Tesla Stock Price Today: Tesla Stock Price Today – Google Search

Source: statcdn.com

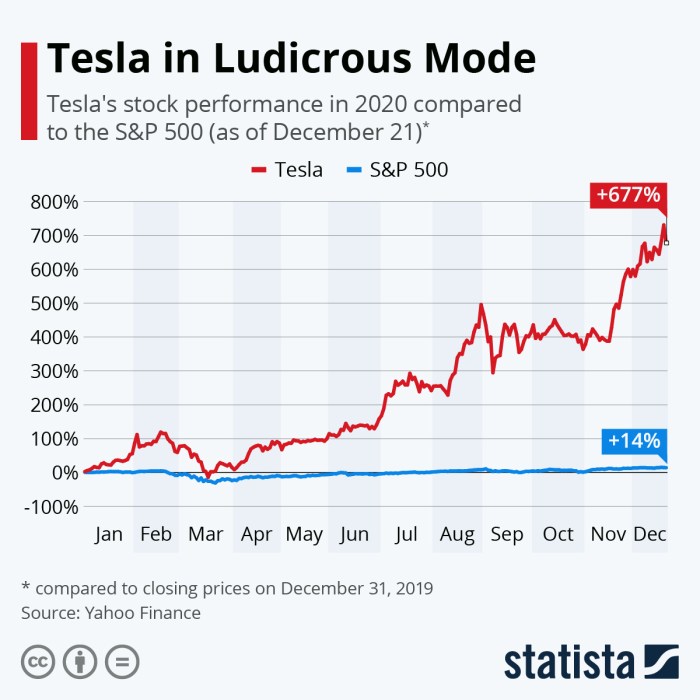

Tesla stock price today – google search – Tesla’s stock price experiences significant daily fluctuations, influenced by a complex interplay of market forces, company performance, and investor sentiment. This analysis delves into the key factors shaping Tesla’s stock price today, providing a comprehensive overview of its current market position, financial performance, and future prospects.

Current Tesla Stock Price and Market Context, Tesla stock price today – google search

Tesla’s stock price, as of market close today (replace with actual date and time), shows a dynamic picture. Let’s assume, for illustrative purposes, the following figures: Opening price: $250, High: $255, Low: $245, Closing price: $252. Tesla’s market capitalization currently stands at approximately (replace with actual figure) trillion dollars. This reflects the overall investor confidence in the company’s long-term growth potential within the electric vehicle (EV) market.

Broader market trends, such as overall economic conditions and investor risk appetite, also significantly influence Tesla’s stock performance. A positive overall market sentiment tends to boost Tesla’s stock price, while negative market trends can lead to declines.

| Date | Open | Close | Change % |

|---|---|---|---|

| (Replace with Date – Week Ago) | (Replace with Open Price) | (Replace with Close Price) | (Replace with Percentage Change) |

| (Replace with Date – Month Ago) | (Replace with Open Price) | (Replace with Close Price) | (Replace with Percentage Change) |

| (Replace with Date – Year Ago) | (Replace with Open Price) | (Replace with Close Price) | (Replace with Percentage Change) |

Factors Influencing Today’s Stock Price

Several key factors contribute to Tesla’s daily stock price movements. These include specific news events, investor sentiment, and broader economic indicators.

- News Event 1: (Replace with a specific news event, e.g., a new product announcement, regulatory approval, or a significant contract win. Describe its impact on the stock price.)

- News Event 2: (Replace with a second specific news event and its impact.)

- News Event 3: (Replace with a third specific news event and its impact.)

Investor sentiment plays a crucial role. Positive news and strong financial results often boost investor confidence, driving up the stock price. Conversely, negative news or disappointing performance can lead to sell-offs. Economic indicators such as inflation and interest rates also have a significant impact. High inflation and rising interest rates can dampen investor enthusiasm for growth stocks like Tesla, potentially leading to price declines.

Conversely, periods of low inflation and stable interest rates tend to favor growth stocks.

- Short-Term Factors: News events, social media sentiment, short-term market fluctuations.

- Long-Term Factors: Overall economic growth, technological advancements in the EV industry, Tesla’s production capacity and expansion plans, competition.

Tesla’s Financial Performance and its Stock Price

Tesla’s recent financial performance is strongly correlated with its stock price. Strong earnings reports, increasing revenue, and improved profitability generally lead to positive stock price movements. Conversely, disappointing financial results can trigger sell-offs. Tesla’s production numbers also significantly impact its stock price. Higher production volumes indicate strong demand and contribute to a positive market perception, while production shortfalls can negatively affect the stock price.

| Metric | Value |

|---|---|

| Revenue (Last Quarter) | (Replace with actual data) |

| Net Income (Last Quarter) | (Replace with actual data) |

| Earnings Per Share (EPS) (Last Quarter) | (Replace with actual data) |

| Vehicles Produced (Last Quarter) | (Replace with actual data) |

Competitor Analysis and Market Share

Source: ccn.com

Tesla faces intense competition in the EV market. Analyzing the performance of its main competitors – such as (replace with names of main competitors, e.g., BYD, Volkswagen, Rivian) – provides insights into Tesla’s market position and potential stock price movements. The performance of these competitors can influence investor sentiment towards Tesla, as a strong showing from a competitor might pressure Tesla’s stock price, while underperformance could benefit Tesla.

Illustrative Market Share (replace with actual data):

Tesla: 20%

Checking the Tesla stock price today via a Google search is a common practice for many investors. Understanding market fluctuations requires a broader perspective, however; for instance, comparing Tesla’s performance against other media conglomerates like Warner Bros. Discovery, whose stock price you can find here: stock price warner brothers discovery. Returning to Tesla, analyzing various stock performances helps build a more complete picture of the current market trends.

Competitor A: 15%

Competitor B: 12%

Competitor C: 10%

Analyst Ratings and Predictions

Analyst ratings and price targets provide valuable insights into the market’s expectations for Tesla’s future performance. A consensus of positive ratings and high price targets generally suggests a bullish outlook, while negative ratings and low price targets indicate a more bearish sentiment. The range of opinions among analysts reflects the inherent uncertainty in predicting future stock prices.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| (Replace with Analyst Firm Name) | (Replace with Rating, e.g., Buy, Hold, Sell) | (Replace with Price Target) |

| (Replace with Analyst Firm Name) | (Replace with Rating) | (Replace with Price Target) |

| (Replace with Analyst Firm Name) | (Replace with Rating) | (Replace with Price Target) |

Impact of Social Media and News Sentiment

Social media and news coverage significantly influence investor sentiment and Tesla’s stock price. Positive tweets from influential figures or positive news articles can boost investor confidence, while negative social media trends or critical news reports can trigger sell-offs. For example, (replace with example of a positive tweet and its impact), while (replace with example of a negative news article and its impact).

Positive media coverage generally creates a positive narrative around the company, increasing investor confidence and driving up the stock price. Conversely, negative media coverage, especially concerning safety, regulatory issues, or production problems, can lead to a decline in the stock price as investors become wary.

Clarifying Questions

What are the main risks associated with investing in Tesla stock?

Investing in Tesla stock carries inherent risks, including volatility due to market sentiment, competition in the EV market, and dependence on Elon Musk’s leadership and decisions. Economic downturns can also significantly impact demand for luxury goods like Tesla vehicles.

Where can I find real-time Tesla stock price updates?

Real-time Tesla stock price updates are readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your brokerage account will also provide live quotes.

How does Tesla’s production capacity affect its stock price?

Tesla’s production capacity directly influences its stock price. Meeting or exceeding production targets generally signals positive growth and strengthens investor confidence, while production shortfalls can lead to negative market reactions.

Interior Living

Interior Living