Understanding Stock Target Prices and Time Frames

Stock target price time frame – Investing in the stock market often involves forecasting future price movements. A crucial aspect of this forecasting is understanding stock target prices and their associated time frames. This involves analyzing various factors to estimate potential future values and the time it might take to reach them. Accurate predictions are challenging, yet understanding the methodologies and limitations is essential for informed investment decisions.

Defining Stock Target Price and Time Frame, Stock target price time frame

Source: cheggcdn.com

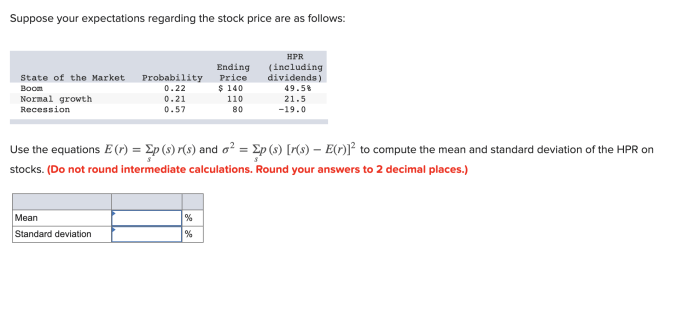

A stock target price represents an analyst’s or investor’s estimate of a stock’s fair value at a specific point in the future. It’s a projected price, not a guaranteed outcome. Several factors influence a stock’s target price, including the company’s financial performance (earnings, revenue growth, profitability), industry trends, macroeconomic conditions (interest rates, inflation), and overall market sentiment.

Time frames for stock price predictions vary widely. Short-term predictions typically cover periods of a few days to a few months. Mid-term predictions span from several months to a couple of years, while long-term predictions extend beyond two years, sometimes even decades.

| Investment Strategy | Time Frame | Target Price Focus | Risk Profile |

|---|---|---|---|

| Short-Term Trading | Days to Months | Near-term price fluctuations | High |

| Mid-Term Investing | Months to Years | Moderate-term price appreciation | Medium |

| Long-Term Investing | Years to Decades | Long-term growth and dividends | Low |

Methods for Determining Stock Target Prices

Source: numerade.com

Several methods exist for determining stock target prices. These methods can be broadly categorized into fundamental analysis and technical analysis, each with its own strengths and limitations.

Determining a stock’s target price often involves considering various timeframes, from short-term market fluctuations to long-term growth projections. Understanding the current market sentiment is crucial, and a good example of volatile price action is the recent performance of Vinfast, which you can track via this resource: stock price vinfast. Analyzing such cases helps refine methodologies for predicting future stock target price time frames and associated risks.

The Discounted Cash Flow (DCF) model is a fundamental analysis technique that estimates a company’s intrinsic value by discounting its projected future cash flows back to their present value. Comparable company analysis involves comparing the valuation multiples (like Price-to-Earnings ratio) of a company to similar companies in the same industry to estimate a target price. Fundamental analysis focuses on a company’s financial health and intrinsic value, while technical analysis uses charts and historical price data to identify patterns and predict future price movements.

In a hypothetical scenario, applying the DCF model to Company X might yield a target price of $50, while comparable company analysis suggests a target price of $45. This difference highlights the inherent uncertainty and subjectivity involved in valuation.

Time Frame Considerations in Target Price Setting

Predicting stock prices across different time horizons presents unique challenges. Short-term predictions are highly susceptible to market volatility and unexpected events, such as sudden economic downturns or company-specific news (e.g., a product recall or a major lawsuit). Long-term predictions are more stable but are influenced by broader economic trends, technological advancements, and shifts in consumer preferences. Factors such as geopolitical instability and regulatory changes also affect long-term projections.

Market volatility significantly impacts the accuracy of short-term target prices. Sharp price swings make short-term predictions less reliable. Long-term predictions, while less sensitive to daily fluctuations, are still affected by unexpected major economic shifts or unforeseen disruptive events.

The Role of Analyst Forecasts

Financial analysts use a combination of quantitative and qualitative methods to arrive at their stock target prices and time frames. These methods include fundamental and technical analysis, along with considerations of industry trends and macroeconomic factors. Analysts often provide a range of target prices rather than a single point estimate, reflecting the inherent uncertainty in their predictions.

The accuracy of analyst forecasts varies considerably across different time frames. Short-term forecasts are generally less accurate than long-term forecasts due to the increased influence of market noise and unexpected events. However, even long-term forecasts are not always reliable.

| Analyst | Target Price | Time Frame |

|---|---|---|

| Analyst A | $48 | 12 Months |

| Analyst B | $52 | 12 Months |

| Analyst C | $55 | 12 Months |

Practical Applications and Limitations

Stock target prices and time frames serve as valuable tools for investors, aiding in the development of investment strategies. However, relying solely on these projections is risky. Investors should always consider their own risk tolerance, diversify their portfolios, and conduct thorough due diligence before making investment decisions.

Investors can use target price and time frame information in conjunction with other investment strategies, such as value investing or growth investing. For instance, a value investor might look for stocks trading below their target price, while a growth investor might focus on stocks with high growth potential and longer-term target prices.

Visual Representation of Target Price and Time Frame

Source: corporatefinanceinstitute.com

A line graph can effectively illustrate the relationship between stock price, target price, and time frame. The horizontal axis represents time, and the vertical axis represents the stock price. The actual stock price is plotted as a line, while the target price is represented by a horizontal line. The distance between the two lines indicates the difference between the current price and the projected target price at a given point in time.

A bar chart can display the distribution of analyst target prices for a specific stock over a defined period. The horizontal axis would list the analysts, and the vertical axis would represent the target prices. The height of each bar would correspond to the target price given by each analyst.

FAQ Overview: Stock Target Price Time Frame

What is the difference between a short-term and long-term stock target price?

Short-term target prices typically focus on price movements within a few months or a year, often influenced by short-term market trends. Long-term target prices project potential value over several years, considering fundamental factors like company growth and industry trends.

How reliable are analyst stock price predictions?

Analyst predictions are not always accurate. Their reliability varies based on the analyst’s expertise, the methodology used, and the inherent unpredictability of the market. It’s crucial to view them as one factor among many in your investment decision-making process.

Can I use stock target prices to time the market?

Attempting to “time the market” using solely target prices is risky. Market timing is notoriously difficult, and relying on target prices alone can lead to missed opportunities or significant losses. A long-term investment strategy is generally more effective.

What factors should I consider beyond target prices when making investment decisions?

Beyond target prices, consider your risk tolerance, investment goals, diversification strategy, and a thorough understanding of the company’s financial health and competitive landscape.

Interior Living

Interior Living