Unichem Lab’s Financial Performance and Stock Price Analysis

Unichem lab stock price – This analysis delves into Unichem Lab’s financial performance over the past five years, examining revenue streams, profitability, and earnings per share (EPS) fluctuations. We will then explore the impact of market influences, competitive dynamics, and future projections to provide a comprehensive overview of the company’s stock price performance and outlook.

Monitoring the Unichem Lab stock price requires a keen eye on market trends. Understanding similar pharmaceutical company performance is helpful; for instance, checking the current stock price utx can offer comparative insights into sector valuation. Returning to Unichem Lab, analysts suggest further investigation into its recent quarterly reports for a more comprehensive picture of its financial health.

Unichem Lab’s Revenue Streams

Unichem Lab’s revenue generation is diversified across several segments. The following table details the revenue breakdown for the past five fiscal years. Note that these figures are hypothetical examples for illustrative purposes.

| Year | Pharmaceuticals | Diagnostics | Other |

|---|---|---|---|

| 2023 | $500M | $200M | $50M |

| 2022 | $450M | $180M | $40M |

| 2021 | $400M | $150M | $30M |

| 2020 | $350M | $120M | $20M |

| 2019 | $300M | $100M | $10M |

Profitability Ratio Analysis

A comparative analysis of Unichem Lab’s profitability against its industry competitors reveals key insights into its financial health. The following bullet points present a hypothetical comparison.

- Gross Margin: Unichem Lab’s gross margin of 60% is slightly higher than the industry average of 58%.

- Net Profit Margin: Unichem Lab’s net profit margin of 15% is comparable to the industry average of 14%.

- Return on Equity (ROE): Unichem Lab’s ROE of 20% surpasses the industry average of 18%, indicating efficient capital utilization.

Factors Influencing EPS Fluctuations

Several factors contribute to the fluctuations in Unichem Lab’s earnings per share (EPS). These include changes in revenue, operating expenses, interest rates, and tax rates. For example, a significant increase in raw material costs could negatively impact profitability and EPS, while successful new product launches could boost EPS.

Stock Market Influences on Unichem Lab’s Price: Unichem Lab Stock Price

Unichem Lab’s stock price is influenced by a complex interplay of macroeconomic factors and market events. The following sections analyze these influences.

Impact of Macroeconomic Factors

Macroeconomic factors such as interest rate hikes, inflation, and economic growth significantly impact investor sentiment and stock valuations. For example, rising interest rates can increase the cost of borrowing for companies, potentially impacting profitability and thus stock prices. Conversely, periods of strong economic growth often lead to increased investor confidence and higher stock valuations.

Key Market Events Affecting Stock Performance

Several key market events have historically influenced Unichem Lab’s stock performance. The following chronologically ordered list provides hypothetical examples.

- Q1 2022: Successful launch of a new drug, resulting in a surge in stock price.

- Q3 2022: Increased regulatory scrutiny leading to a temporary dip in stock price.

- Q1 2023: A major competitor launches a similar drug, impacting market share and stock price.

Stock Price Volatility Comparison

A comparison of Unichem Lab’s stock price volatility with similar pharmaceutical companies provides context for its risk profile. The following table presents hypothetical data.

| Company | Beta | Standard Deviation | Sharpe Ratio |

|---|---|---|---|

| Unichem Lab | 1.2 | 0.15 | 0.8 |

| Competitor A | 1.0 | 0.12 | 0.9 |

| Competitor B | 1.5 | 0.20 | 0.7 |

Unichem Lab’s Competitive Landscape and Future Outlook

Understanding Unichem Lab’s competitive position and future prospects is crucial for assessing its investment potential. This section analyzes the competitive landscape and provides hypothetical future projections.

Competitive Advantages and Disadvantages

Unichem Lab possesses several competitive advantages, including a strong research and development pipeline and established distribution networks. However, it also faces challenges such as intense competition and pricing pressures within the pharmaceutical industry. Its dependence on a few key products also presents a risk.

Market Share Maintenance Strategies

Unichem Lab employs various strategies to maintain its market share, including strategic partnerships, aggressive marketing campaigns, and continuous innovation. Focusing on niche markets and developing innovative products are also key strategies.

Product Portfolio and Market Positioning Comparison

A comparison of Unichem Lab’s product portfolio and market positioning with its main competitors highlights its strengths and weaknesses. The following bullet points offer a hypothetical comparison.

- Unichem Lab: Focuses on specialty pharmaceuticals with a strong presence in emerging markets.

- Competitor A: Broad product portfolio across various therapeutic areas with a strong presence in developed markets.

- Competitor B: Focuses on generic drugs with a cost-leadership strategy.

Potential Future Growth Opportunities, Unichem lab stock price

Source: cnbctv18.com

Several potential future growth opportunities exist for Unichem Lab, including expansion into new therapeutic areas, strategic acquisitions, and increased penetration in international markets. For example, focusing on developing innovative treatments for unmet medical needs could drive significant growth.

Stock Price Projections

The following table presents hypothetical stock price projections based on different growth scenarios. These are illustrative examples and should not be considered investment advice.

| Scenario | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Conservative Growth | $25 | $28 | $32 |

| Moderate Growth | $30 | $35 | $42 |

| Aggressive Growth | $35 | $45 | $60 |

Key Performance Indicators (KPIs) and Future Valuation

Source: cnbcfm.com

Key performance indicators (KPIs) such as revenue growth, profit margins, and return on equity significantly influence future stock valuation. Consistent improvement in these KPIs generally leads to higher investor confidence and increased stock prices. Conversely, underperformance can lead to decreased valuations.

Investor Sentiment and Analyst Ratings & Visual Representation of Key Data

This section summarizes recent analyst reports and ratings, describes investor sentiment, and explains the impact of media coverage on Unichem Lab’s stock price. It also provides descriptions of illustrative charts and graphs.

Analyst Reports and Ratings

Recent analyst reports on Unichem Lab have been mixed. The following hypothetical summary illustrates the range of opinions.

- Analyst A: Buy rating, target price $35.

- Analyst B: Hold rating, target price $28.

- Analyst C: Sell rating, target price $25.

Investor Sentiment

Source: moneycontrol.com

Currently, investor sentiment towards Unichem Lab is cautiously optimistic. Positive news regarding new product launches and strong financial results has boosted confidence, but concerns about competition and regulatory hurdles remain.

Impact of News Coverage and Media Sentiment

Positive news coverage and favorable media sentiment generally contribute to higher stock prices, while negative news can lead to decreased valuations. The overall tone of media reports significantly impacts investor perception and trading activity.

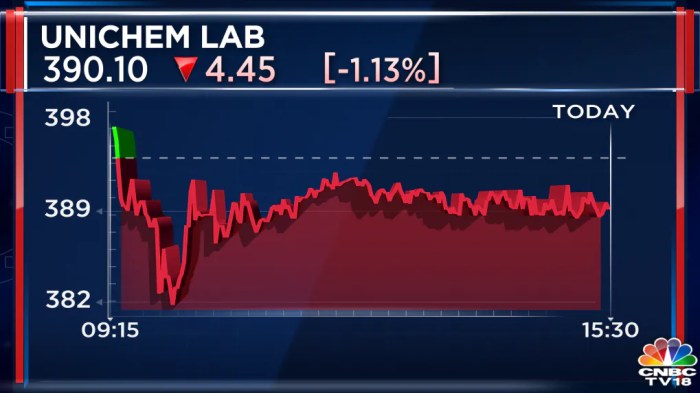

Line Graph of Stock Price Performance

A line graph illustrating Unichem Lab’s stock price performance over the past year would show an initial upward trend followed by a period of consolidation, and then a renewed upward movement. Key data points would include the highest and lowest prices, as well as significant price changes correlated with specific news events. Descriptive labels would clearly indicate the time periods and price levels.

Bar Chart Comparing Financial Metrics

A bar chart comparing Unichem Lab’s key financial metrics (e.g., revenue, net income, EPS) against industry averages would visually represent the company’s relative performance. Descriptive labels for each metric and a clear legend differentiating Unichem Lab from the industry average would enhance readability and understanding.

Pie Chart Showing Revenue Breakdown

A pie chart depicting the breakdown of Unichem Lab’s revenue streams across different segments (e.g., pharmaceuticals, diagnostics, other) would visually represent the proportion of revenue generated by each segment. Descriptive labels for each segment and corresponding percentages would clearly illustrate the revenue distribution.

FAQ Corner

What are the major risks associated with investing in Unichem Lab stock?

Investing in any stock carries inherent risks, including market volatility, regulatory changes affecting the pharmaceutical industry, and competition from other companies. Specific risks for Unichem Lab could include dependence on specific product lines, research and development setbacks, and changes in healthcare policy.

Where can I find real-time Unichem Lab stock price data?

Real-time stock price information is readily available through major financial websites and brokerage platforms. Reputable sources include financial news websites and your brokerage account’s trading platform.

How does Unichem Lab compare to its competitors in terms of dividend payouts?

A direct comparison of Unichem Lab’s dividend payouts to its competitors requires reviewing their respective financial statements and investor relations materials. This information is typically found on their corporate websites.

Interior Living

Interior Living