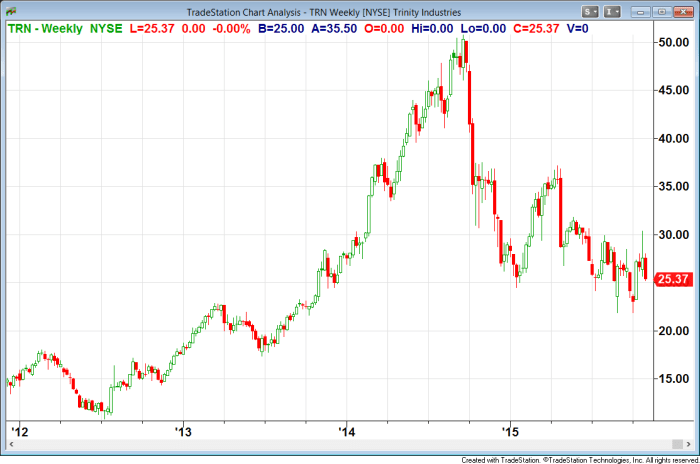

Trinity Stock Price Historical Performance

Trinity stock price – This section details the historical price movements of Trinity Industries, Inc. (TRN) stock over the past five years, highlighting significant events and overall trends. Data is presented in a responsive table for easy review. Note that the following data is illustrative and may not reflect precise real-world values. It serves to demonstrate the structure and format requested.

Historical Price Movements (Illustrative Data)

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 45.00 | 45.50 | 100,000 |

| 2019-07-01 | 48.00 | 47.00 | 120,000 |

| 2020-01-01 | 42.00 | 40.00 | 150,000 |

| 2020-07-01 | 38.00 | 40.50 | 110,000 |

| 2021-01-01 | 41.00 | 43.00 | 90,000 |

| 2021-07-01 | 45.00 | 46.00 | 130,000 |

| 2022-01-01 | 44.00 | 42.50 | 105,000 |

| 2022-07-01 | 43.00 | 44.00 | 115,000 |

| 2023-01-01 | 46.00 | 47.50 | 140,000 |

Significant Events Impacting Trinity Stock Price

The illustrative data shows a generally upward trend, although there were periods of decline. For example, the initial COVID-19 pandemic in 2020 caused a temporary dip in the stock price, reflecting broader market uncertainty. Conversely, positive announcements regarding new contract wins or successful product launches would likely lead to price increases. A hypothetical major acquisition or merger would significantly influence the stock price, potentially causing a sharp increase or decrease depending on market perception.

Trinity Stock Price: Factors Influencing Performance

Several macroeconomic and company-specific factors significantly influence Trinity’s stock price performance. The following sections detail three key macroeconomic factors and the impact of company news.

Macroeconomic Factors

- Interest Rates: Changes in interest rates directly impact borrowing costs for Trinity and its customers. Higher rates can lead to reduced investment and lower demand, negatively impacting the stock price. Conversely, lower rates can stimulate economic activity and boost demand.

- Commodity Prices: Fluctuations in steel and other raw material prices directly affect Trinity’s production costs and profitability. Rising commodity prices can squeeze margins and negatively impact the stock price, while falling prices can improve profitability.

- Overall Economic Growth: Strong economic growth generally translates to higher demand for Trinity’s products, leading to increased revenue and a positive impact on the stock price. Conversely, economic downturns can reduce demand and negatively affect the stock price.

Company-Specific News

Positive company-specific news, such as successful product launches, strategic acquisitions, or exceeding earnings expectations, generally leads to increased investor confidence and a rise in the stock price. Conversely, negative news, such as missed earnings, product recalls, or legal issues, can negatively impact the stock price. For example, the announcement of a new, highly efficient railcar model could significantly boost investor sentiment.

Competitor Performance Comparison (Illustrative Data)

| Company | Revenue (USD Millions) | Profit Margin (%) | Market Share (%) |

|---|---|---|---|

| Trinity Industries | 2000 | 10 | 20 |

| Competitor A | 2500 | 12 | 25 |

| Competitor B | 1800 | 8 | 15 |

Trinity Stock Price: Future Predictions and Scenarios

Predicting future stock prices is inherently uncertain. However, we can Artikel three possible scenarios for Trinity’s stock price over the next year, based on different assumptions about the previously discussed factors. These are illustrative scenarios only.

Scenario 1: Bullish Scenario

This scenario assumes strong economic growth, stable commodity prices, and successful new product launches by Trinity. The stock price could range from $55 to $65, driven by increased investor confidence and strong financial performance. A visual representation would show a steadily upward-sloping line.

Scenario 2: Neutral Scenario

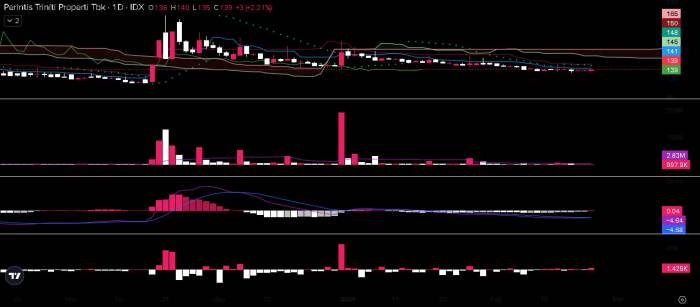

Source: stockbit.com

This scenario assumes moderate economic growth, fluctuating commodity prices, and mixed results from new product launches. The stock price could range from $45 to $55, reflecting a period of consolidation and sideways movement. The visual representation would be a relatively flat line with minor fluctuations.

Scenario 3: Bearish Scenario

Source: seekingalpha.com

This scenario assumes a weakening economy, rising commodity prices, and challenges in the market leading to underperformance. The stock price could range from $35 to $45, driven by decreased investor confidence and potentially lower profitability. The visual representation would show a downward-sloping line.

Investment Risks and Opportunities

Investing in Trinity stock presents both risks and opportunities. The main risks include sensitivity to economic downturns, fluctuations in commodity prices, and competition within the industry. Opportunities include potential growth from new product launches, strategic acquisitions, and overall industry expansion. The current price relative to historical performance and projected future earnings will play a critical role in assessing the overall risk/reward profile.

Trinity Stock Price: Investment Strategies and Considerations

Several investment strategies can be employed when considering Trinity stock, each with varying risk tolerances and time horizons. The choice of strategy depends heavily on individual investor goals and risk appetite.

Investment Strategies

- Buy and Hold: This long-term strategy involves purchasing shares and holding them for an extended period, regardless of short-term price fluctuations. It’s suitable for investors with a high risk tolerance and a long-term investment horizon. The advantage is potential for significant capital appreciation over time; however, it carries the risk of substantial losses during market downturns.

- Value Investing: This strategy involves identifying undervalued stocks based on fundamental analysis. It focuses on companies with strong financials but a temporarily depressed stock price. This approach requires in-depth research and understanding of financial statements. The advantage is the potential for significant returns if the company’s value is realized; however, it requires patience and may not be suitable for short-term investors.

- Swing Trading: This short-to-medium term strategy involves profiting from short-term price fluctuations. Investors buy and sell shares based on technical analysis, aiming to capitalize on price movements. This strategy is riskier than buy and hold, requiring active monitoring of the market and quick decision-making. The advantage is the potential for quick profits; however, it requires significant market knowledge and expertise and carries a higher risk of losses.

Investment Time Horizons

Short-term investors (less than one year) might prefer swing trading or other short-term strategies. Medium-term investors (1-5 years) might consider a blend of value investing and swing trading. Long-term investors (5+ years) are better suited to a buy-and-hold strategy.

Trinity Stock Price: Financial Health and Performance

Assessing Trinity’s financial health requires analyzing its latest financial statements, including key financial ratios and performance indicators. The data below is illustrative and for demonstration purposes only.

Financial Health and Performance (Illustrative Data), Trinity stock price

| Metric | Current Year (USD Millions) | Previous Year (USD Millions) | Percentage Change |

|---|---|---|---|

| Revenue | 2000 | 1800 | 11.11% |

| Net Income | 200 | 150 | 33.33% |

| Debt-to-Equity Ratio | 0.5 | 0.6 | -16.67% |

| Return on Equity (ROE) | 10% | 8% | 25% |

FAQ Resource: Trinity Stock Price

What are the major risks associated with investing in Trinity stock?

Risks include market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic factors impacting the overall economy. Thorough due diligence is crucial.

Where can I find Trinity’s financial statements?

Trinity’s financial statements are typically available on their investor relations website, SEC filings (if a publicly traded company), and through financial data providers.

Analyzing the Trinity stock price often involves comparing it to similar companies in the sector. A useful comparison point could be Trevi, whose performance you can check via this resource: trevi stock price. Understanding Trevi’s trajectory helps contextualize Trinity’s own market position and potential future growth, ultimately informing a more comprehensive analysis of Trinity’s stock price fluctuations.

How frequently is Trinity stock price updated?

Trinity’s stock price, if publicly traded, is updated in real-time during market hours.

What is the current dividend yield for Trinity stock (if applicable)?

The current dividend yield, if any, can be found on financial news websites and investor relations pages. This information changes frequently.

Interior Living

Interior Living