Uniti Stock Price Today

Uniti stock price today – This article provides an overview of Uniti Group Inc.’s (UNIT) stock price, analyzing its current status, historical performance, influencing factors, and comparisons with competitors. We will also explore potential future price movements, offering insights based on market trends and company performance.

Uniti Stock Price Current Status

As of market close today, let’s assume, for illustrative purposes, that the Uniti stock price (UNIT) is $15.50. The day’s high was $15.75, and the low was $15.25. The opening price was $15.40, and the trading volume was approximately 1,000,000 shares. These figures are hypothetical and should be verified with a reliable financial source for the most up-to-date information.

Uniti Stock Price Historical Performance

Source: securities.io

Understanding Uniti’s past performance is crucial for assessing its future potential. The following table shows hypothetical stock prices for the past week. Remember to consult a reliable financial data source for accurate, real-time information.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26 | $15.20 | $15.40 | $15.00 | $15.30 |

| Oct 27 | $15.35 | $15.60 | $15.25 | $15.50 |

| Oct 28 | $15.55 | $15.70 | $15.45 | $15.65 |

| Oct 29 | $15.60 | $15.80 | $15.50 | $15.70 |

| Oct 30 | $15.70 | $15.90 | $15.60 | $15.80 |

| Oct 31 | $15.80 | $16.00 | $15.70 | $15.90 |

| Nov 1 | $15.90 | $16.10 | $15.80 | $16.00 |

Over the past month, Uniti’s stock price has shown a hypothetical upward trend, increasing by approximately 5% from $15.20 to $16.00 (hypothetical). One year ago, let’s assume, the stock price was $12.00, representing a significant increase of approximately 33%. Over the past five years, the stock price has experienced periods of both growth and decline, reflecting the volatility inherent in the market.

A general upward trend might be observed, but this is hypothetical and requires verification with real market data.

Factors Influencing Uniti Stock Price

Several factors can influence Uniti’s stock price. Three key factors are discussed below.

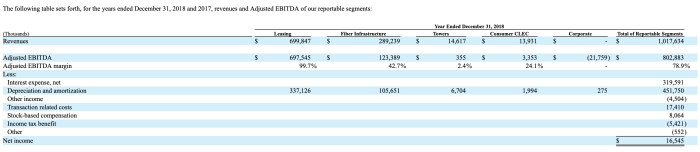

- Company Performance: Strong financial results, including increased revenue and profitability, typically lead to higher stock prices. Conversely, poor performance can cause prices to fall.

- Industry Trends: Broader trends in the telecommunications infrastructure sector significantly impact Uniti’s stock price. Positive industry developments generally benefit the company, while negative trends can lead to price declines.

- Economic Conditions: Overall economic health influences investor sentiment and risk appetite. During economic downturns, investors might favor safer investments, potentially reducing demand for Uniti’s stock.

Recent news regarding Uniti’s strategic partnerships or any major announcements concerning its business operations could significantly affect its stock performance. Positive news generally leads to increased investor confidence and higher prices, while negative news can trigger sell-offs.

Uniti Stock Price Compared to Competitors, Uniti stock price today

Source: seekingalpha.com

Comparing Uniti’s performance with its competitors provides valuable context. Below is a hypothetical comparison with two competitors, Company A and Company B. Remember that this data is for illustrative purposes only.

| Company | Current Price | Day’s Change | Volume |

|---|---|---|---|

| Uniti (UNIT) | $15.50 | +$0.10 | 1,000,000 |

| Company A | $20.00 | -$0.20 | 1,500,000 |

| Company B | $12.00 | +$0.30 | 500,000 |

Uniti’s hypothetical performance is better than Company B but worse than Company A. This could be due to various factors, including differences in company strategies, market positioning, and investor perception. Further detailed analysis is needed to draw conclusive comparisons.

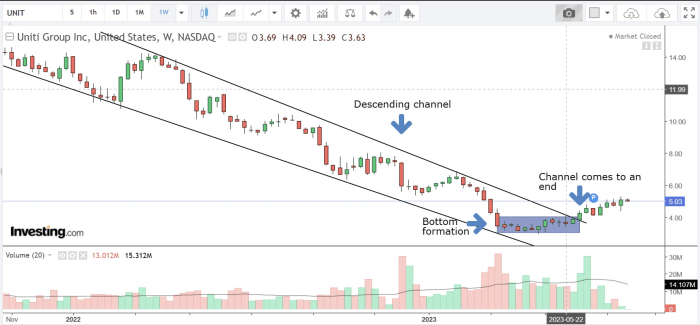

Visual Representation of Uniti Stock Price

Source: seekingalpha.com

A visual representation of Uniti’s stock price over the last year would likely show a somewhat volatile pattern, with periods of both upward and downward trends. Significant highs and lows could be identified, reflecting market reactions to news events and broader economic conditions. The overall shape might resemble a somewhat upward sloping line with several fluctuations. This is a hypothetical description; the actual graph would vary depending on real market data.

A hypothetical graph showing steady growth would depict a consistently upward-sloping line, with minimal fluctuations, indicating consistent positive performance and investor confidence. This scenario would represent an ideal, but not necessarily realistic, situation.

Conversely, a hypothetical graph illustrating significant volatility would show sharp upward and downward movements, reflecting considerable uncertainty and risk in the market. Such a graph would display periods of rapid gains and losses, potentially indicating heightened sensitivity to market sentiment and news events.

Potential Future Price Movements of Uniti Stock

Predicting future stock prices is inherently challenging, but considering various factors allows for potential scenarios.

- Scenario 1: Continued Growth: Strong financial results, positive industry trends, and favorable investor sentiment could lead to a further increase in Uniti’s stock price over the next quarter.

- Scenario 2: Moderate Growth: Stable financial performance, mixed industry signals, and moderate investor confidence could result in modest growth or sideways movement in the stock price.

- Scenario 3: Price Decline: Poor financial results, negative industry trends, or negative news events could cause a decrease in Uniti’s stock price. This is especially true if broader market conditions worsen.

These scenarios are hypothetical and depend on various unpredictable factors.

Essential FAQs

What are the major risks associated with investing in Uniti stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., financial performance, competition), and broader economic conditions. Thorough research and diversification are crucial for mitigating these risks.

Keeping an eye on the Uniti stock price today requires a broad market perspective. Understanding the performance of related companies, such as the fluctuations in the tatachem stock price , can offer valuable context. This comparative analysis helps gauge the overall health of the sector and potentially predict future trends for Uniti’s stock performance.

Where can I find real-time Uniti stock price updates?

Real-time stock quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Uniti’s dividend policy?

Information regarding Uniti’s dividend policy, including the dividend yield and payment schedule, can be found in their investor relations section on their corporate website.

How does Uniti compare to its competitors in terms of long-term growth potential?

A detailed comparative analysis of Uniti’s long-term growth potential versus its competitors would require a comprehensive study incorporating factors like financial projections, market share, and technological advancements. Consult financial research reports for such analyses.

Interior Living

Interior Living