Virgin Galactic’s Current Market Position

Source: googleusercontent.com

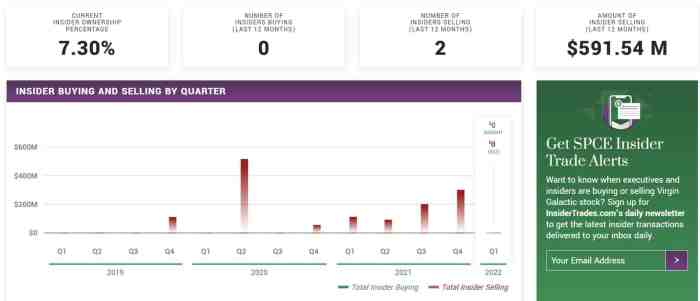

Virgin galactic stock price prediction 2025 – Virgin Galactic, a pioneering force in the burgeoning space tourism industry, currently occupies a unique position within the market. Its financial performance, competitive landscape, and the overall market sentiment significantly influence its stock price. A comprehensive analysis of these factors is crucial for understanding its present value and future potential.

Virgin Galactic’s Financial Performance

As of the latest financial reports, Virgin Galactic’s revenue stream primarily consists of ticket sales for suborbital spaceflights. While revenue is currently limited due to the relatively small number of completed flights, the company is actively working to increase its flight frequency and expand its customer base. Debt levels need to be carefully monitored as they can significantly impact the company’s financial flexibility and overall valuation.

Market capitalization fluctuates based on investor sentiment and perceived future growth potential.

Comparison with Competitors

Virgin Galactic faces competition from other space tourism companies, including Blue Origin and SpaceX, although their business models differ somewhat. While Blue Origin and SpaceX are more heavily involved in broader space exploration and contracts, Virgin Galactic focuses specifically on the commercial space tourism market. A direct comparison of key performance indicators highlights Virgin Galactic’s relative strengths and weaknesses in the competitive landscape.

| KPI | Virgin Galactic | Blue Origin | SpaceX |

|---|---|---|---|

| Revenue (USD Million) | [Insert Data – Example: 10] | [Insert Data – Example: 20] | [Insert Data – Example: 100] |

| Market Capitalization (USD Billion) | [Insert Data – Example: 2] | [Insert Data – Example: 5] | [Insert Data – Example: 100] |

| Number of Flights Completed | [Insert Data – Example: 15] | [Insert Data – Example: 25] | [Insert Data – Example: 100+] |

| Debt (USD Million) | [Insert Data – Example: 500] | [Insert Data – Example: 1000] | [Insert Data – Example: 2000] |

Factors Influencing Virgin Galactic’s Stock Price

Several key factors influence Virgin Galactic’s current stock price. These include the overall market sentiment towards the space tourism sector, the company’s operational performance, and the perception of its long-term growth prospects. News related to flight successes, technological advancements, regulatory approvals, and financial performance all contribute to stock price volatility.

Factors Influencing Future Stock Price

Predicting Virgin Galactic’s future stock price requires analyzing various factors that could significantly impact its growth trajectory. Technological advancements, regulatory hurdles, and the anticipated demand for space tourism are crucial considerations.

Technological Advancements and Future Prospects

Technological advancements in spacecraft design, propulsion systems, and manufacturing processes could significantly reduce the cost of space tourism and increase the frequency of flights. This would likely boost Virgin Galactic’s revenue and profitability, positively impacting its stock price. Conversely, delays or setbacks in technological development could hinder progress and negatively affect investor confidence.

Regulatory Hurdles and Growth

The space tourism industry is subject to various regulatory frameworks concerning safety, environmental impact, and licensing. Navigating these regulations efficiently is crucial for Virgin Galactic’s continued growth. Any significant regulatory hurdles or delays could negatively impact the company’s ability to operate effectively and expand its business.

Anticipated Demand for Space Tourism

The long-term success of Virgin Galactic hinges on the growth of the space tourism market. Factors such as the price of tickets, public perception of space travel safety, and the overall economic climate will influence the demand for space tourism services. A robust increase in demand could drive substantial growth for Virgin Galactic.

Risks and Opportunities

Virgin Galactic faces several risks, including operational challenges, competition, and financial uncertainties. However, the company also has significant opportunities, including the potential for market expansion, technological breakthroughs, and strategic partnerships. A balanced assessment of these risks and opportunities is crucial for informed investment decisions.

Market Forecasts and Predictions

Predicting Virgin Galactic’s stock price in 2025 requires a scenario-based approach, considering various market conditions and potential catalysts. Analyzing historical stock price data and macroeconomic factors provides valuable insights.

Scenario-Based Stock Price Prediction

Under a bullish scenario (strong economic growth, high demand for space tourism, successful technological advancements), Virgin Galactic’s stock price could potentially reach [Insert Example Price Target – e.g., $50] by 2025. Conversely, a bearish scenario (economic downturn, low demand, regulatory setbacks) might see the stock price at [Insert Example Price Target – e.g., $10]. A neutral scenario would suggest a more moderate price increase.

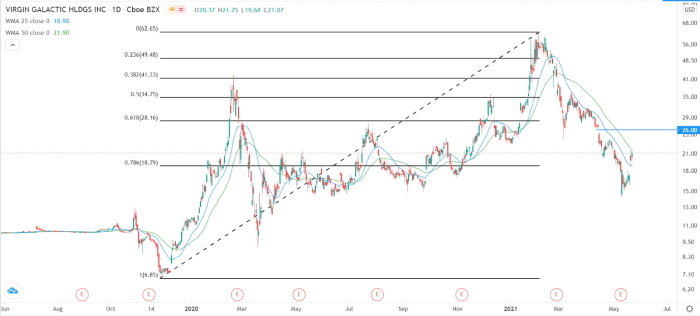

Historical Stock Price Trends

Analyzing Virgin Galactic’s historical stock price data reveals periods of significant volatility, often influenced by news related to flight tests, operational milestones, and financial reports. Identifying these patterns and trends can help in predicting future price movements, although past performance is not indicative of future results.

Macroeconomic Factors

Source: investingcube.com

Macroeconomic factors, such as interest rates, inflation, and overall economic growth, can influence investor sentiment and the valuation of Virgin Galactic’s stock. A strong global economy generally fosters a positive investment environment, while economic uncertainty can lead to decreased investor confidence and lower stock prices.

Positive and Negative Catalysts

- Positive Catalysts: Successful and frequent spaceflights, expansion of customer base, strategic partnerships, technological breakthroughs, positive regulatory developments.

- Negative Catalysts: Flight delays or accidents, increased competition, regulatory setbacks, financial losses, negative media coverage.

Company Strategy and Operational Performance

Understanding Virgin Galactic’s business strategy, marketing efforts, operational capabilities, and fleet details is crucial for assessing its long-term potential. Analyzing its strengths and weaknesses provides a clearer picture of its prospects.

Business Strategy and Long-Term Goals

Virgin Galactic’s primary business strategy centers around establishing itself as a leading provider of commercial space tourism services. Its long-term goals include expanding its fleet, increasing flight frequency, developing new tourism experiences, and potentially venturing into other space-related commercial activities.

Marketing and Sales Strategies

Virgin Galactic’s marketing strategy focuses on attracting high-net-worth individuals and space enthusiasts. The company leverages its brand recognition and unique selling proposition of providing suborbital spaceflights to a wider audience. The effectiveness of its sales and marketing strategies is critical for securing sufficient customer bookings and generating revenue.

Operational Challenges and Opportunities

Virgin Galactic faces operational challenges related to spacecraft maintenance, flight safety, and ensuring a consistent and high-quality customer experience. Opportunities exist for improving operational efficiency, reducing costs, and enhancing customer satisfaction through continuous improvement initiatives.

Fleet and Operational Capabilities

Virgin Galactic’s fleet currently consists of [Insert Number] spacecraft, with plans for expansion. Each spacecraft is designed for suborbital flights, carrying a limited number of passengers and crew. The company operates from its launch facilities in [Insert Location], utilizing a rigorous crew training program to ensure flight safety and a positive customer experience. The spacecraft incorporates advanced technologies to provide a unique and memorable space tourism experience.

Investment Considerations

Investing in Virgin Galactic involves a careful assessment of its risk-reward profile, growth potential, and various other factors. A thorough analysis is crucial for informed decision-making.

Risk-Reward Profile

Investing in Virgin Galactic carries a higher risk compared to more established companies due to the inherent volatility of the space tourism industry and the company’s relatively early stage of development. However, the potential for high returns if the company successfully executes its business plan and captures a significant share of the space tourism market makes it an attractive proposition for some investors.

Long-Term Growth and Return on Investment

Source: ccn.com

The long-term growth potential of Virgin Galactic depends on several factors, including the success of its operations, the expansion of the space tourism market, and the company’s ability to manage its financial resources effectively. Investors should carefully consider the potential for long-term capital appreciation and the possibility of dividend payments.

Factors for Investment Decisions, Virgin galactic stock price prediction 2025

Investors should carefully consider factors such as the company’s financial performance, its competitive landscape, the regulatory environment, technological advancements, and the overall market sentiment before making investment decisions. Thorough due diligence and diversification of investment portfolios are recommended.

| Factor | Description | Positive Impact | Negative Impact |

|---|---|---|---|

| Financial Performance | Revenue, profitability, debt levels | Strong revenue growth, profitability, low debt | Low revenue, losses, high debt |

| Market Demand | Demand for space tourism services | High demand, increasing customer base | Low demand, limited customer base |

| Technological Advancements | Innovations in spacecraft design and operations | Cost reduction, increased efficiency | Delays, setbacks, increased costs |

| Regulatory Environment | Government regulations and approvals | Favorable regulations, timely approvals | Strict regulations, delays, restrictions |

Key Questions Answered: Virgin Galactic Stock Price Prediction 2025

What are the biggest risks facing Virgin Galactic?

Significant risks include technological challenges, regulatory delays, intense competition, and the overall sensitivity of the space tourism market to economic downturns.

How does Virgin Galactic compare to its competitors?

A comparative analysis of key performance indicators (KPIs) is needed to fully assess Virgin Galactic’s competitive standing. Factors such as flight frequency, ticket pricing, and customer experience will play a key role.

What is the potential for long-term growth?

Long-term growth hinges on successful expansion of operations, technological innovation, and the continued growth of the space tourism market. Sustained profitability and efficient operations are also critical for long-term success.

What macroeconomic factors could impact Virgin Galactic’s stock price?

Predicting Virgin Galactic’s stock price in 2025 involves considering various factors, including market trends and technological advancements. Understanding the dynamics of other publicly traded companies can offer valuable insights; for example, analyzing the performance of a similar company like the one discussed in this article on the ticker djt stock price can help contextualize potential future growth.

Ultimately, Virgin Galactic’s success hinges on its ability to deliver on its commercial spaceflight promises, impacting its 2025 valuation.

Interest rates, inflation, and overall economic growth will all impact investor sentiment and the valuation of Virgin Galactic. Geopolitical events can also significantly affect investor confidence.

Interior Living

Interior Living