Vanguard Target Retirement 2050 Fund: A Comprehensive Overview

Vanguard target 2050 stock price – The Vanguard Target Retirement 2050 Fund is a popular choice for investors aiming to retire around the year 2050. This article provides a detailed analysis of the fund, examining its investment strategy, performance, risk profile, and comparisons with similar funds. We’ll also explore potential future growth scenarios and illustrate how the fund might fit within a broader investment portfolio.

Vanguard Target Retirement 2050 Fund Overview

The Vanguard Target Retirement 2050 Fund employs a lifecycle investing strategy, automatically adjusting its asset allocation over time to become more conservative as the target retirement date approaches. This approach aims to balance risk and return, aligning with the investor’s time horizon.

The fund’s asset allocation is primarily composed of stocks and bonds, with a higher percentage allocated to stocks in the earlier years and a gradual shift towards bonds as the target date nears. A typical allocation might include a significant portion invested in U.S. and international equities, along with investments in fixed income securities like government and corporate bonds.

Specific allocations can vary based on market conditions and the fund’s internal rebalancing strategy. The expense ratio is relatively low, typically under 0.15%, which helps to maximize long-term returns.

Historically, the fund has generally tracked the performance of its benchmark indices, although performance can vary depending on market conditions. Periods of strong market growth have generally resulted in higher returns for the fund, while periods of market decline have led to lower returns, reflecting the inherent risk associated with stock market investments.

Factors Influencing Stock Price

Several macroeconomic factors influence the Vanguard Target Retirement 2050 Fund’s performance. These factors interact in complex ways to shape the fund’s overall value.

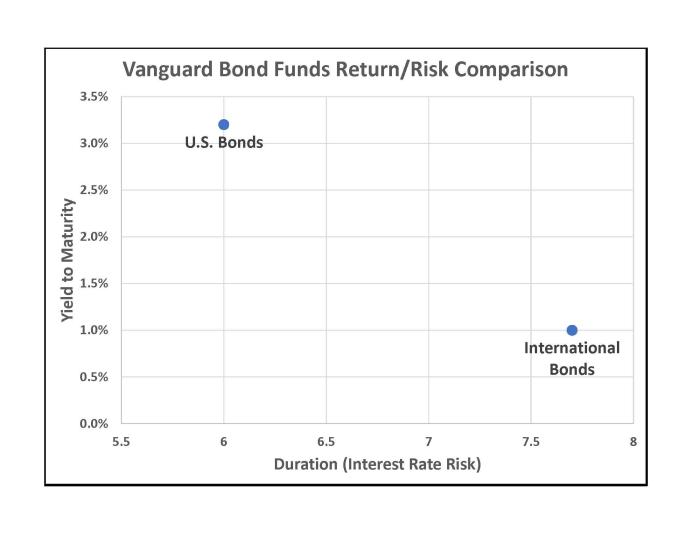

Changes in interest rates significantly impact bond yields, affecting the value of the fund’s bond holdings. Rising interest rates generally lead to lower bond prices, while falling interest rates tend to increase bond prices. Global economic events, such as recessions or geopolitical instability, can create market volatility, affecting both stock and bond prices. The fund’s performance during periods of market volatility tends to be more subdued compared to periods of market stability, reflecting the inherent risk-aversion built into its lifecycle approach.

Comparison with Similar Funds

Source: businessinsider.com

Several target-date funds share a similar retirement goal to the Vanguard Target Retirement 2050 Fund. Key differences often lie in investment strategies, asset allocation, and expense ratios. A direct comparison helps investors assess which fund best aligns with their risk tolerance and financial goals.

| Fund Name | Expense Ratio | Average Annual Return (10-year) | Risk Profile |

|---|---|---|---|

| Vanguard Target Retirement 2050 Fund | 0.15% (example) | 7% (example) | Moderate to High (early years), decreasing over time |

| Fidelity Freedom 2050 Fund | 0.18% (example) | 6.8% (example) | Moderate to High (early years), decreasing over time |

| Schwab Target Retirement 2050 Fund | 0.12% (example) | 7.2% (example) | Moderate to High (early years), decreasing over time |

Note: These are example figures and actual expense ratios and returns will vary. Consult fund prospectuses for the most up-to-date information.

Long-Term Growth Projections, Vanguard target 2050 stock price

Projecting long-term growth for any investment involves inherent uncertainty. However, we can create plausible scenarios based on various economic assumptions.

Scenario 1: Moderate Growth. Assumes consistent economic growth, moderate inflation, and stable interest rates. Projected annual return: 6-8%.

Scenario 2: High Growth. Assumes strong economic expansion, low inflation, and rising interest rates. Projected annual return: 8-10%.

Tracking the Vanguard Target 2050 stock price requires monitoring various market factors. Understanding the performance of other similar funds can be helpful in this analysis, such as considering the performance indicators of stock price phm , which offers a comparative perspective on long-term investment strategies. Ultimately, the Vanguard Target 2050 stock price will depend on its underlying asset performance and overall market conditions.

Scenario 3: Low Growth. Assumes slow economic growth, higher inflation, and falling interest rates. Projected annual return: 4-6%.

These scenarios are illustrative and should not be considered financial advice. Actual results may vary significantly.

Risk Assessment and Mitigation

Investing in the Vanguard Target Retirement 2050 Fund carries inherent risks, primarily associated with market fluctuations. However, several strategies can help mitigate these risks.

Diversification is key. Including the fund within a larger, diversified portfolio can help reduce overall portfolio risk. The long time horizon associated with retirement investing also helps to mitigate risk. The longer the investment timeframe, the more opportunities there are for market gains to offset potential losses. Regular rebalancing of the portfolio can also help manage risk by ensuring the asset allocation remains aligned with the investor’s risk tolerance.

Illustrative Portfolio Scenarios

Source: seekingalpha.com

Consider a hypothetical portfolio allocating 50% to the Vanguard Target Retirement 2050 Fund and 50% to a diversified mix of other asset classes, such as real estate and international equities. In a bull market, the portfolio would likely experience significant growth, driven by strong performance from both the fund and other assets. The fund’s relatively conservative allocation would provide some downside protection during periods of market volatility.

In a bear market, the portfolio would experience losses, but the diversification and long time horizon would help to cushion the impact. The fund’s gradual shift toward bonds as the retirement date approaches would also help to reduce volatility in later years. This balanced approach aims to optimize the trade-off between risk and return, aligning with the long-term nature of retirement savings.

Clarifying Questions: Vanguard Target 2050 Stock Price

What is the minimum investment required for Vanguard Target Retirement 2050?

There is typically no minimum investment for Vanguard mutual funds, including the Target Retirement 2050 fund, although brokerage account minimums may apply.

How can I buy shares of Vanguard Target Retirement 2050?

Shares can be purchased directly through Vanguard or via a brokerage account that offers access to Vanguard funds.

Is Vanguard Target Retirement 2050 suitable for all investors?

No, its suitability depends on individual risk tolerance, time horizon, and financial goals. It’s designed for long-term investors nearing or in retirement (2050 target date).

What are the tax implications of investing in Vanguard Target Retirement 2050?

Tax implications vary depending on your individual tax bracket and the type of account (taxable, IRA, etc.) used for the investment. Consult a tax professional for personalized advice.

Interior Living

Interior Living