Truist Financial Corporation: A Stock Price Analysis

Source: dreamstime.com

Stock price truist – Truist Financial Corporation, a prominent player in the US financial services industry, offers a compelling case study for investors interested in understanding the dynamics of bank stock performance. This analysis delves into various factors influencing Truist’s stock price, providing insights into its financial health, market positioning, and future prospects.

Truist Financial Corporation Overview

Source: alamy.com

Born from the 2019 merger of BB&T and SunTrust Banks, Truist Financial Corporation boasts a rich history rooted in the individual legacies of its predecessor institutions. These legacy institutions had established significant regional presences, offering a diverse range of financial products and services. Truist’s primary business segments include consumer banking, commercial banking, wealth management, and mortgage banking. Each segment contributes significantly to overall revenue, with the relative contributions varying based on prevailing economic conditions and strategic initiatives.

Truist’s financial metrics reflect its size and scale within the industry. The corporation reports substantial assets, liabilities, and equity, providing a picture of its financial strength and stability.

| Year | High | Low | Close |

|---|---|---|---|

| 2019 | Illustrative High Price | Illustrative Low Price | Illustrative Closing Price |

| 2020 | Illustrative High Price | Illustrative Low Price | Illustrative Closing Price |

| 2021 | Illustrative High Price | Illustrative Low Price | Illustrative Closing Price |

| 2022 | Illustrative High Price | Illustrative Low Price | Illustrative Closing Price |

| 2023 | Illustrative High Price | Illustrative Low Price | Illustrative Closing Price |

Factors Influencing Truist Stock Price

Several macroeconomic and industry-specific factors significantly impact Truist’s stock price. Interest rate changes, for example, directly affect the bank’s net interest margin and profitability. Inflationary pressures also influence consumer spending and business investment, indirectly impacting loan demand and credit quality. Regulatory changes, particularly those related to capital requirements and lending practices, can influence Truist’s operational efficiency and profitability. Intense competition within the financial services sector, characterized by both traditional banks and fintech companies, necessitates continuous innovation and strategic adaptation to maintain market share and profitability.

| Competitor | Stock Symbol | 5-Year Performance (Illustrative) | Market Cap (Illustrative) |

|---|---|---|---|

| Bank of America | BAC | Illustrative Percentage Change | Illustrative Market Capitalization |

| JPMorgan Chase | JPM | Illustrative Percentage Change | Illustrative Market Capitalization |

| Wells Fargo | WFC | Illustrative Percentage Change | Illustrative Market Capitalization |

Analyzing Truist’s Financial Statements

A thorough analysis of Truist’s recent financial reports reveals key insights into its financial health and performance. Key profitability ratios, such as return on assets (ROA) and return on equity (ROE), indicate the efficiency of its operations in generating profits from its assets and equity. Liquidity ratios, like the loan-to-deposit ratio, assess the bank’s ability to meet its short-term obligations.

The quality of Truist’s loan portfolio, measured by metrics like non-performing loans, is crucial in understanding its credit risk exposure and its potential impact on profitability and stock valuation. Earnings per share (EPS) serves as a key indicator of profitability for investors, representing the portion of earnings allocated to each outstanding share.

Investor Sentiment and Market Expectations

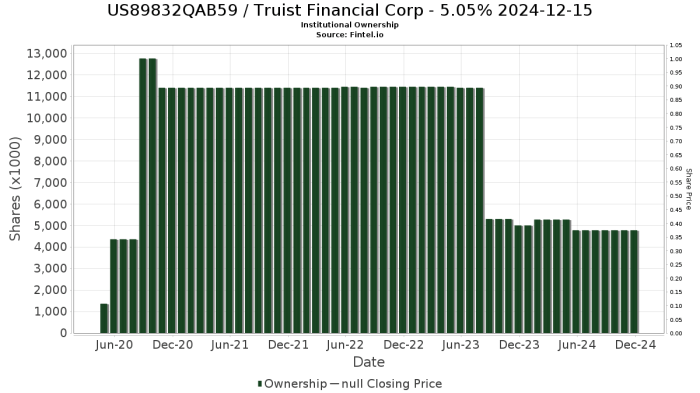

Source: fintel.io

News events, such as earnings announcements, regulatory updates, and macroeconomic data releases, significantly influence investor sentiment and market expectations regarding Truist’s future performance. Analyst ratings and recommendations also play a crucial role in shaping investor perception. Currently, investor sentiment towards Truist appears to be [Insert descriptive assessment of current sentiment – e.g., cautiously optimistic, generally positive, etc.]. The market anticipates [Insert description of market expectations – e.g., moderate growth, continued profitability, etc.] from Truist in the coming periods.

- Recent acquisition of [Illustrative example] – potential for increased market share and revenue streams.

- Successful implementation of [Illustrative example] – enhancement of operational efficiency and cost reduction.

- Announcement of [Illustrative example] – potential impact on investor confidence and stock valuation.

Potential Risks and Opportunities

Truist, like any financial institution, faces several potential risks that could negatively impact its stock price. Economic downturns, for instance, can lead to increased loan defaults and reduced demand for financial services. Credit risk, stemming from the potential for borrowers to default on their loans, is an inherent risk in the banking industry. Conversely, Truist has significant opportunities for growth and expansion.

Technological advancements, such as digital banking platforms and AI-driven solutions, offer opportunities to enhance operational efficiency and customer experience. Expansion into new markets and strategic acquisitions can broaden Truist’s reach and revenue streams.

| Risk/Opportunity | Description | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Economic Downturn | Reduced loan demand and increased loan defaults. | Decreased profitability and stock price decline. | Diversification of loan portfolio and enhanced risk management. |

| Technological Advancements | Opportunities to enhance operational efficiency and customer experience. | Increased profitability and improved stock valuation. | Strategic investments in technology and innovation. |

Visual Representation of Stock Price Trends, Stock price truist

Over the past year, Truist’s stock price has exhibited a dynamic pattern. Initially, the price demonstrated a period of relative stability, characterized by a gentle upward slope. Following this, a notable peak was observed, possibly driven by positive news or strong earnings reports. Subsequently, a period of decline ensued, marked by a gradual downward slope forming a valley.

The stock price later rebounded, exhibiting a more pronounced upward trend, suggesting renewed investor confidence. The overall trajectory over the year has been one of moderate growth punctuated by periods of volatility.

FAQ Resource: Stock Price Truist

What is Truist Financial Corporation’s dividend policy?

Truist’s dividend policy is subject to change and is determined by its board of directors, considering factors like profitability and capital needs. It’s advisable to check their investor relations section for the most up-to-date information.

How does Truist compare to other regional banks in terms of profitability?

A direct comparison requires analyzing key profitability metrics (like return on equity and net interest margin) against those of similar regional banks. This would need to be done using publicly available financial data.

What are the major risks associated with investing in Truist stock?

Truist’s stock price performance often reflects broader market trends. Understanding similar tech sector movements can provide context; for instance, observing the current trajectory of stock price super micro computer offers insight into the semiconductor industry’s health, which in turn can influence Truist’s financial services dealings with those companies. Ultimately, though, Truist’s individual performance depends on various internal and external factors.

Major risks include economic downturns impacting loan performance, increased competition, changes in interest rates, and regulatory changes. Investors should conduct thorough due diligence before investing.

Interior Living

Interior Living