T. Rowe Price Growth Stock Fund: A Comprehensive Overview

T rowe price growth stock i – The T. Rowe Price Growth Stock Fund is a well-established mutual fund known for its long-term growth strategy and experienced management team. This overview delves into its investment approach, historical performance, risk considerations, portfolio holdings, and future outlook, providing a comprehensive understanding of this investment vehicle.

T. Rowe Price Growth Stock Fund Overview

The T. Rowe Price Growth Stock Fund seeks long-term capital appreciation by investing primarily in a diversified portfolio of common stocks of companies believed to possess superior growth potential. The fund managers employ a rigorous, bottom-up stock selection process focusing on companies with strong competitive advantages, sustainable growth prospects, and capable management teams. They look for companies poised for above-average earnings growth over the long term, rather than focusing on short-term market trends.

Historically, the fund has exhibited periods of both strong and weak returns, mirroring the broader market cycles. While past performance is not indicative of future results, analyzing its historical data reveals its resilience during market downturns and its ability to generate significant returns during periods of growth. Specific data points regarding historical performance should be obtained from reliable financial sources such as the fund’s fact sheet or Morningstar.

The fund’s expense ratio is a key factor to consider. Again, precise figures should be verified through official fund documentation. Similarly, the minimum investment requirement is subject to change and should be confirmed with T. Rowe Price or a financial advisor.

| Fund Name | Expense Ratio | 5-Year Return | Investment Minimum |

|---|---|---|---|

| T. Rowe Price Growth Stock Fund | (Insert Data from reliable source) | (Insert Data from reliable source) | (Insert Data from reliable source) |

| (Comparable Fund 1) | (Insert Data from reliable source) | (Insert Data from reliable source) | (Insert Data from reliable source) |

| (Comparable Fund 2) | (Insert Data from reliable source) | (Insert Data from reliable source) | (Insert Data from reliable source) |

| (Comparable Fund 3) | (Insert Data from reliable source) | (Insert Data from reliable source) | (Insert Data from reliable source) |

Fund Manager and Investment Philosophy

The fund’s investment philosophy centers on identifying and investing in companies with strong long-term growth prospects. This approach involves extensive research and analysis of individual companies, focusing on factors such as management quality, competitive landscape, and financial strength. The current fund manager’s experience and investment approach are critical to understanding the fund’s performance and future direction. Information on the fund manager’s background and investment strategy can be found on the T.

Rowe Price website.

The fund’s approach differs from other growth strategies by emphasizing a long-term perspective and a focus on fundamental analysis. Unlike some growth funds that may focus on momentum or short-term market trends, this fund prioritizes identifying companies with sustainable competitive advantages and robust long-term growth potential. Examples of companies held in the portfolio, along with the rationale behind those selections, can be found in the fund’s portfolio holdings which are regularly updated on the T.

Rowe Price website.

Risk and Reward Considerations, T rowe price growth stock i

Investing in the T. Rowe Price Growth Stock Fund carries inherent risks, primarily associated with fluctuations in the stock market. Market downturns can lead to significant losses in the short term. However, the potential rewards of investing in the fund, particularly over the long term, are significant. The fund aims for capital appreciation, meaning the potential for significant returns outweighs the risk for long-term investors.

A hypothetical portfolio incorporating the T. Rowe Price Growth Stock Fund could be diversified with other asset classes like bonds or real estate to mitigate risk. The specific allocation would depend on the investor’s risk tolerance and financial goals. The suitability of this fund varies depending on the investor’s profile. Aggressive investors with a higher risk tolerance and longer time horizon might find it suitable, while conservative investors may prefer a more diversified portfolio with lower risk.

Portfolio Holdings and Sector Allocation

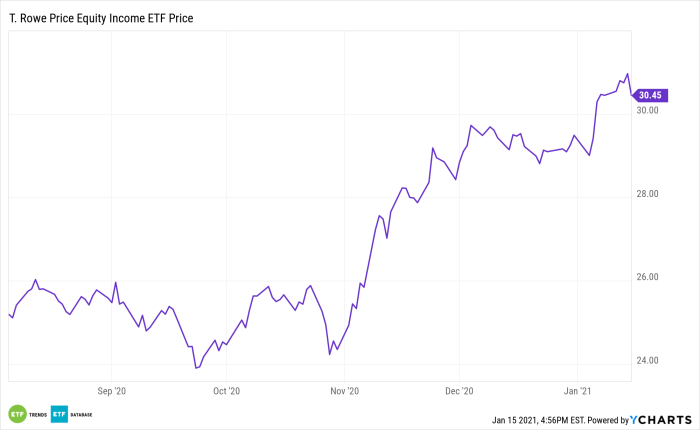

Source: ycharts.com

The fund’s top ten holdings are regularly updated and available on the T. Rowe Price website. This information should be used to analyze the sector allocation and geographical diversification. The sector allocation provides insights into the fund’s concentration in specific industries and its impact on overall portfolio diversification. Similarly, understanding the geographical distribution of holdings helps to assess the fund’s exposure to various economic regions and geopolitical risks.

| Company Name | Sector | Market Cap (Illustrative) |

|---|---|---|

| (Company 1) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 2) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 3) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 4) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 5) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 6) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 7) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 8) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 9) | (Sector) | (Market Cap – Illustrative data only) |

| (Company 10) | (Sector) | (Market Cap – Illustrative data only) |

A detailed description of the fund’s investment in a specific sector, such as Technology, would involve an analysis of the companies held within that sector, the rationale for those investments, and the sector’s overall contribution to the fund’s performance and diversification.

Performance Analysis and Future Outlook

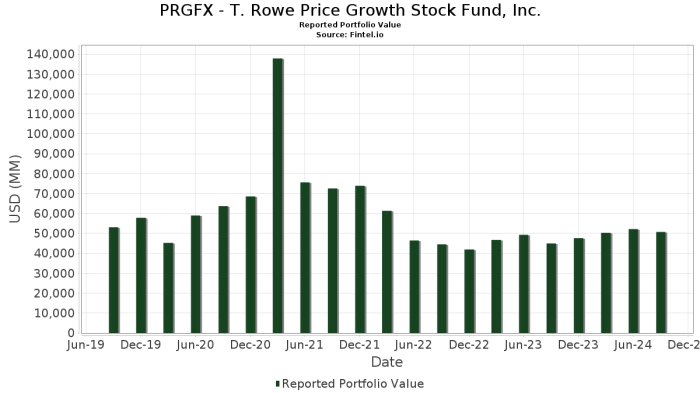

Source: fintel.io

Analyzing the fund’s performance relative to its benchmark index requires reviewing its historical returns over various timeframes. This analysis should compare the fund’s performance against a relevant benchmark, such as the S&P 500, to assess its risk-adjusted returns and overall performance.

Factors influencing the fund’s future performance include macroeconomic conditions, market trends, and the fund manager’s investment decisions. Economic growth, interest rates, inflation, and geopolitical events can all significantly impact the fund’s returns. Analyzing these factors is crucial for understanding potential challenges and opportunities.

A visual representation of the fund’s performance compared to its benchmark over the last 10 years could be a line graph. The x-axis would represent the years (2014-2024), and the y-axis would represent the cumulative return. Two lines would be plotted: one for the fund’s return and another for the benchmark’s return. Key data points, such as annual returns and periods of outperformance or underperformance, would be labeled.

T. Rowe Price’s growth stock investment strategy often focuses on companies with strong long-term potential. Understanding the performance of other growth-oriented companies can offer valuable comparative insights; for instance, checking the current sylvamo stock price might be helpful in analyzing market trends. This comparative analysis can then inform a more nuanced understanding of T. Rowe Price’s overall growth stock portfolio performance and potential future returns.

This would illustrate the fund’s relative performance and its volatility compared to the benchmark.

Questions Often Asked: T Rowe Price Growth Stock I

What is the minimum investment required for T. Rowe Price Growth Stock I?

The minimum investment amount varies and is typically detailed on the fund’s official website. It’s advisable to check the current requirements before investing.

How does the fund’s expense ratio compare to its competitors?

The expense ratio is a key factor to consider. A comparison with similar funds should be conducted to assess its competitiveness. Look for data on the fund’s fact sheet or prospectus.

What are the tax implications of investing in this fund?

Tax implications depend on individual circumstances and may include capital gains taxes upon the sale of shares. Consult a tax professional for personalized advice.

Interior Living

Interior Living