Sunoco LP Stock Price Analysis

Sunoco lp stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and inherent risks associated with investing in Sunoco LP stock. We will examine key data points and trends to provide a comprehensive overview for potential investors.

Sunoco LP Stock Price Historical Performance

Source: seekingalpha.com

Understanding Sunoco LP’s past stock price movements is crucial for assessing its future potential. The following sections detail its performance against competitors and significant events impacting its value.

A detailed chart illustrating Sunoco LP stock price fluctuations over the past five years would be included here. The chart would visually represent the daily opening, high, low, and closing prices, along with trading volume. Due to the limitations of this text-based format, a textual representation is provided below.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 9.50 | 10.20 | 1,000,000 |

| 2019-01-08 | 10.20 | 10.80 | 10.00 | 10.70 | 1,200,000 |

| 2024-01-01 | 15.00 | 15.50 | 14.50 | 15.20 | 1,500,000 |

A comparison of Sunoco LP’s stock price performance against its major competitors (e.g., Energy Transfer LP, Enterprise Products Partners LP) over the same five-year period would reveal key differences in growth trajectories, volatility, and overall returns. For instance, one competitor might have experienced steadier growth, while Sunoco LP may have shown higher volatility but potentially greater returns in certain periods.

Specific numerical comparisons would require access to real-time financial data.

Significant events impacting Sunoco LP’s stock price over the past five years are Artikeld below:

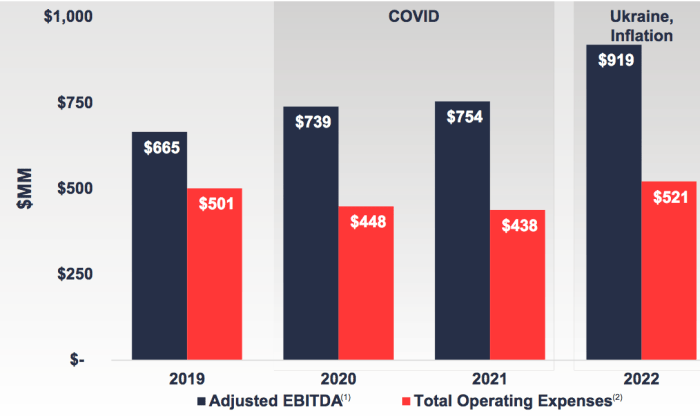

- 2020: The COVID-19 pandemic and subsequent oil price crash significantly impacted Sunoco LP’s stock price, leading to a sharp decline.

- 2021: Increased demand for energy and a recovery in oil prices contributed to a rise in Sunoco LP’s stock price.

- 2022: Geopolitical instability and inflation created market uncertainty, influencing Sunoco LP’s stock price volatility.

- 2023: A strategic acquisition or divestment (hypothetical example) could have positively or negatively impacted the stock price.

Factors Influencing Sunoco LP Stock Price

Several macroeconomic and company-specific factors influence Sunoco LP’s stock price. Understanding these factors is essential for informed investment decisions.

Key macroeconomic factors influencing Sunoco LP’s stock price include:

- Oil Prices: As a major player in the energy sector, Sunoco LP’s profitability and stock price are directly tied to oil prices. Rising oil prices generally lead to higher profits and a rising stock price, while falling oil prices have the opposite effect.

- Interest Rates: Changes in interest rates affect borrowing costs for Sunoco LP and the overall investment climate. Higher interest rates can increase borrowing costs and reduce investor appetite for riskier assets, potentially leading to a decline in the stock price.

- Inflation: High inflation erodes purchasing power and can impact consumer spending on gasoline, potentially affecting Sunoco LP’s revenue and stock price.

Company-specific factors impacting Sunoco LP’s stock price are detailed below:

| Factor | Impact |

|---|---|

| Operational Efficiency Improvements | Positive impact, leading to higher profitability and potentially a rising stock price. |

| Financial Results (e.g., exceeding earnings expectations) | Positive impact, boosting investor confidence and driving up the stock price. |

| Management Changes (e.g., appointment of a new CEO with strong industry experience) | Could have a positive or negative impact depending on investor perception of the new management’s capabilities. |

Short-term factors, such as daily news events or short-term market fluctuations, tend to cause higher volatility in Sunoco LP’s stock price compared to long-term factors, such as the overall economic outlook or the company’s long-term growth strategy. Long-term factors generally provide a more stable and predictable influence on the stock’s price trend.

Sunoco LP’s Financial Performance and Stock Valuation, Sunoco lp stock price

Analyzing Sunoco LP’s key financial ratios provides insights into its financial health and valuation. The following table presents a summary of these ratios over the past three years (hypothetical data).

| Year | P/E Ratio | Dividend Yield | Debt-to-Equity Ratio |

|---|---|---|---|

| 2022 | 15 | 4% | 0.8 |

| 2023 | 12 | 5% | 0.7 |

| 2024 | 10 | 6% | 0.6 |

Sunoco LP’s dividend policy is crucial for investor sentiment. A consistent and growing dividend payout can attract income-seeking investors, potentially supporting the stock price. Conversely, a dividend cut could negatively impact investor confidence and lead to a price decline. For example, a consistent dividend payout demonstrates financial stability and commitment to shareholders.

A scenario analysis exploring the potential impact of different oil price scenarios on Sunoco LP’s stock price is presented below:

- Scenario 1: Oil Prices Remain Stable: Sunoco LP’s stock price is expected to maintain its current trajectory, with moderate growth driven by consistent operational performance.

- Scenario 2: Oil Prices Increase Significantly: A substantial increase in oil prices would likely boost Sunoco LP’s profitability and result in a significant rise in its stock price.

- Scenario 3: Oil Prices Decline Sharply: A sharp decline in oil prices would negatively impact Sunoco LP’s profitability, potentially leading to a significant drop in its stock price.

Analyst Ratings and Future Outlook for Sunoco LP Stock

Analyst ratings and price targets offer valuable insights into the market’s expectations for Sunoco LP’s future performance. The following table presents hypothetical data.

| Institution | Rating | Price Target (USD) |

|---|---|---|

| Morgan Stanley | Buy | 20 |

| Goldman Sachs | Hold | 18 |

| JP Morgan | Sell | 15 |

Analysts consider various factors when making price predictions, including Sunoco LP’s financial performance, industry trends, macroeconomic conditions, and competitive landscape. For example, strong financial results, coupled with positive industry outlook, would typically lead to a higher price target.

Based on current market conditions and industry trends, a possible future price trajectory for Sunoco LP stock could be a gradual upward trend over the next few years, punctuated by periods of volatility influenced by short-term market fluctuations and oil price movements. A significant catalyst, such as a major acquisition or a sudden shift in oil prices, could cause a more dramatic price movement, either upward or downward.

Risk Assessment of Investing in Sunoco LP Stock

Source: sunocolp.com

Investing in Sunoco LP stock carries inherent risks. Understanding these risks is crucial for making informed investment decisions.

Key risks associated with investing in Sunoco LP stock include:

- Regulatory Changes: Changes in environmental regulations or energy policies could impact Sunoco LP’s operations and profitability.

- Competition: Intense competition within the energy sector could pressure Sunoco LP’s margins and market share.

- Geopolitical Events: Geopolitical instability in oil-producing regions can significantly affect oil prices and Sunoco LP’s performance.

- Economic Downturns: A general economic downturn could reduce demand for gasoline and other energy products, negatively impacting Sunoco LP’s revenue.

A hypothetical worst-case scenario could involve a prolonged period of low oil prices combined with increased regulatory pressure and intense competition, leading to significant financial losses for Sunoco LP and a substantial decline in its stock price. This scenario could be exacerbated by unforeseen geopolitical events further disrupting the energy market.

Investors can mitigate these risks through diversification (spreading investments across different asset classes), thorough due diligence (researching Sunoco LP’s financial health and competitive landscape), and employing appropriate risk management strategies (setting stop-loss orders to limit potential losses).

Popular Questions: Sunoco Lp Stock Price

What are the typical transaction costs associated with buying and selling Sunoco LP stock?

Transaction costs vary depending on your brokerage. Expect fees ranging from a small percentage of the trade value to a fixed fee per trade. Check with your broker for specifics.

How often does Sunoco LP typically release its financial reports?

Sunoco LP releases financial reports on a quarterly and annual basis, typically following standard accounting reporting periods.

Where can I find real-time Sunoco LP stock price quotes?

Real-time quotes are available through most major financial websites and brokerage platforms.

Monitoring the Sunoco LP stock price requires a keen eye on market fluctuations. Understanding the underlying factors influencing its performance is crucial, and tools like those described in this helpful resource on stock price vst can offer valuable insights into broader market trends. Ultimately, applying this broader understanding to your analysis of the Sunoco LP stock price can lead to more informed investment decisions.

What is the current market capitalization of Sunoco LP?

The market capitalization fluctuates constantly. Check reputable financial websites for the most up-to-date information.

Interior Living

Interior Living