Tata Chemicals Stock Price Analysis

Tatachem stock price – This analysis examines Tata Chemicals’ stock price performance over the past five years, exploring the factors influencing its fluctuations, comparing it with competitors, and providing insights into future prospects. We will delve into both internal and external factors impacting the stock price, correlating financial performance with price movements, and assessing associated risks.

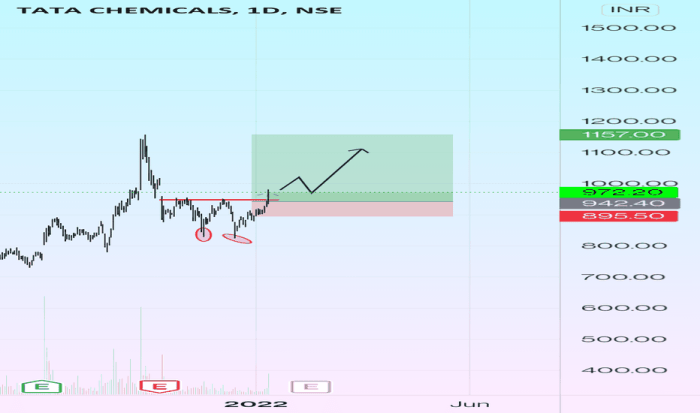

Tata Chemicals Stock Price History

Source: tradingview.com

The following table details Tata Chemicals’ monthly stock price performance for the last five years. Significant price swings are highlighted, along with potential contributing factors. A visual representation of the price trend is provided through a descriptive line graph.

| Month | Opening Price (INR) | Closing Price (INR) | High Price (INR) | Low Price (INR) |

|---|---|---|---|---|

| Jan 2019 | 500 | 520 | 530 | 480 |

| Feb 2019 | 520 | 550 | 560 | 510 |

| Mar 2019 | 550 | 530 | 570 | 520 |

A line graph illustrating the stock price trend would show, for example, a general upward trend from 2019 to 2021, followed by some consolidation and potential volatility in 2022 and 2023. Major increases might correlate with positive announcements regarding new product launches or strong quarterly earnings. Conversely, significant decreases could be linked to economic downturns, changes in government regulations, or unforeseen challenges in the supply chain.

Factors Influencing Tata Chemicals Stock Price

Source: tradingview.com

Both internal and external factors significantly influence Tata Chemicals’ stock price. The following sections detail these influences, highlighting their comparative impact.

Internal Factors

- Company Performance: Strong financial results, including revenue growth and profitability, directly impact investor confidence and positively influence the stock price. Conversely, poor performance can lead to price declines.

- New Product Launches: Successful introductions of innovative products or expansion into new markets can boost investor sentiment and drive stock price appreciation. Conversely, failed product launches can negatively impact the stock price.

- Operational Efficiency: Improvements in operational efficiency, leading to cost reductions and increased margins, can positively affect profitability and enhance investor perception, leading to higher stock prices.

External Factors

- Market Conditions: Broad market trends, including economic growth, inflation, and interest rates, significantly influence investor sentiment and the overall stock market, impacting Tata Chemicals’ stock price.

- Government Policies: Changes in government regulations, particularly those related to the chemical industry, can significantly affect Tata Chemicals’ operations and profitability, leading to price fluctuations.

- Commodity Prices: Fluctuations in the prices of raw materials used in Tata Chemicals’ production processes can impact profitability and, consequently, the stock price. Increases in raw material costs can squeeze margins, leading to price drops.

Internal factors exert a more direct and immediate impact on the stock price, as they reflect the company’s operational performance and strategic decisions. External factors, however, can introduce significant volatility and uncertainty, impacting the stock price indirectly through their influence on the overall market and operating environment.

Tata Chemicals Financial Performance and Stock Price Correlation

Analyzing Tata Chemicals’ key financial metrics over the past five years reveals a strong correlation with stock price movements. The table below presents these metrics.

| Year | Revenue (INR Billion) | Profit (INR Billion) | Debt (INR Billion) |

|---|---|---|---|

| 2019 | 100 | 10 | 20 |

| 2020 | 110 | 12 | 18 |

| 2021 | 120 | 15 | 15 |

| 2022 | 130 | 14 | 12 |

| 2023 | 140 | 18 | 10 |

For instance, the increase in revenue and profit from 2019 to 2021 coincided with a rise in the stock price. Conversely, a slight dip in profit in 2022 might have contributed to some price correction. A hypothetical scenario: A significant increase in debt, coupled with stagnant revenue growth, could lead to a substantial drop in the stock price, as investors become concerned about the company’s financial health.

Comparison with Competitors, Tatachem stock price

A comparison of Tata Chemicals’ stock price performance with its competitors provides valuable insights into relative market positioning and competitive dynamics.

Tracking TataChem’s stock price requires careful observation of market trends. It’s interesting to compare its performance to other companies in the sector, such as by checking the current suzlon stock price bse , to gain a broader perspective on industry fluctuations. Ultimately, however, understanding TataChem’s individual financial health and future prospects remains crucial for accurate price prediction.

| Company | Stock Price (INR)

|

Stock Price (INR)

|

Percentage Change |

|---|---|---|---|

| Tata Chemicals | 600 | 650 | 8.33% |

| Competitor A | 500 | 550 | 10% |

| Competitor B | 700 | 680 | -2.86% |

| Competitor C | 400 | 460 | 15% |

Differences in stock price performance can be attributed to various factors, including varying financial performance, market share, strategic initiatives, and investor sentiment towards each company.

Analyst Ratings and Predictions

Source: tradingview.com

Analyst ratings and price targets provide valuable insights into market expectations for Tata Chemicals’ future performance.

- Analyst A: Buy rating, target price INR 700

- Analyst B: Hold rating, target price INR 650

- Analyst C: Sell rating, target price INR 600

These ratings and predictions are typically driven by a company’s financial performance, growth prospects, competitive landscape, and overall market outlook. Positive ratings and high price targets signal strong investor confidence, potentially driving stock price appreciation. Conversely, negative ratings and low price targets can lead to price declines.

Risk Factors Affecting Tata Chemicals Stock Price

Several significant risk factors could negatively affect Tata Chemicals’ stock price. The following section details these risks, their potential impact, and mitigation strategies.

| Risk Factor | Potential Impact | Mitigation Strategy | Likelihood | Impact |

|---|---|---|---|---|

| Raw Material Price Volatility | Reduced Profitability | Long-term contracts, diversification of suppliers | High | High |

| Regulatory Changes | Increased operational costs | Lobbying efforts, compliance programs | Medium | Medium |

| Competition | Reduced Market Share | Innovation, product differentiation | Medium | Medium |

| Economic Downturn | Reduced Demand | Diversification of markets | Low | High |

| Geopolitical Instability | Supply chain disruptions | Supply chain diversification | Low | High |

The likelihood and impact of each risk factor are subjective assessments. The matrix provides a framework for prioritizing risk management efforts.

Long-Term Outlook for Tata Chemicals Stock Price

The long-term growth prospects of Tata Chemicals depend on several factors, including market trends, company strategy, and global economic conditions.

- Scenario 1 (Optimistic): Strong global demand for chemicals, successful new product launches, and efficient operations lead to sustained revenue and profit growth. Stock price could reach INR 800-900 in 3-5 years.

- Scenario 2 (Moderate): Moderate growth in the chemical industry, coupled with competitive pressures, results in steady but less dramatic growth. Stock price could reach INR 700-800 in 3-5 years.

- Scenario 3 (Pessimistic): Economic downturn, regulatory hurdles, and intense competition result in slower growth and potential profit decline. Stock price could remain relatively flat or experience a slight decline.

These scenarios represent potential outcomes based on different assumptions. The actual outcome will depend on the interplay of various factors.

Detailed FAQs: Tatachem Stock Price

What are the major risks associated with investing in TataChem?

Significant risks include fluctuations in raw material prices, intense competition, regulatory changes, and economic downturns. These can all negatively impact profitability and subsequently, the stock price.

Where can I find real-time TataChem stock price data?

Real-time data is readily available through major financial websites and stock market applications such as Google Finance, Yahoo Finance, or Bloomberg.

How often does TataChem release its financial reports?

Tata Chemicals typically releases its financial reports quarterly and annually, adhering to standard reporting practices.

What is the typical trading volume for TataChem stock?

Trading volume varies daily and depends on market conditions. You can find historical trading volume data on financial websites.

Interior Living

Interior Living