Understanding the US Food Stock Market

Us food stock price – The US food stock market is a dynamic and complex ecosystem encompassing various sectors, key players, and influencing factors. Its performance reflects broader economic trends, consumer behavior, and global events. Analyzing this market requires understanding its components and the forces shaping its trajectory.

Major Sectors within the US Food Stock Market, Us food stock price

The US food stock market is broadly segmented into several key sectors. These include processed foods (companies like Kraft Heinz and Conagra Brands), agricultural products (companies involved in farming, processing, and distribution of raw agricultural commodities), food retail (grocery chains and supermarkets), and food service (restaurants and food delivery services). Each sector exhibits unique characteristics and performance patterns.

Key Players and Market Capitalization

Major players in the US food stock market vary significantly in size and market capitalization. For example, companies like Nestle, PepsiCo, and Coca-Cola are multinational giants with massive market caps, reflecting their global reach and brand recognition. Other companies, such as regional food producers or smaller restaurant chains, have significantly smaller market capitalizations. Precise market capitalization figures are dynamic and change constantly, requiring access to real-time financial data.

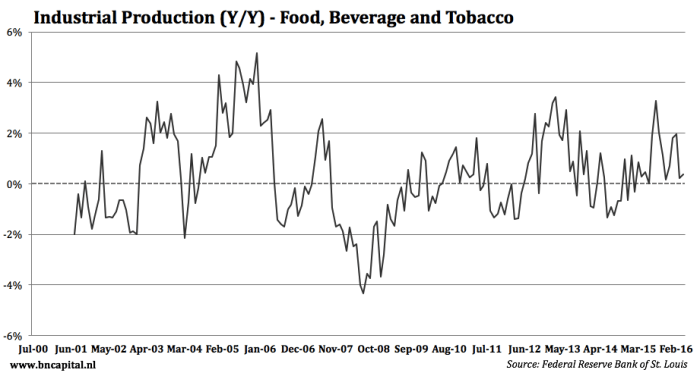

Historical Performance of the US Food Stock Market

The US food stock market’s historical performance has shown periods of growth and decline, mirroring overall economic cycles. During periods of economic expansion, consumer spending increases, boosting demand for food products and driving stock prices upward. Conversely, economic downturns often lead to reduced consumer spending, impacting stock valuations. Major trends include increasing consolidation within the industry, the rise of organic and sustainable food options, and the growing influence of technology.

Comparison of Food Sub-sector Performance

Performance varies considerably across different food sub-sectors. Processed foods, for instance, may be more resilient during economic downturns due to their relatively inelastic demand. Agricultural products, however, are highly sensitive to commodity price fluctuations and weather patterns. The restaurant sector experiences significant volatility, influenced by consumer preferences, economic conditions, and health concerns.

Factors Influencing US Food Stock Prices

Numerous factors influence the price of US food stocks, creating both opportunities and risks for investors. Understanding these factors is crucial for effective investment decision-making.

Impact of Agricultural Commodity Prices

Fluctuations in agricultural commodity prices (e.g., corn, wheat, soybeans) directly impact the profitability of food companies relying on these raw materials. Higher commodity prices increase input costs, squeezing profit margins, while lower prices can boost profitability. This sensitivity makes agricultural-focused food stocks inherently volatile.

Influence of Consumer Spending Habits and Economic Conditions

Consumer spending is a primary driver of food stock performance. During economic expansions, increased disposable income translates into higher food spending, benefiting food companies across all sectors. Conversely, economic recessions lead to reduced spending, particularly on discretionary food items, impacting stock prices negatively. Consumer preferences, such as shifts towards healthier or more sustainable options, also play a significant role.

Effects of Government Regulations and Policies

Source: investopedia.com

Government regulations, including food safety standards, labeling requirements, and agricultural subsidies, significantly influence the food industry. Changes in regulations can impact costs, production processes, and market access for food companies, leading to shifts in stock valuations. For example, stricter food safety regulations may increase compliance costs, affecting profitability.

Role of Supply Chain Disruptions and Logistics

Supply chain disruptions, such as those caused by pandemics or natural disasters, can severely impact food stock prices. Disruptions lead to increased costs, shortages, and delays, affecting production, distribution, and ultimately, the bottom line of food companies. Efficient logistics and resilient supply chains are crucial for mitigating these risks.

Correlation Between Macroeconomic Indicators and Food Stock Performance

Several macroeconomic indicators correlate with food stock performance. This table provides a simplified illustration; actual correlations can vary depending on the specific company and market conditions.

| Macroeconomic Indicator | Correlation with Food Stock Performance | Example | Impact |

|---|---|---|---|

| Inflation | Positive (generally) | Increased food prices | Higher revenue, but potentially reduced consumer demand |

| Consumer Confidence Index | Positive | Rising consumer optimism | Increased spending on food, driving demand |

| Interest Rates | Negative (generally) | Higher interest rates | Increased borrowing costs, potentially impacting investment and expansion |

| Unemployment Rate | Negative | High unemployment | Reduced consumer spending on discretionary food items |

Analyzing Individual Food Stock Performance: Us Food Stock Price

Analyzing individual food companies provides a more granular understanding of the market. This involves examining their financial performance, competitive positioning, and growth prospects.

Comparative Analysis of Major Food Companies

Source: dreamstime.com

A comparative analysis of three major food companies – Nestlé, PepsiCo, and Kraft Heinz – reveals differences in their strategies, performance, and market positions. Nestlé focuses on a broad range of food and beverage products, while PepsiCo concentrates on beverages and snacks. Kraft Heinz specializes in processed foods. Their relative performance varies depending on market conditions and consumer trends.

Detailed Financial Information for a Selected Company

Let’s examine a hypothetical example based on publicly available information (Note: This is a simplified example and does not reflect real-time data). Assume Company X, a processed food manufacturer, reported the following in its most recent financial statement: Revenue: $10 billion, Profit Margin: 15%, Debt Level: $3 billion. This information, combined with other data, provides insights into the company’s financial health and sustainability.

Factors Contributing to Success or Failure

The success or failure of a food company depends on various factors, including brand strength, product innovation, efficient operations, effective marketing, and adaptability to changing consumer preferences. Companies that fail to adapt to evolving tastes or manage costs effectively may struggle, while those that innovate and meet consumer demand thrive.

Hypothetical Investment Portfolio

A hypothetical investment portfolio focused on the US food sector might diversify across different sub-sectors to mitigate risk. This could include investments in a large, established food manufacturer, a growth-oriented organic food company, and a company in the rapidly expanding plant-based food sector. The specific allocation would depend on the investor’s risk tolerance and investment goals.

Monitoring the US food stock price requires a broad perspective, considering various market factors. It’s interesting to compare this with the performance of other sectors, such as the cannabis industry; for example, one could examine the current tilray brands stock price to understand broader market trends. Ultimately, understanding the interplay between different sectors helps better predict future movements in the US food stock price.

Future Trends and Predictions for US Food Stocks

Predicting future trends in the US food stock market requires considering technological advancements, evolving consumer preferences, and potential risks and opportunities.

Impact of Technological Advancements

Technological advancements, such as automation in food production, precision agriculture, and food biotechnology, are reshaping the food industry. Automation increases efficiency and reduces costs, while biotechnology offers opportunities for developing new, healthier, and more sustainable food products. Companies embracing these technologies are likely to gain a competitive advantage.

Emerging Trends in Consumer Preferences

Consumers are increasingly health-conscious and demand sustainable and ethically sourced food. This trend drives demand for organic, plant-based, and locally produced food products, creating opportunities for companies catering to these preferences. Companies failing to adapt to these changing preferences may face declining market share.

Potential Risks and Opportunities

The US food stock market faces risks such as climate change, geopolitical instability, and supply chain disruptions. However, opportunities exist in the growing demand for healthier and more sustainable food options, technological innovation, and the expansion of emerging markets. Companies successfully navigating these challenges and capitalizing on emerging opportunities are likely to perform well.

Potential Investment Strategies

Source: seekingalpha.com

- Invest in companies focused on sustainable and ethical food production.

- Consider companies utilizing technology to improve efficiency and reduce costs.

- Diversify across different food sub-sectors to reduce risk.

- Focus on companies with strong brands and a proven track record of innovation.

Visual Representation of Data

Historical Price Movements of a Major Food Stock

Consider a hypothetical example: Company Y’s stock price experienced significant growth between 2015 and 2018, reaching a peak in late 2018. This was followed by a period of consolidation, with the price fluctuating within a range until mid-2020. A sharp decline occurred in early 2020 due to the COVID-19 pandemic, but the stock recovered quickly and resumed its upward trajectory, surpassing its previous peak by late 2021.

This recovery reflects the company’s resilience and adaptability during the crisis, combined with strong consumer demand for its products.

Relationship Between Food Prices and Inflation

A hypothetical chart illustrating the relationship between food prices and inflation would show a generally positive correlation. As inflation rises, so do food prices, though the relationship may not be perfectly linear. During periods of high inflation, food prices often increase at a faster rate than other goods and services, reflecting the essential nature of food and the sensitivity of its supply chain to cost increases.

The chart would likely show periods where the correlation is stronger or weaker, depending on factors such as supply chain disruptions or government intervention.

Answers to Common Questions

What are the major risks associated with investing in US food stocks?

Risks include agricultural commodity price volatility, changes in consumer preferences, supply chain disruptions, and the impact of government regulations.

How can I diversify my investment portfolio within the US food sector?

Diversification can be achieved by investing across different sub-sectors (e.g., processed foods, agricultural products, restaurants) and by selecting companies with varying levels of market capitalization and risk profiles.

What are some key metrics to consider when analyzing individual food company performance?

Key metrics include revenue growth, profit margins, debt levels, return on equity, and free cash flow.

Where can I find reliable data on US food stock prices and performance?

Reliable data can be found through financial news websites, stock market data providers (e.g., Bloomberg, Refinitiv), and the SEC’s EDGAR database.

Interior Living

Interior Living