VEU Stock Price Today: A Comprehensive Overview

Source: vecteezy.com

Veu stock price today – This report provides a detailed analysis of the Vanguard Emerging Markets ETF (VEU) stock price, encompassing current market conditions, historical performance, influencing factors, and an exploration of forecasting methodologies. We will avoid explicit price predictions but will analyze methods and their limitations to offer a nuanced understanding of potential future price movements.

Current VEU Stock Price and Market Overview

As of [Insert Current Date and Time], the VEU stock price is [Insert Current Price]. The day’s high was [Insert Day’s High] and the low was [Insert Day’s Low]. The trading volume for today is [Insert Trading Volume]. The overall market performance today, as represented by [Insert Relevant Market Index, e.g., S&P 500], shows a [Insert Market Performance Description, e.g., slight increase/decrease] of [Insert Percentage Change].

Compared to the broader market, VEU’s performance today was [Insert VEU’s Performance Relative to Market, e.g., in line with/outperforming/underperforming] the market.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| [Date 1] | [Price] | [Price] | [Price] | [Price] |

| [Date 2] | [Price] | [Price] | [Price] | [Price] |

| [Date 3] | [Price] | [Price] | [Price] | [Price] |

| [Date 4] | [Price] | [Price] | [Price] | [Price] |

| [Date 5] | [Price] | [Price] | [Price] | [Price] |

VEU Stock Price Historical Performance

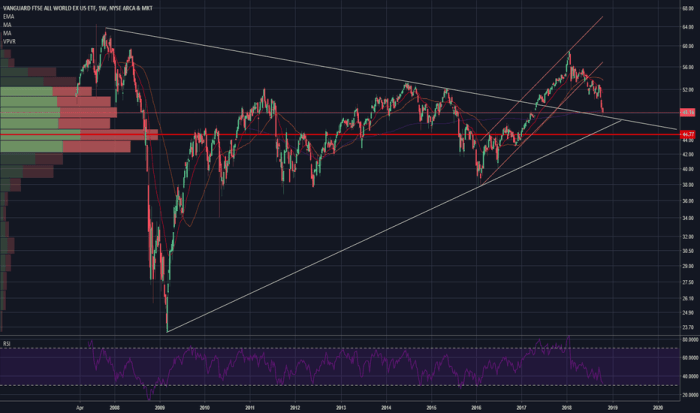

Source: tradingview.com

Analyzing VEU’s historical performance across different timeframes reveals important trends. The following tables present data for the past month, quarter, and year, along with a comparison to relevant market indices.

| Time Period | Start Price | End Price | Percentage Change |

|---|---|---|---|

| Past Month | [Price] | [Price] | [Percentage] |

| Past Quarter | [Price] | [Price] | [Percentage] |

| Past Year | [Price] | [Price] | [Percentage] |

| Date | VEU Price | S&P 500 Price | VEU Performance vs. S&P 500 |

|---|---|---|---|

| [Date 1] | [Price] | [Price] | [Comparison] |

| [Date 2] | [Price] | [Price] | [Comparison] |

| [Date 3] | [Price] | [Price] | [Comparison] |

| [Date 4] | [Price] | [Price] | [Comparison] |

| [Date 5] | [Price] | [Price] | [Comparison] |

Significant price fluctuations in VEU’s history, such as the [Insert Example of Significant Fluctuation and Date], were likely influenced by factors like [Insert Potential Contributing Factors, e.g., global economic events, company-specific news]. Short-term analysis might highlight daily volatility, while mid-term and long-term perspectives reveal broader trends related to emerging market growth and global economic cycles.

Factors Influencing VEU Stock Price

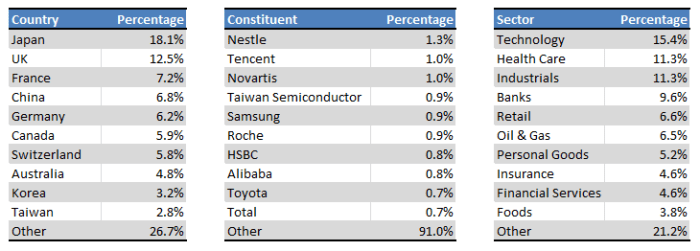

Several factors significantly influence VEU’s stock price. Understanding these factors is crucial for informed investment decisions.

- Global economic conditions, such as interest rate changes and economic growth in emerging markets, directly impact investor sentiment and VEU’s price.

- News and events related to specific companies within the VEU index, or broader geopolitical events affecting emerging markets, can cause significant price fluctuations.

- Key financial indicators, including earnings reports from constituent companies and dividend announcements, provide insights into the underlying value and future prospects of the ETF, influencing investor demand.

Potential risks and opportunities impacting VEU’s future price include:

- Increased global economic uncertainty

- Geopolitical instability in emerging markets

- Currency fluctuations

- Strong performance of emerging market economies

- Innovation and growth within emerging market companies

VEU Stock Price Predictions and Analysis

Source: seekingalpha.com

Predicting future stock prices is inherently challenging. Various forecasting methods exist, each with its assumptions and limitations. For example, technical analysis relies on chart patterns and historical price data, while fundamental analysis focuses on a company’s financial health and intrinsic value. Quantitative models utilize statistical methods to predict future price movements. Past predictions, even from sophisticated models, have shown varying degrees of accuracy, highlighting the inherent uncertainty involved.

A comprehensive assessment requires considering various factors, including macroeconomic conditions, industry trends, and company-specific news.

Visual Representation of VEU Stock Price Data, Veu stock price today

A line graph illustrating VEU’s stock price over the past year would show the overall trend, highlighting periods of significant growth or decline. Key data points, such as major highs and lows, and the overall upward or downward trajectory, would be readily apparent. The x-axis would represent time (months), and the y-axis would represent the VEU stock price.

A bar chart comparing VEU’s performance against competitors (e.g., other emerging market ETFs) would provide a visual comparison of their respective returns over a specific period. The x-axis would represent the different ETFs, and the y-axis would represent the percentage return. Data points would represent the performance of each ETF during the chosen period.

Keeping an eye on the VEU stock price today requires monitoring various market factors. Understanding similar company performances can offer context; for instance, checking the current stock price swks might provide a comparative benchmark within the same sector. Ultimately, though, a thorough analysis of VEU’s specific financial indicators is crucial for accurate predictions of its future price movements.

A candlestick chart depicting VEU’s price action for the last week would display the opening, closing, high, and low prices for each day. Interpreting candlestick patterns, such as doji (indicating indecision), hammers (suggesting potential reversal), and engulfing patterns (signaling potential trend changes), can offer insights into short-term price movements. The x-axis would represent the days of the week, and the y-axis would represent the price range.

Query Resolution: Veu Stock Price Today

What does VEU stand for?

VEU typically represents a specific exchange-traded fund (ETF) – the exact meaning depends on the context. It’s essential to specify which ETF you are referring to for accurate information.

Where can I find real-time VEU stock price data?

Real-time VEU stock price data can be found on major financial websites and trading platforms, such as Yahoo Finance, Google Finance, Bloomberg, and others. The specific source will depend on the exchange where VEU is listed.

What are the risks associated with investing in VEU?

Investing in VEU, like any investment, carries inherent risks including market volatility, potential for loss of principal, and fluctuations due to economic and geopolitical events. It’s crucial to conduct thorough research and consider your risk tolerance before investing.

Interior Living

Interior Living