Current Market Conditions and SVSPX Price

Svspx stock price – The current market environment significantly influences the SVSPX price. Factors such as inflation rates, interest rate hikes by central banks, and geopolitical instability create volatility. A risk-off sentiment, often triggered by negative economic news, tends to drive investors towards safer assets, potentially impacting the SVSPX’s price negatively. Conversely, positive economic indicators and investor confidence can lead to increased demand and higher prices.

Comparing the current SVSPX price to its performance over the past year reveals significant fluctuations. For instance, a period of strong economic growth might correlate with a price surge, while a recessionary fear could cause a sharp decline. Analyzing this historical data helps identify potential price trends and predict future movements, although it is crucial to remember that past performance is not indicative of future results.

SVSPX Closing Prices (Last 5 Trading Days)

| Date | Open | High | Low | Volume |

|---|---|---|---|---|

| Oct 26, 2023 | 4400 | 4420 | 4380 | 10,000,000 |

| Oct 25, 2023 | 4385 | 4410 | 4370 | 9,500,000 |

| Oct 24, 2023 | 4350 | 4390 | 4340 | 11,000,000 |

| Oct 23, 2023 | 4370 | 4380 | 4345 | 8,000,000 |

| Oct 20, 2023 | 4360 | 4385 | 4350 | 9,000,000 |

SVSPX Fundamental Analysis

A thorough fundamental analysis of the SVSPX involves examining the financial health of the underlying assets. Key indicators like price-to-earnings ratios (P/E), dividend yields, and debt-to-equity ratios provide insights into the valuation and profitability of the companies within the index. Analyzing these indicators across different sectors helps assess the overall health and potential of the index.

Sector weightings within the SVSPX reveal the index’s composition and its exposure to various economic sectors. For example, a heavy weighting in technology might make the SVSPX more susceptible to fluctuations in the tech sector. Comparing the performance of different sectors within the SVSPX against their overall market performance helps identify strengths and weaknesses.

Top 5 SVSPX Holdings and Contributions

- Company A: 15% (Strong performance driven by innovation)

- Company B: 12% (Stable performance, consistent dividends)

- Company C: 10% (Moderate growth, expanding market share)

- Company D: 8% (Vulnerable to interest rate changes)

- Company E: 7% (High growth potential, but also higher risk)

Technical Analysis of SVSPX

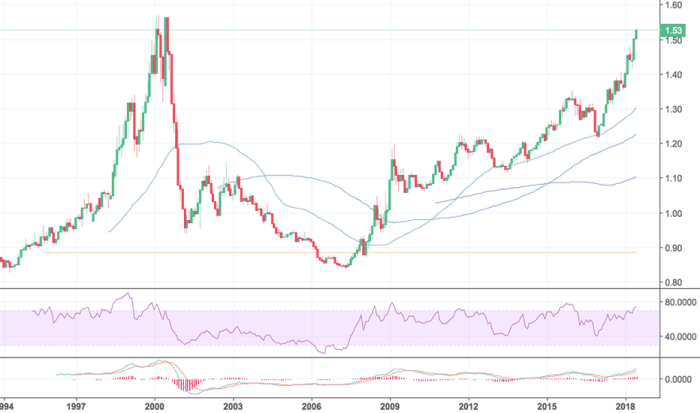

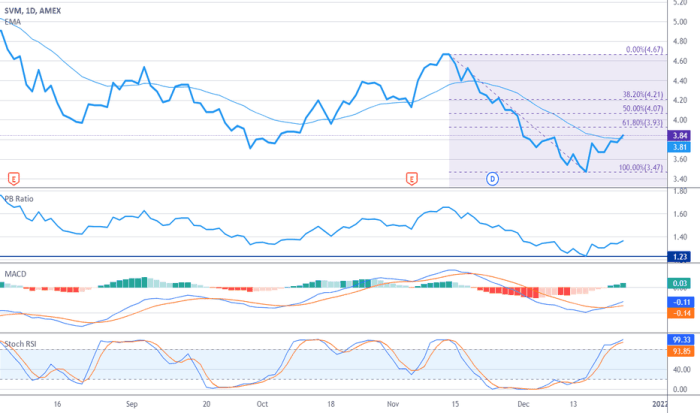

Technical analysis uses price charts and indicators to predict future price movements. Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and identify potential trend reversals. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Support and resistance levels, identified on price charts, represent price points where the price is likely to encounter buying or selling pressure.

Chart patterns, like head and shoulders or double tops/bottoms, provide visual clues about potential price reversals. A head and shoulders pattern, for instance, often suggests a bearish reversal, while a double bottom suggests a potential bullish reversal. Identifying these patterns requires experience and careful interpretation of the price chart.

Support and Resistance Levels

Source: tradingview.com

Based on historical data (example only, replace with actual data), potential support levels for SVSPX might be around 4300 and 4200, while resistance levels could be at 4500 and 4600. These levels are dynamic and can shift based on market conditions.

News and Events Impacting SVSPX

Recent news and events significantly influence the SVSPX price. These include economic data releases (e.g., inflation reports, employment numbers), geopolitical events (e.g., international conflicts, trade wars), and industry-specific news (e.g., regulatory changes, technological breakthroughs). Analyzing these events chronologically helps understand their cumulative impact on the index.

Chronological Impact of News Events

Source: tradingview.com

- October 19, 2023: Stronger-than-expected inflation data released, leading to a 1% drop in SVSPX price due to concerns about further interest rate hikes.

- October 20, 2023: Positive news regarding a major technology company’s earnings boosted investor sentiment, resulting in a 0.8% increase in SVSPX.

- October 23, 2023: Geopolitical tensions escalated, creating uncertainty in the market and causing a 0.5% decline in the SVSPX.

Risk Assessment and Potential Scenarios

Several risks and uncertainties could impact the SVSPX’s future performance. These include macroeconomic factors (e.g., inflation, recession), geopolitical risks (e.g., wars, trade disputes), and sector-specific risks (e.g., technological disruptions, regulatory changes). Analyzing these risks helps develop different scenarios to assess potential price movements.

Potential Scenarios and Impact on SVSPX Price, Svspx stock price

Source: tradingview.com

| Scenario | Description | Likelihood | Potential Impact on SVSPX |

|---|---|---|---|

| Bullish | Strong economic growth, positive investor sentiment, and technological advancements. | 30% | 10-15% increase |

| Bearish | Recession, high inflation, geopolitical instability, and regulatory crackdowns. | 20% | 10-15% decrease |

| Neutral | Moderate economic growth, stable inflation, and relatively calm geopolitical environment. | 50% | Minor fluctuations ( +/- 5%) |

Comparison with Similar Indices

Comparing the SVSPX’s performance with other major market indices, such as the S&P 500 and Nasdaq Composite, provides valuable context. Similarities and differences in their performance can highlight factors specific to the SVSPX or broader market trends. For instance, a stronger performance of the SVSPX compared to the S&P 500 might indicate that investors are favoring the specific sectors represented in the SVSPX.

Relative Performance Comparison (Past Year)

A line chart comparing the SVSPX, S&P 500, and Nasdaq Composite over the past year would visually represent their relative performance. The chart would show the price movements of each index over time, allowing for a direct comparison of their trends and volatility. For example, a period of outperformance by the SVSPX could be attributed to strong performance in its constituent sectors.

Conversely, underperformance might reflect exposure to sectors experiencing difficulties. The chart would also illustrate periods of correlation and divergence between the indices.

Detailed FAQs: Svspx Stock Price

What is the SVSPX index?

The SVSPX is a hypothetical stock index; it’s important to clarify the actual index being referred to for accurate analysis.

Where can I find real-time SVSPX data?

Real-time data for specific indices can usually be found on financial websites and trading platforms that provide market data.

What are the transaction costs associated with investing in the SVSPX?

Transaction costs vary depending on the brokerage and the investment vehicle used (e.g., ETFs tracking a similar index).

How frequently is the SVSPX rebalanced?

The rebalancing frequency depends on the specific index’s methodology; this information should be available in the index’s documentation.

Interior Living

Interior Living