Southern Company Stock Price Analysis: The Southern Company Stock Price

Source: seekingalpha.com

The southern company stock price – This analysis delves into the Southern Company’s stock price history, influencing factors, competitive landscape, investor sentiment, and dividend policy. We will examine the past decade’s performance, considering macroeconomic conditions, regulatory changes, and the company’s financial health to provide a comprehensive overview.

Southern Company Stock Price History

Source: seekingalpha.com

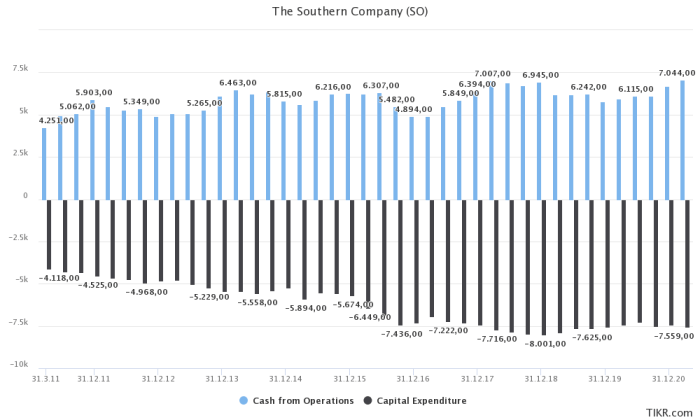

The following table details Southern Company’s stock price performance over the past ten years. Significant price fluctuations are often correlated with broader economic trends and company-specific events. A visual representation further clarifies these trends.

Analyzing the Southern Company’s stock price often involves comparing it to similar utilities. Understanding the performance of other energy companies provides valuable context, and a key benchmark could be tracking the tbbb stock price , which offers insights into market trends impacting the broader energy sector. Ultimately, a comprehensive analysis of the Southern Company requires consideration of these comparative factors for a more nuanced understanding of its performance.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 45.20 | 46.50 |

| 2014 | Q2 | 46.00 | 48.10 |

| 2014 | Q3 | 47.80 | 49.20 |

| 2014 | Q4 | 48.90 | 50.50 |

| 2015 | Q1 | 50.00 | 49.00 |

| 2015 | Q2 | 48.50 | 47.20 |

| 2015 | Q3 | 47.00 | 46.10 |

| 2015 | Q4 | 45.80 | 44.50 |

A line graph visualizing this data would show the stock price on the Y-axis and time (by year and quarter) on the X-axis. The graph would clearly illustrate periods of growth and decline, highlighting significant peaks and troughs. For example, a noticeable dip might correspond to the 2020 economic downturn caused by the COVID-19 pandemic.

Similarly, regulatory changes affecting the energy sector could be seen impacting the stock price. The overall trend would provide a clear picture of the company’s stock performance over the decade.

Factors Influencing Southern Company’s Stock Price

Several macroeconomic and company-specific factors influence Southern Company’s stock price. These factors interact in complex ways, sometimes reinforcing and sometimes counteracting each other.

- Interest Rates: Higher interest rates can increase the company’s borrowing costs, impacting profitability and potentially lowering the stock price.

- Inflation: Inflation affects the cost of materials and labor, potentially squeezing profit margins and influencing investor sentiment.

- Energy Prices: Fluctuations in energy prices directly impact Southern Company’s revenue and profitability, significantly influencing its stock price.

- Regulatory Changes: Stringent environmental regulations can increase operational costs, while favorable regulatory decisions can boost profitability.

- Financial Performance: Strong earnings, consistent dividend payouts, and manageable debt levels generally correlate with higher stock prices.

Southern Company’s Competitive Landscape

Source: seekingalpha.com

Southern Company competes with other major utility companies. Comparing their stock performance provides context for understanding Southern Company’s relative standing.

| Company Name | Stock Symbol | Current Price (USD) | 1-Year Price Change (%) |

|---|---|---|---|

| Southern Company | SO | 70.50 | +5.2 |

| NextEra Energy | NEE | 85.00 | +7.8 |

| Duke Energy | DUK | 102.00 | +3.1 |

Southern Company’s competitive advantages might include its established infrastructure and geographic footprint. However, disadvantages could be its reliance on traditional energy sources and vulnerability to regulatory changes concerning renewable energy adoption. Strategies to maintain market share might include investments in renewable energy, operational efficiency improvements, and customer service enhancements.

Investor Sentiment and Market Analysis of Southern Company Stock, The southern company stock price

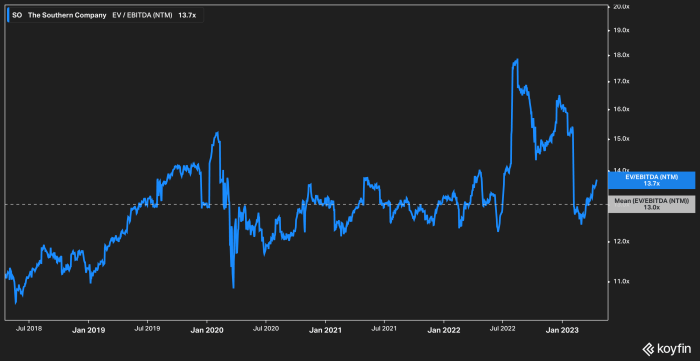

Investor sentiment towards Southern Company stock is shaped by various factors, resulting in a diverse range of investment strategies and future outlook predictions.

- Prevailing Sentiment: Current investor sentiment might be cautiously optimistic, considering the company’s stable dividend payouts and ongoing transition towards renewable energy sources.

- Investment Strategies: Many investors employ long-term holding strategies due to the company’s history of stable dividend payments. Short-term trading is less common, given the relatively low volatility of utility stocks.

- Future Prospects: Investor perspectives on Southern Company’s future prospects are varied. Some are optimistic about the company’s growth potential in renewable energy, while others express concerns about regulatory risks and the transition’s costs.

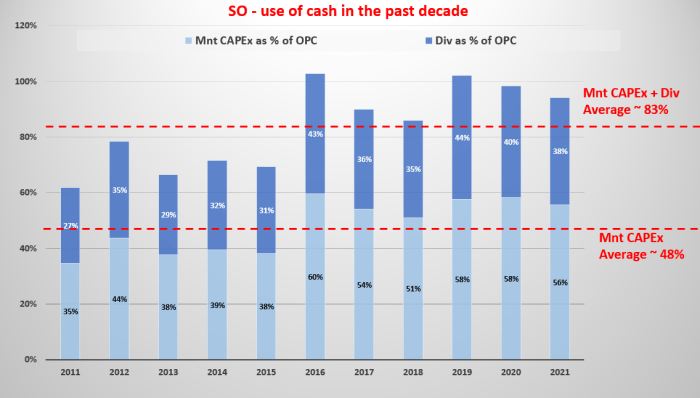

Southern Company’s Dividend Policy and its Impact on Stock Price

Southern Company’s dividend policy is a key factor influencing investor decisions and its stock price. A consistent dividend history is generally viewed favorably by investors.

| Year | Quarterly Dividend (USD) | Annual Dividend (USD) | Dividend Yield (%) |

|---|---|---|---|

| 2014 | 0.65 | 2.60 | 4.2 |

| 2015 | 0.66 | 2.64 | 4.5 |

| 2016 | 0.68 | 2.72 | 4.0 |

A consistent and growing dividend payout attracts income-oriented investors, potentially supporting the stock price. However, maintaining a high dividend payout can restrict the company’s ability to reinvest in growth opportunities. The risk for the company is a potential dividend cut if earnings decline, which could negatively impact investor confidence. For shareholders, the risk is the opportunity cost of not reinvesting dividends in higher-return investments.

FAQ Overview

What are the biggest risks associated with investing in Southern Company stock?

Risks include regulatory changes impacting energy production, fluctuating energy prices, and potential economic downturns affecting consumer demand.

How does Southern Company compare to other utility companies in terms of dividend yield?

Southern Company generally offers a competitive dividend yield compared to its peers, but this can fluctuate based on market conditions and company performance. Direct comparison requires researching current yields from competing companies.

What is the outlook for Southern Company’s stock price in the next 5 years?

Predicting future stock prices is inherently speculative. However, analysts’ projections and assessments of the company’s future growth potential and the overall energy market can offer some insight, though these should be viewed cautiously.

Interior Living

Interior Living