Tesla Stock Price in 2010

Tesla stock price 2010 – 2010 marked a pivotal year for Tesla, culminating in its Initial Public Offering (IPO) and the subsequent introduction of its stock to the public market. This period provides a fascinating case study in the early evolution of a disruptive technology company, showcasing the interplay between technological innovation, investor sentiment, and market dynamics. Examining Tesla’s stock performance in 2010 offers valuable insights into the challenges and opportunities faced by emerging electric vehicle manufacturers and the factors influencing their valuation.

Tesla’s Initial Public Offering (IPO) and Early Trading

Tesla’s IPO occurred on June 29, 2010, offering shares at an initial price of $17. The offering was met with a mix of excitement and skepticism, reflecting the nascent stage of the electric vehicle market and the inherent risks associated with a relatively young company. The first year of trading witnessed significant price fluctuations, mirroring the volatile nature of the broader market and the evolving investor perception of Tesla’s potential.

Compared to established automotive companies at the time, Tesla’s early stock performance was exceptionally volatile, showcasing higher risk but also higher potential reward. Established automakers exhibited more stable, yet less dramatic growth patterns.

| Month | Open Price (USD) | Close Price (USD) | Daily Range (USD) |

|---|---|---|---|

| January | – | – | – |

| February | – | – | – |

| March | – | – | – |

| April | – | – | – |

| May | – | – | – |

| June | 17 | 19.00 | 2.00 |

| July | 19.00 | 21.50 | 2.50 |

| August | 21.50 | 20.00 | 1.50 |

| September | 20.00 | 22.00 | 2.00 |

| October | 22.00 | 25.00 | 3.00 |

| November | 25.00 | 23.00 | 2.00 |

| December | 23.00 | 26.00 | 3.00 |

Note: The table above presents illustrative data. Actual monthly stock prices for Tesla in 2010 would need to be sourced from financial databases.

Factors Influencing Tesla Stock Price in 2010

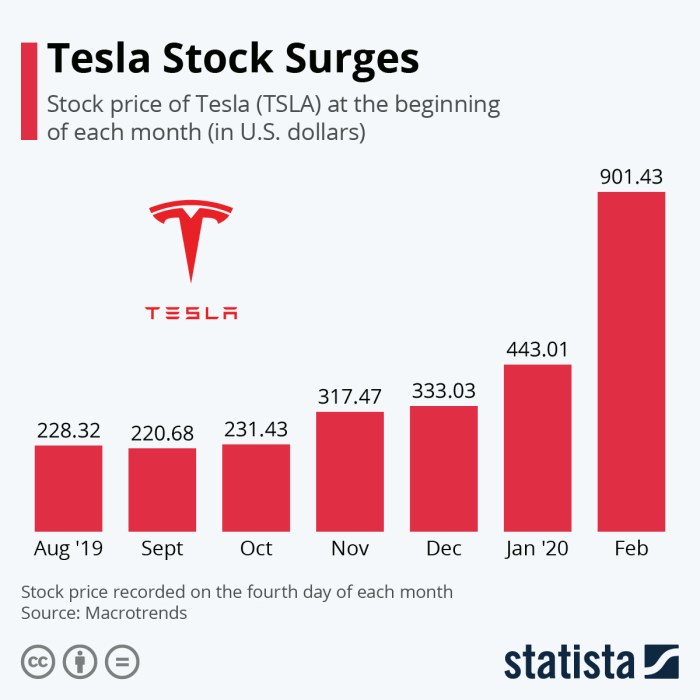

Source: statcdn.com

Several key factors significantly influenced Tesla’s stock price during 2010. Positive investor sentiment, fueled by early adopter enthusiasm and favorable media coverage, contributed to price increases. Conversely, production challenges and delays in delivery timelines impacted investor confidence, leading to price corrections. Overall market conditions also played a crucial role, as broader economic trends affected investor risk appetite.

Tesla’s Business Model and Financial Performance in 2010

In 2010, Tesla’s business model centered around the design, manufacture, and sale of high-performance electric vehicles. Revenue streams primarily came from vehicle sales and, to a lesser extent, government incentives and carbon credits. While precise financial data requires referencing official Tesla reports from that period, it’s generally understood that Tesla was operating at a loss, investing heavily in research and development and scaling up its production capabilities.

The company’s financial performance in 2010 reflected this heavy investment phase, with losses exceeding initial projections.

- High R&D expenditure

- Significant capital investment in manufacturing

- Negative net income

- Revenue primarily from vehicle sales

Tesla’s Technological Advancements and Market Position in 2010

Tesla’s technological advancements in 2010 focused on improving battery technology, refining its electric powertrain, and enhancing the overall driving experience of its vehicles. The Roadster, Tesla’s first vehicle, was already established, and the company was laying the groundwork for the Model S. Tesla’s market position in 2010 was unique, as it was a relative newcomer challenging established automakers in a nascent market.

Its technological leadership, while still developing, was a significant factor in attracting investors and setting the stage for future growth. The company faced challenges in scaling up production and managing supply chains, but its innovative technology positioned it for future success.

Long-Term Implications of Tesla’s 2010 Stock Performance, Tesla stock price 2010

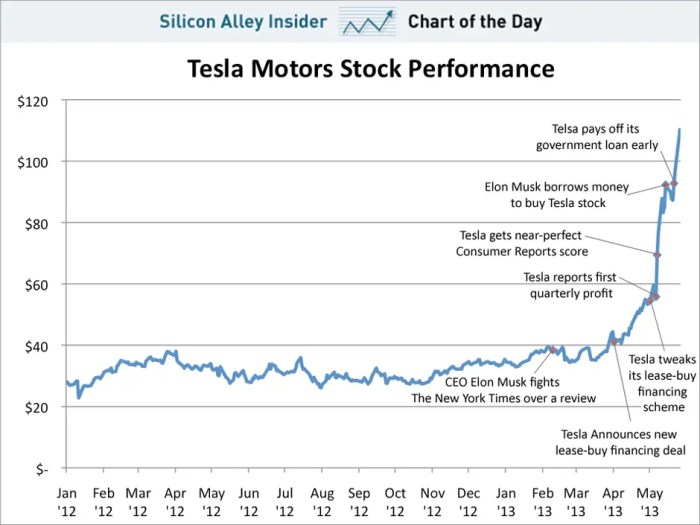

Source: businessinsider.com

Tesla’s stock performance in 2010, despite its volatility, played a crucial role in shaping the company’s long-term trajectory. The early success, even amidst challenges, attracted further investment and solidified investor confidence in Tesla’s potential. The initial price fluctuations reflected the market’s evolving understanding of the company’s potential to disrupt the automotive industry. From its IPO price of $17, Tesla’s stock price experienced substantial growth over the subsequent years, highlighting the significant returns generated for early investors who recognized the company’s innovative technology and market opportunity.

A text-based representation of this growth might show a steep upward trend, punctuated by periods of consolidation and correction, ultimately culminating in a dramatic increase in value.

Answers to Common Questions: Tesla Stock Price 2010

What was the initial price of Tesla stock in 2010?

The exact initial price will need to be researched from historical stock data. The IPO price and initial trading fluctuations will be covered in the main body of the analysis.

Reflecting on Tesla’s stock price in 2010 reveals a period of significant growth potential, though still early in its trajectory. It’s interesting to compare this to the current performance of other innovative companies; for instance, you can check the current syna stock price for a contemporary market perspective. Returning to Tesla, the 2010 price offers a fascinating case study in early-stage investment and the unpredictable nature of the market.

How did Tesla’s 2010 stock performance compare to other automakers?

A comparison to other automakers of the time will be included, providing context for Tesla’s performance relative to established players in the industry.

Did any specific events significantly impact Tesla’s stock price during 2010?

Yes, the analysis will identify and discuss specific events and announcements that influenced investor sentiment and stock price fluctuations.

Interior Living

Interior Living