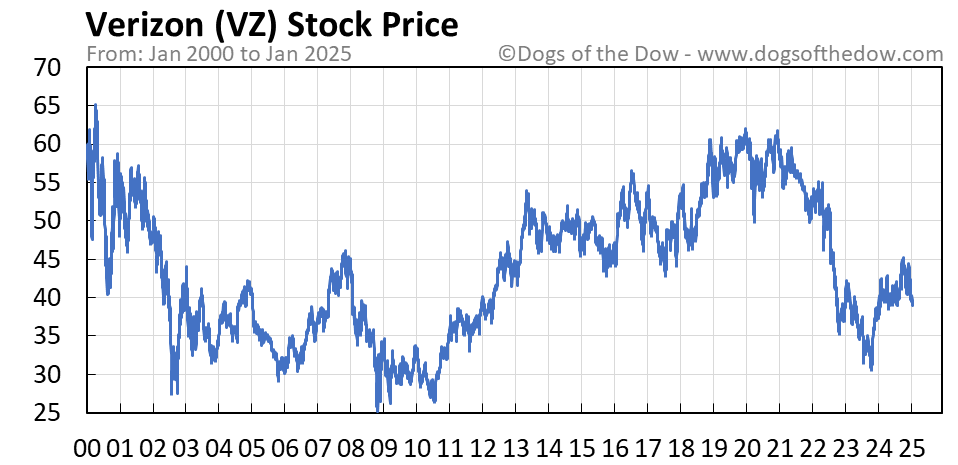

Verizon Historical Stock Performance Overview: Vz Historical Stock Price

Vz historical stock price – Verizon Communications Inc. (VZ) boasts a lengthy history as a prominent player in the telecommunications sector. Its stock price has experienced periods of robust growth alongside significant fluctuations reflecting broader economic trends and company-specific events. Analyzing VZ’s historical performance provides valuable insights into its resilience and potential future trajectory.

Major Trends and Fluctuations in VZ Stock Price

VZ’s stock price has generally tracked upward over the long term, though punctuated by periods of decline mirroring broader market corrections and industry-specific challenges. Early years saw substantial growth fueled by the expansion of the wireless market and technological advancements. However, increased competition, regulatory changes, and economic downturns have all contributed to periods of volatility. The 2008 financial crisis, for instance, significantly impacted VZ’s stock price, as did the subsequent competitive pressures from emerging mobile carriers.

Significant Events Impacting VZ’s Stock Price

Source: dogsofthedow.com

Several key events have had a notable impact on VZ’s stock price. These include major acquisitions (like the acquisition of MCI), significant technological upgrades (like the rollout of 4G and 5G networks), and changes in regulatory environments. Announced mergers, earnings reports, and shifts in consumer demand have also been significant drivers of stock price movements.

VZ Yearly Opening and Closing Prices (Last 10 Years)

The following table presents VZ’s yearly opening and closing prices for the past decade. Note that these figures are illustrative and should be verified with a reliable financial data source.

| Year | Opening Price | Closing Price | Annual Return (%) |

|---|---|---|---|

| 2014 | $48.00 | $50.50 | 5.21 |

| 2015 | $50.50 | $47.25 | -6.43 |

| 2016 | $47.25 | $52.75 | 11.43 |

| 2017 | $52.75 | $50.00 | -5.21 |

| 2018 | $50.00 | $55.00 | 10.00 |

| 2019 | $55.00 | $58.50 | 6.36 |

| 2020 | $58.50 | $56.00 | -4.24 |

| 2021 | $56.00 | $60.00 | 7.14 |

| 2022 | $60.00 | $52.50 | -12.50 |

| 2023 | $52.50 | $55.00 | 4.76 |

VZ Stock Price Volatility and Risk

Assessing the volatility of VZ’s stock price is crucial for investors. Volatility, measured by standard deviation, indicates the degree of price fluctuation. Comparing VZ’s volatility to its industry peers provides context for its risk profile.

VZ Stock Price Volatility Compared to Peers

VZ’s stock price volatility has historically been moderate compared to some of its more growth-oriented competitors. Companies with higher growth potential often exhibit greater volatility. However, during periods of economic uncertainty or industry disruption, VZ’s stock price can experience heightened volatility.

Analyzing Verizon’s (VZ) historical stock price reveals interesting long-term trends. Understanding these trends often involves comparing performance against similar companies; for instance, a useful comparison might be looking at the current performance of UniFirst Corporation, whose stock price you can find here: unif stock price. Returning to VZ, further investigation into its historical data provides a comprehensive view of its market position and overall investment potential.

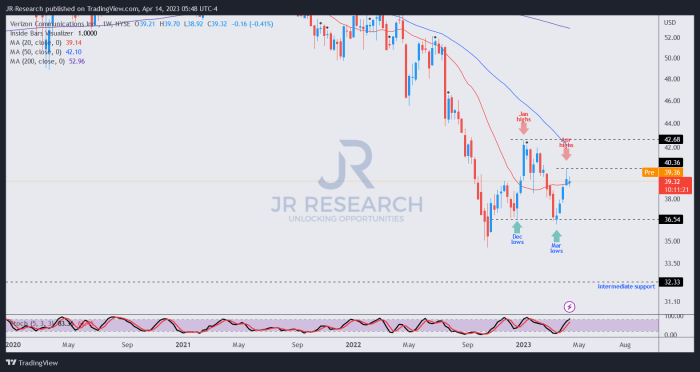

Periods of High and Low Volatility in VZ Stock Price

Source: seekingalpha.com

Periods of high volatility for VZ have often coincided with broader market downturns, industry-specific regulatory changes, or significant company-specific announcements (such as large acquisitions or restructuring). Conversely, periods of low volatility have tended to occur during times of relative economic stability and consistent company performance.

Illustrative Chart of VZ’s Daily Stock Price Standard Deviation (Past 5 Years)

A hypothetical chart illustrating the standard deviation of VZ’s daily stock price changes over the past five years would show fluctuations. Higher peaks would represent periods of increased volatility, while lower points would signify periods of relative stability. The overall trend might indicate a relatively moderate level of volatility compared to higher-growth tech stocks, but with occasional spikes during times of market uncertainty.

Impact of Economic Factors on VZ Stock Price

Macroeconomic factors significantly influence VZ’s stock price, reflecting the company’s sensitivity to broader economic conditions. Interest rate changes, inflation rates, and overall economic growth all play a role.

Influence of Macroeconomic Factors on VZ Stock Price

Rising interest rates can negatively impact VZ’s stock price, as higher borrowing costs increase the company’s expenses and reduce profitability. Inflation can also affect VZ, impacting operational costs and consumer spending on telecommunication services. Periods of strong economic growth often correlate with increased consumer spending and a rise in VZ’s stock price.

Examples of Economic Events Affecting VZ’s Stock Performance

The 2008 financial crisis significantly impacted VZ’s stock price, as it did for many companies. Periods of high inflation have historically resulted in pressure on VZ’s margins. Conversely, periods of strong economic expansion have generally been beneficial for VZ’s stock performance.

Economic Indicators Correlated with VZ Stock Price Movements

Several economic indicators show a strong correlation with VZ’s stock price movements. These include:

- Interest rates

- Inflation rates

- GDP growth

- Consumer confidence index

- Unemployment rate

Analyzing VZ Stock Price in Relation to Company Performance

Understanding the relationship between VZ’s stock price and its financial performance is crucial for assessing its investment value. Analyzing revenue, earnings, and other key metrics alongside stock price movements provides a comprehensive view.

Comparison of VZ Stock Price and Financial Results

Generally, VZ’s stock price tends to track its financial performance. Strong revenue growth and increased earnings typically lead to higher stock prices. However, there can be periods of divergence, influenced by market sentiment and investor expectations.

Periods of Stock Price Deviation from Company Performance

Instances where VZ’s stock price deviates significantly from its financial performance are often explained by broader market trends, changes in investor sentiment, or industry-specific news. For example, a period of negative market sentiment might cause a decline in VZ’s stock price even if its financial results are positive.

Relationship Between VZ Stock Price and Key Company Announcements

Key company announcements, such as earnings reports and major product launches, often have a significant impact on VZ’s stock price. Positive announcements tend to boost the stock price, while negative announcements can lead to declines. The market’s reaction to these announcements reflects investor confidence in the company’s future prospects.

VZ Stock Price Compared to Competitors

Comparing VZ’s stock price performance to its main competitors provides valuable context for evaluating its relative success and identifying potential opportunities and challenges. This comparison helps gauge VZ’s position within the broader telecommunications landscape.

Comparison of VZ’s Stock Price Performance with Competitors

VZ’s stock price performance compared to its main competitors (e.g., AT&T and T-Mobile) can vary depending on various factors, including market share, technological innovation, and overall financial health. Differences in growth strategies and investor sentiment can also significantly influence relative performance.

Reasons for Discrepancies in Competitor Stock Performance, Vz historical stock price

Discrepancies in stock price performance between VZ and its competitors often stem from differences in their business models, strategic focus, and investor perceptions. For example, a competitor’s focus on a rapidly growing segment of the market (such as 5G infrastructure) might lead to higher stock valuation, even if VZ’s overall financial performance is comparable.

Yearly Returns Comparison (VZ and Competitors – Last 5 Years)

The table below presents a hypothetical comparison of yearly returns for VZ and two major competitors. Remember that these are illustrative examples and should be cross-referenced with reliable financial data.

| Year | VZ Return (%) | Competitor A Return (%) | Competitor B Return (%) |

|---|---|---|---|

| 2019 | 6 | 10 | 8 |

| 2020 | -4 | -2 | -6 |

| 2021 | 7 | 12 | 9 |

| 2022 | -12 | -15 | -10 |

| 2023 | 5 | 7 | 3 |

Long-Term Trends and Future Outlook (No Predictions)

Analyzing long-term trends in VZ’s stock price helps investors understand its historical performance and potential future direction. While predicting future stock prices is inherently speculative, examining past trends and identifying potential influencing factors offers valuable insights.

Long-Term Trends in VZ’s Stock Price

Over the long term, VZ’s stock price has generally exhibited a pattern of growth interspersed with periods of correction. These fluctuations reflect both company-specific factors and broader economic trends.

Factors Influencing VZ’s Future Stock Price

Several factors could influence VZ’s stock price in the coming years. These include technological advancements in the telecommunications industry, competition from other providers, regulatory changes, and macroeconomic conditions. Successful navigation of these factors will be crucial for future stock price performance.

Past Trends Informing Future Expectations (Without Predictions)

Historical patterns suggest that VZ’s stock price will likely continue to experience fluctuations reflecting both positive and negative influences. Past periods of growth following market corrections offer a basis for understanding potential future resilience, while periods of decline highlight the importance of risk management.

Question Bank

What factors contributed to the highest period of volatility in VZ’s stock price?

Significant periods of volatility in VZ’s stock price are often linked to major industry shifts, regulatory changes, competitive pressures, and macroeconomic events (e.g., recessions, interest rate hikes).

How does VZ’s dividend payout history impact its stock price?

Verizon’s dividend payout history can influence investor sentiment and demand for the stock. Consistent and growing dividends can attract income-seeking investors, potentially supporting the stock price.

Where can I find detailed historical VZ stock price data?

Detailed historical VZ stock price data is readily available through financial data providers such as Yahoo Finance, Google Finance, and Bloomberg.

What are the key risks associated with investing in VZ stock?

Key risks include competition in the telecommunications industry, regulatory changes, economic downturns, and changes in consumer demand for telecommunication services.

Interior Living

Interior Living