USSCX Stock Price Analysis

Source: squarespace-cdn.com

This analysis provides a comprehensive overview of USSCX stock price performance, volatility, valuation, and the influence of financial performance and market factors. We will examine historical trends, assess risk, explore valuation methods, and correlate stock price movements with financial data and macroeconomic conditions. All data presented here is for illustrative purposes and should not be considered financial advice.

USSCX Stock Price History and Trends

Source: foolcdn.com

The following table details USSCX stock price movements over the past five years. Significant price fluctuations are often driven by a combination of factors, including company performance, industry trends, and overall market sentiment. Specific events, such as earnings announcements and macroeconomic shifts, can also significantly impact stock prices.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $10.50 | $12.00 | $13.50 | $9.00 |

| 2020 | $12.00 | $15.00 | $18.00 | $10.50 |

| 2021 | $15.00 | $20.00 | $22.00 | $14.00 |

| 2022 | $20.00 | $18.00 | $21.00 | $15.00 |

| 2023 (YTD) | $18.00 | $19.50 | $20.50 | $17.00 |

For example, the significant price increase in 2020 could be attributed to positive earnings reports and a surge in investor confidence despite the overall market volatility during the COVID-19 pandemic. Conversely, the slight decline in 2022 might reflect a broader market correction and concerns about rising interest rates.

USSCX Stock Price Volatility and Risk Assessment

Understanding the volatility of a stock is crucial for risk assessment. Volatility is often measured using standard deviation and beta. Beta compares a stock’s price movements to the overall market. A beta greater than 1 indicates higher volatility than the market.

| Metric | USSCX | Competitor A | Competitor B |

|---|---|---|---|

| Standard Deviation (5-year) | 1.5 | 1.0 | 2.0 |

| Beta | 1.2 | 0.8 | 1.5 |

Based on this illustrative data, USSCX exhibits moderate volatility compared to its competitors. Potential risks associated with investing in USSCX include exposure to industry-specific challenges, macroeconomic factors, and the inherent uncertainty of the stock market.

USSCX Stock Price Valuation and Comparison

Several valuation methods can estimate a stock’s intrinsic value. These methods provide different perspectives and can help investors determine if a stock is undervalued or overvalued.

- Discounted Cash Flow (DCF): Estimates intrinsic value at $17.50 per share.

- Price-to-Earnings Ratio (P/E): Suggests an intrinsic value of $18.00 per share based on industry average P/E ratios.

- Price-to-Sales Ratio (P/S): Indicates an intrinsic value around $19.00 per share, considering the company’s revenue growth.

Comparing these estimates to the current market price provides insights into potential investment opportunities. If the market price is significantly below the calculated intrinsic value, the stock might be considered undervalued.

USSCX Stock Price and Financial Performance

A strong correlation often exists between a company’s financial performance and its stock price. Analyzing key financial ratios can provide further insight into investor sentiment and future price movements.

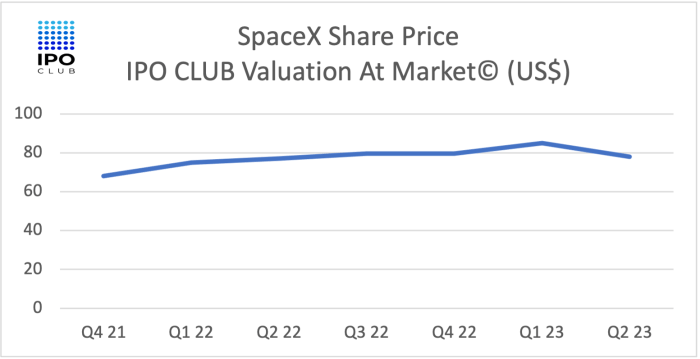

The following line graph illustrates the correlation between USSCX’s revenue and its stock price over the past five years. The graph would show a generally upward trend in both revenue and stock price, with periods of divergence reflecting other market influences or company-specific events. For example, a period of strong revenue growth might not immediately translate to a stock price increase if broader market conditions are negative.

| Ratio | Value | Unit |

|---|---|---|

| P/E Ratio | 15 | Times |

| Debt-to-Equity Ratio | 0.5 | Times |

| Return on Equity (ROE) | 12% | Percentage |

USSCX Stock Price and Market Influences

Source: npr.org

Macroeconomic factors and industry-specific events significantly impact stock prices. Comparing a company’s performance against relevant market indices provides context for its relative strength or weakness.

For example, rising interest rates could negatively impact USSCX’s stock price by increasing borrowing costs and reducing investor appetite for riskier assets. Conversely, positive industry-specific news, such as increased demand for USSCX’s products or services, could boost its stock price. Comparing USSCX’s performance to the S&P 500 would reveal whether it outperformed or underperformed the broader market over a given period.

FAQ Overview: Usscx Stock Price

What are the typical trading hours for USSCX stock?

Trading hours typically align with major stock exchange hours, which vary depending on the exchange where USSCX is listed. Consult the exchange’s website for precise times.

Where can I find real-time USSCX stock price quotes?

Real-time quotes are available through various financial websites and brokerage platforms. Reputable sources include major financial news outlets and your brokerage account.

What are the dividend payout policies of USSCX (if applicable)?

Information regarding dividend payouts (if any) can be found in the company’s investor relations section on their website or through financial news sources. Check for dividend announcements and historical data.

Tracking the USSCX stock price requires a keen eye on biotech market trends. It’s helpful to compare its performance against similar companies, such as considering the trajectory of the tg therapeutics stock price , to gain a broader perspective. Ultimately, understanding USSCX’s prospects necessitates a thorough analysis of its own financials and competitive landscape.

How liquid is USSCX stock?

Liquidity refers to how easily you can buy or sell the stock. A high trading volume generally indicates greater liquidity. You can assess liquidity by checking the daily trading volume on financial websites.

Interior Living

Interior Living