements. Understanding these dynamics is key to interpreting “stock price tosts.”

Influence of Investor Sentiment

Optimistic investor sentiment often leads to higher stock prices, potentially creating a positive “stock price tost.” Conversely, pessimistic sentiment can drive prices down, leading to a negative one. This sentiment can be influenced by news, economic data, or broader market trends.

Impact of Different Investor Trading Strategies

Various trading strategies, such as day trading or value investing, can influence stock prices. High-frequency trading, for instance, can contribute to short-term volatility, increasing the likelihood of both positive and negative “stock price tosts.”

Hypothetical Scenario Showing Change in Investor Behavior, Stock price tost

Imagine a scenario where a widely held belief that a particular stock is undervalued is suddenly replaced by widespread fear of a market correction. This shift in investor sentiment could cause a sharp, negative “stock price tost,” regardless of the company’s actual financial performance.

Illustrative Examples

Real-world examples illustrate how various factors combine to create “stock price tosts”.

Real-World Example of Significant Price Change

Tesla’s stock price has experienced numerous significant fluctuations. Positive news, such as record sales figures or innovative product announcements, has often resulted in sharp price increases (positive “stock price tosts”). Conversely, negative news, such as production delays or regulatory challenges, has often caused equally sharp declines (negative “stock price tosts”).

Second Example Illustrating a Different Scenario

Consider a pharmaceutical company announcing a successful clinical trial for a new drug. This positive news could create a substantial positive “stock price tost” as investors anticipate future revenue growth. However, subsequent regulatory hurdles or unexpected side effects could reverse this, resulting in a significant negative “stock price tost.”

Visual Representation of Factors and Stock Price Relationship

Imagine a three-dimensional graph. The x-axis represents company performance (earnings, revenue), the y-axis represents macroeconomic conditions (interest rates, inflation), and the z-axis represents the stock price. Positive movement on the x and y axes generally leads to positive movement on the z-axis (positive “stock price tost”), while negative movement often results in the opposite (negative “stock price tost”). However, the relationship is not always linear and can be complex due to investor sentiment and other unpredictable factors.

Predictive Modeling Challenges: Stock Price Tost

Source: seekingalpha.com

Predicting stock prices accurately is notoriously difficult, and creating a reliable model for “stock price tosts” presents unique challenges.

Challenges in Creating a Predictive Model

The inherent volatility of the stock market, the influence of unpredictable events, and the difficulty in quantifying investor sentiment make accurate prediction extremely challenging. Models are often limited by the availability and quality of data.

Potential Variables for a Predictive Model

A predictive model for “stock price tosts” might include variables such as company financial performance, macroeconomic indicators, industry trends, news sentiment, and investor trading activity. However, accurately weighting and incorporating these variables remains a significant challenge.

Limitations of Using Any Predictive Model

- No model can perfectly predict the future.

- Unforeseen events can significantly impact stock prices.

- Models are only as good as the data they use.

- Over-reliance on models can lead to poor investment decisions.

- Investor sentiment and behavior are difficult to quantify and predict.

FAQ Summary

What are some potential misinterpretations of “Stock Price Tost”?

The term’s ambiguity lends itself to misinterpretations. It could be confused with established financial terms or misinterpreted as a specific trading strategy, necessitating careful contextual analysis.

How does social media sentiment affect “Stock Price Tost”?

Social media sentiment can significantly influence investor behavior and, consequently, “Stock Price Tost.” Positive or negative trends on platforms like Twitter or Reddit can drive market movements.

Are there ethical considerations related to manipulating “Stock Price Tost”?

Yes, attempts to artificially manipulate “Stock Price Tost” through misinformation or coordinated trading strategies are unethical and often illegal, violating securities regulations.

Interior Living

Interior Living