Understanding UL Solutions’ Business Model

Ul solutions stock price – UL Solutions operates within the testing, inspection, and certification (TIC) industry, providing a wide array of services to ensure product safety, security, and sustainability. Their business model centers around providing independent verification and validation services to businesses across diverse sectors. This involves rigorous testing, auditing, and certification processes to meet various safety and quality standards.

Core Business Activities and Revenue Streams

Source: wsj.net

UL Solutions’ primary revenue streams are derived from fees charged for testing, inspection, and certification services. These services span a broad range of industries, including consumer products, industrial manufacturing, energy, and healthcare. Revenue is generated through contracts with businesses of all sizes, from small startups to multinational corporations. Specific services include product testing, compliance audits, certification programs, and training courses related to safety standards.

Target Markets and Customer Base

UL Solutions’ target market encompasses a vast array of businesses across numerous sectors. Their customer base includes manufacturers, retailers, importers, and other organizations seeking to ensure the safety and compliance of their products and operations. The company caters to both domestic and international clients, reflecting the global nature of product standards and regulations.

Comparison to Competitors

UL Solutions competes with other prominent players in the TIC industry, including Intertek and SGS. While all three offer similar services, UL Solutions differentiates itself through its established brand reputation, extensive network of testing facilities, and specialized expertise in certain niche markets. A key differentiator is UL Solutions’ long history and recognition for setting industry standards. Competition is primarily based on pricing, service quality, speed of turnaround, and geographic reach.

Key Factors Driving Revenue Growth

Several factors contribute to UL Solutions’ revenue growth. These include expansion into new markets and service offerings, increased demand for safety and compliance certifications due to stricter regulations, and strategic acquisitions of smaller companies to broaden their service portfolio. The increasing complexity of products and growing consumer awareness of safety also fuel demand for UL Solutions’ services.

Hypothetical Scenario: New Product Launch Impact

Imagine UL Solutions launches a new rapid testing service for electric vehicle batteries. This service, faster and more cost-effective than existing methods, targets the rapidly expanding EV market. Assuming a conservative market penetration of 10% within the first year, and an average revenue per test of $5,000, with 100,000 EV battery manufacturers globally, this new service could generate an additional $50 million in revenue annually.

This illustrates the potential for significant revenue growth through the introduction of innovative and in-demand services.

Analyzing UL Solutions’ Financial Performance

A thorough analysis of UL Solutions’ financial performance requires examining key metrics over several years to identify trends and assess overall health. The following sections provide insights into the company’s profitability, efficiency, and financial stability.

Key Financial Metrics

UL Solutions’ financial performance, as reflected in public filings, would typically show data on revenue, profit margins (gross and net), and debt levels over the past five years. These metrics would reveal trends in revenue growth, profitability, and the company’s reliance on debt financing. Analyzing these trends alongside industry benchmarks provides a comprehensive view of the company’s financial health.

Profitability and Efficiency

Profitability analysis would involve examining the company’s gross profit margin, operating profit margin, and net profit margin over time. Efficiency can be assessed by calculating metrics such as return on assets (ROA) and return on equity (ROE). These ratios provide insights into how effectively UL Solutions manages its assets and generates profits relative to its investments.

Comparison to Industry Benchmarks

Comparing UL Solutions’ financial performance to industry benchmarks, such as those of Intertek and SGS, allows for a relative assessment of its profitability, efficiency, and financial strength. This comparison helps identify areas where UL Solutions excels or lags behind its competitors.

Key Financial Ratios (Past Three Years)

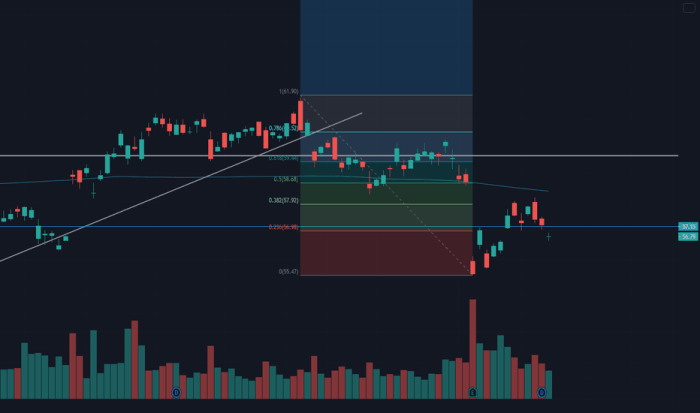

Source: tradingview.com

Understanding the UL Solutions stock price requires a broad view of the renewable energy sector. For comparative analysis, it’s helpful to examine the performance of similar companies, such as checking the current suzlon stock price bse , to gauge market trends. Ultimately, a thorough assessment of UL Solutions’ financial health and market position, independent of Suzlon’s performance, will determine its future stock price trajectory.

The following table presents a hypothetical illustration of UL Solutions’ key financial ratios over the past three years. Note that these figures are for illustrative purposes only and should not be considered actual financial data.

| Year | Revenue (in millions) | Net Income (in millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 2500 | 300 | 0.5 |

| 2022 | 2750 | 350 | 0.4 |

| 2023 | 3000 | 400 | 0.3 |

Examining Market Influences on Stock Price

Several factors influence UL Solutions’ stock price, reflecting the interplay between macroeconomic conditions, industry trends, and regulatory changes. Understanding these factors is crucial for investors seeking to assess the company’s valuation and potential for future growth.

Macroeconomic Factors, Ul solutions stock price

Macroeconomic factors such as interest rates, inflation, and economic growth significantly impact investor sentiment and market valuations. A strong economy generally boosts investor confidence, while economic downturns can lead to decreased demand for UL Solutions’ services and a decline in stock price. Inflationary pressures can also impact the company’s costs and profitability.

Industry Trends

Industry trends, such as the increasing adoption of automation in manufacturing and the growing demand for sustainable products, influence UL Solutions’ valuation. Adapting to these trends and providing relevant services is critical for the company’s continued success.

Regulatory Changes

Changes in safety regulations and compliance standards directly impact UL Solutions’ business. New regulations can create opportunities for growth by increasing the demand for testing and certification services, but can also present challenges if the company struggles to adapt quickly enough.

Potential Risks and Opportunities

Source: pcdn.co

- Risk: Increased competition from new entrants in the TIC market.

- Risk: Economic slowdown impacting demand for testing and certification services.

- Risk: Failure to adapt to evolving technological advancements and industry trends.

- Opportunity: Expansion into emerging markets with growing demand for safety and compliance solutions.

- Opportunity: Development of new testing and certification services for innovative technologies.

- Opportunity: Strategic acquisitions to broaden service offerings and geographic reach.

Evaluating Investor Sentiment and Expectations: Ul Solutions Stock Price

Understanding investor sentiment and expectations is crucial for assessing the current market valuation of UL Solutions’ stock and predicting potential future price movements. This section delves into analyst ratings, price targets, and investor confidence.

Prevailing Investor Sentiment

Investor sentiment towards UL Solutions is typically gauged through market analysis, news coverage, and social media discussions. Positive sentiment is often reflected in a rising stock price and increased trading volume, while negative sentiment can lead to price declines and decreased investor interest.

Analyst Ratings and Price Targets

Financial analysts regularly issue ratings and price targets for UL Solutions’ stock. These assessments are based on various factors, including the company’s financial performance, growth prospects, and overall market conditions. A consensus of positive ratings and high price targets usually signals strong investor confidence.

Factors Influencing Investor Confidence

Investor confidence in UL Solutions is influenced by several factors, including the company’s financial stability, growth trajectory, management team’s effectiveness, and its ability to adapt to industry changes. Positive news regarding new product launches, successful acquisitions, or strong financial results generally boosts investor confidence.

Comparison of Investor Sentiment (UL Solutions vs. Competitor)

Comparing investor sentiment towards UL Solutions and a key competitor, such as Intertek, provides valuable insights into relative market positioning and investor preferences. The following bullet points highlight hypothetical differences.

- UL Solutions: Generally positive sentiment due to strong financial performance and consistent growth in key markets.

- Intertek: More mixed sentiment, with concerns regarding increased competition and potential challenges in certain geographic regions.

Exploring Potential Future Growth

UL Solutions’ future growth prospects depend on various factors, including its ability to execute its strategic plans, adapt to market changes, and capitalize on emerging opportunities. This section explores the key drivers of potential future growth and assesses the impact of different market scenarios.

Growth Strategies and Expansion Plans

UL Solutions’ growth strategies likely involve expanding into new markets, developing new services, and strategically acquiring companies with complementary offerings. Geographic expansion into developing economies with growing industrial sectors is a key aspect of their growth strategy. Furthermore, investments in research and development to create innovative testing and certification services are crucial.

Key Drivers of Future Growth

Key drivers of future growth include increased demand for safety and compliance solutions in emerging markets, the growing adoption of new technologies (such as AI and IoT), and the expansion of UL Solutions’ services into new industries. The company’s ability to adapt to changing regulations and consumer preferences is also a critical driver of future growth.

Impact of Technological Advancements

Technological advancements, such as AI-powered testing and automation, can significantly enhance UL Solutions’ efficiency and expand its service offerings. Embracing these technologies is crucial for maintaining a competitive edge and achieving future growth. For example, the integration of AI into their testing processes could lead to faster turnaround times and reduced operational costs.

Impact of Market Scenarios

Various market scenarios could significantly affect UL Solutions’ future stock price.

- Increased Competition: Increased competition could lead to price pressure and reduced profit margins, potentially impacting stock price negatively.

- Economic Downturn: An economic downturn could reduce demand for UL Solutions’ services, leading to lower revenue and a decline in stock price.

Assessing Risk Factors

Investing in UL Solutions stock involves certain risks that investors should carefully consider. This section identifies and assesses key risks associated with the company and its operations.

Key Risks Associated with Investing

Key risks include competition, economic downturns, regulatory changes, geopolitical events, and operational disruptions. Each of these risks can have a significant impact on UL Solutions’ financial performance and stock price.

Impact of Geopolitical Events

Geopolitical events, such as trade wars or international conflicts, can disrupt supply chains, impact demand for UL Solutions’ services in specific regions, and negatively affect investor sentiment.

Operational Risks (e.g., Supply Chain Disruptions)

Supply chain disruptions can impact UL Solutions’ ability to provide its services efficiently. Disruptions can lead to delays, increased costs, and potentially dissatisfied clients. Effective risk management strategies are crucial to mitigate these disruptions.

Summary of Risk Factors

| Risk Factor | Potential Impact | Mitigation Strategy | Likelihood |

|---|---|---|---|

| Increased Competition | Reduced market share, lower profit margins | Innovation, strategic acquisitions | Medium |

| Economic Downturn | Decreased demand for services, lower revenue | Cost reduction, diversification | Medium |

| Regulatory Changes | Increased compliance costs, potential for non-compliance | Proactive monitoring, legal expertise | Medium |

| Geopolitical Instability | Supply chain disruptions, reduced demand in certain regions | Diversified sourcing, regional diversification | Low |

| Supply Chain Disruptions | Delays, increased costs | Redundant suppliers, inventory management | Medium |

Essential Questionnaire

What is UL Solutions’ primary competitor?

Identifying a single primary competitor is difficult as UL Solutions operates across various sectors. However, key competitors often vary depending on the specific service or market segment.

How does UL Solutions’ stock price compare to the S&P 500?

A direct comparison requires examining historical stock price data relative to the S&P 500 index to determine performance differences over specific timeframes. This analysis would reveal if UL Solutions has outperformed or underperformed the broader market.

What are the major risks associated with a short-term investment in UL Solutions?

Short-term investments carry inherent market volatility risk. Specific risks for UL Solutions could include unexpected regulatory changes, competitive pressures, or economic downturns, all of which could impact the stock price negatively in the short term.

Interior Living

Interior Living