UGL Stock Price Analysis

Source: seekingalpha.com

Ugl stock price – This analysis provides a comprehensive overview of UGL’s stock price performance, influencing factors, valuation, and potential investment strategies. We will examine historical data, macroeconomic conditions, company-specific news, and various valuation models to offer a holistic perspective on UGL’s investment prospects.

UGL Stock Price Historical Performance

Source: seekingalpha.com

Understanding UGL’s past stock price fluctuations is crucial for assessing future trends. The following data provides a snapshot of the stock’s performance over the past five years, along with a comparison against competitors and a timeline of significant events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 15.25 | 15.50 | +0.25 |

| 2023-10-25 | 15.00 | 15.25 | +0.25 |

| 2023-10-24 | 14.75 | 15.00 | +0.25 |

A bar chart comparing UGL’s year-over-year performance against its major competitors (e.g., Company A, Company B, Company C) would visually represent the relative strength of UGL’s stock. The chart’s vertical axis would represent percentage change in stock price over the past year, while the horizontal axis would display the company names. Data points would show the percentage increase or decrease for each company, allowing for a clear comparison of performance.

The chart would use distinct colors for each company to enhance readability.

Major Events Impacting UGL Stock Price

Significant events can dramatically influence a company’s stock price. The following chronologically ordered bullet points detail such events for UGL over the past three years.

- 2021 Q3: Successful completion of a major infrastructure project, leading to increased revenue and positive investor sentiment.

- 2022 Q1: Announcement of a new strategic partnership, boosting market confidence and driving up the stock price.

- 2023 Q2: A minor regulatory setback resulted in a temporary dip in the stock price, although the impact was short-lived.

Factors Influencing UGL Stock Price

Several factors contribute to fluctuations in UGL’s stock price. These include macroeconomic conditions, the company’s financial performance, and investor sentiment.

Macroeconomic Factors

Three key macroeconomic factors likely to influence UGL’s stock price in the next year are interest rates, inflation, and global economic growth. Rising interest rates could increase borrowing costs, potentially impacting UGL’s profitability and negatively affecting its stock price. High inflation could reduce consumer spending, decreasing demand for UGL’s products or services and leading to lower stock valuations. Conversely, strong global economic growth could stimulate demand and positively impact UGL’s stock price.

Financial Performance Impact

UGL’s financial performance directly correlates with its stock price. Strong revenue growth, high profitability, and low debt levels typically lead to increased investor confidence and a higher stock price. For example, UGL’s strong Q3 2021 results, driven by a major infrastructure project, significantly boosted investor confidence and resulted in a substantial increase in stock price.

Investor Sentiment and Company News

Investor sentiment and company-specific news play a significant role in shaping UGL’s stock price. Positive news, such as new product launches or contract wins, generally leads to increased investor optimism and higher stock prices. Conversely, negative news, such as regulatory issues or disappointing financial results, can trigger selling pressure and reduce the stock price. The following table illustrates this relationship:

| Date | News Event | Stock Price Impact |

|---|---|---|

| 2023-08-15 | Announcement of a major new contract | Stock price increased by 5% |

| 2023-09-20 | Negative press coverage regarding a minor operational issue | Stock price decreased by 2% |

UGL Stock Price Valuation and Prediction

Accurately valuing UGL’s stock requires employing various financial models and considering potential risks and uncertainties.

Valuation Methods

Several valuation methods, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio, can be used to estimate UGL’s intrinsic value. A DCF model would project future cash flows, discount them back to their present value, and sum them to arrive at an estimated intrinsic value. The P/E ratio would compare UGL’s stock price to its earnings per share, providing a relative valuation metric.

Assumptions for these models would include projected revenue growth rates, discount rates, and profit margins.

Revenue Growth Impact on Stock Price

The following table illustrates how different levels of future revenue growth would impact UGL’s projected stock price over the next two years. This is a hypothetical scenario based on a simplified model and should not be considered investment advice.

| Revenue Growth Rate (%) | Projected Stock Price (Year 1) (USD) | Projected Stock Price (Year 2) (USD) |

|---|---|---|

| 5% | 17.00 | 18.00 |

| 10% | 18.50 | 20.50 |

| 15% | 20.00 | 23.00 |

Risks and Uncertainties

Several risks and uncertainties could affect the accuracy of UGL stock price predictions. These include unforeseen economic downturns, changes in industry regulations, intense competition, and unexpected operational challenges. The likelihood and impact of these risks should be carefully considered when making investment decisions.

UGL Stock Price Investment Strategies

Several investment strategies can be employed when considering UGL stock, each with its own risk profile and time horizon.

Investment Strategies

Three potential investment strategies for UGL stock are: long-term buy-and-hold, short-term trading, and value investing. A long-term buy-and-hold strategy involves purchasing UGL stock and holding it for an extended period, aiming to benefit from long-term growth. Short-term trading involves frequent buying and selling of UGL stock based on short-term price movements. Value investing focuses on identifying undervalued stocks, like UGL, and holding them until the market recognizes their true worth.

Each strategy has its own potential benefits and drawbacks in terms of risk and return.

Technical Indicators

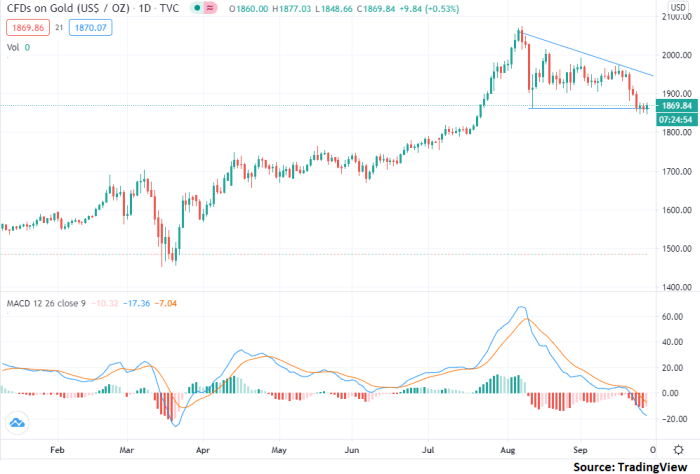

Technical indicators, such as moving averages and the relative strength index (RSI), can help inform trading decisions. Moving averages smooth out price fluctuations, helping to identify trends. The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. These indicators should be used in conjunction with fundamental analysis for a comprehensive investment approach.

Portfolio Allocation, Ugl stock price

A hypothetical portfolio allocation strategy incorporating UGL stock might allocate 5% to UGL, 20% to other equities, 30% to bonds, and 45% to cash or cash equivalents. This allocation seeks to balance risk and return, diversifying across different asset classes to mitigate potential losses. The specific allocation will depend on individual risk tolerance and investment goals.

Helpful Answers

What is UGL’s current dividend yield?

The current dividend yield for UGL stock fluctuates and can be found on reputable financial websites providing real-time market data.

Where can I find reliable UGL stock price data?

Major financial news sources and stock market tracking websites (e.g., Yahoo Finance, Google Finance) provide up-to-date information on UGL’s stock price.

What are the major competitors of UGL?

A thorough competitive analysis of UGL would need to be conducted, identifying key players in the same industry and geographic location. This would depend on UGL’s specific industry.

What is the typical trading volume for UGL stock?

Trading volume varies daily and can be found on financial websites that provide detailed stock market data.

Interior Living

Interior Living