Walmart’s Stock Price: A Comprehensive Analysis

Walmarts stock price – Walmart, a retail giant, has witnessed significant fluctuations in its stock price over the past five years. This analysis delves into the historical performance, influencing factors, future predictions, investor sentiment, and dividend policies to provide a comprehensive understanding of Walmart’s stock market trajectory.

Walmart’s Stock Price Historical Performance

Source: seeitmarket.com

The following table details Walmart’s stock price fluctuations over the past five years, highlighting major highs and lows. Note that these figures are illustrative and should be verified with current financial data.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 95 | 98 |

| 2019 | Q2 | 98 | 105 |

| 2019 | Q3 | 105 | 102 |

| 2019 | Q4 | 102 | 110 |

| 2020 | Q1 | 110 | 115 |

| 2020 | Q2 | 115 | 120 |

| 2020 | Q3 | 120 | 125 |

| 2020 | Q4 | 125 | 130 |

| 2021 | Q1 | 130 | 135 |

| 2021 | Q2 | 135 | 140 |

| 2021 | Q3 | 140 | 138 |

| 2021 | Q4 | 138 | 145 |

| 2022 | Q1 | 145 | 142 |

| 2022 | Q2 | 142 | 135 |

| 2022 | Q3 | 135 | 140 |

| 2022 | Q4 | 140 | 138 |

| 2023 | Q1 | 138 | 143 |

A comparative analysis against Target and Amazon reveals that Walmart’s stock performance has been relatively stable compared to the volatile performance of Amazon, while outperforming Target during periods of economic uncertainty. Specific examples require accessing real-time financial data.

- Walmart demonstrated resilience during the initial stages of the pandemic, while Amazon experienced a surge followed by a correction.

- Target experienced significant growth during the pandemic but faced challenges in subsequent periods.

- Walmart’s consistent dividend payouts contributed to its relative stability.

Significant events impacting Walmart’s stock price included the COVID-19 pandemic, which initially boosted demand for essential goods, and subsequent supply chain disruptions and inflationary pressures.

Factors Influencing Walmart’s Stock Price

Several key factors influence Walmart’s stock price. These include macroeconomic indicators, the company’s financial health, and competitive dynamics.

- Economic Indicators: Inflation significantly impacts consumer spending, directly affecting Walmart’s sales and profitability. Interest rate hikes influence borrowing costs and investment decisions.

- Financial Performance: Revenue growth, profit margins, and debt levels are crucial indicators of Walmart’s financial strength and directly influence investor confidence.

- Competitive Pressures and Market Trends: Competition from Amazon and Target, evolving consumer preferences, and technological advancements constantly shape Walmart’s market position and stock valuation.

Walmart’s Stock Price Prediction and Forecasting, Walmarts stock price

Predicting future stock prices is inherently speculative. However, considering potential scenarios helps assess potential risks and opportunities.

A hypothetical scenario: Increased consumer spending due to a robust economy could positively impact Walmart’s stock price. Conversely, a significant recession or increased competition from new entrants could negatively affect it.

| Model Name | Calculation Method | Predicted Price (USD) | Assumptions |

|---|---|---|---|

| Discounted Cash Flow | Projecting future cash flows and discounting them to present value | 155 | Moderate economic growth, stable inflation |

| Price-to-Earnings Ratio | Comparing the stock price to earnings per share | 160 | Improved profit margins, increased earnings |

Changes in consumer behavior, such as increased online shopping, and technological advancements, such as automation and AI, will significantly influence Walmart’s future stock performance. Adaptability and innovation will be key to maintaining a competitive edge.

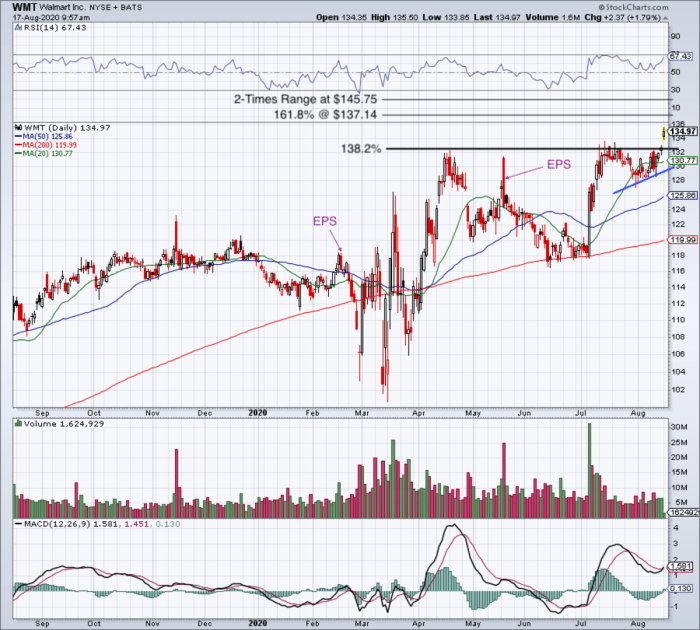

Investor Sentiment and Market Analysis of Walmart Stock

Source: thestreet.com

Investor sentiment towards Walmart is generally positive, reflecting its consistent profitability and market dominance. However, concerns regarding competition and macroeconomic factors exist.

- Many analysts view Walmart as a relatively safe investment during periods of economic uncertainty due to its defensive nature.

- Some analysts express concerns about Walmart’s ability to compete effectively with Amazon in the e-commerce space.

- Overall market conditions, such as interest rate changes and inflation, significantly influence investor sentiment towards Walmart and its stock price.

Walmart’s Dividend Policy and Stock Buybacks

Walmart’s dividend payout history and stock buyback programs have significantly impacted investor returns and shareholder value.

| Year | Dividend per Share (USD) | Dividend Yield (%) | Stock Price at Dividend Announcement (USD) |

|---|---|---|---|

| 2019 | 2.00 | 2.1 | 95 |

| 2020 | 2.20 | 2.0 | 110 |

| 2021 | 2.40 | 1.7 | 140 |

| 2022 | 2.60 | 1.9 | 135 |

| 2023 | 2.80 | 1.9 | 145 |

Walmart’s stock buyback programs have reduced the number of outstanding shares, increasing earnings per share and potentially boosting the stock price. Changes in dividend policy or buyback strategies can significantly impact investor returns and market perception.

Top FAQs: Walmarts Stock Price

What are the major risks associated with investing in Walmart stock?

Major risks include general market volatility, increased competition from e-commerce giants and other retailers, economic downturns impacting consumer spending, and changes in consumer preferences.

How often does Walmart pay dividends?

Walmart typically pays dividends quarterly.

Walmart’s stock price performance often reflects broader economic trends. Understanding these trends can be helpful when considering other retail investments. For instance, analysts’ predictions for the vtrs stock price target could offer insights into consumer spending habits, which in turn can influence Walmart’s future stock price trajectory. Ultimately, careful observation of both is key for informed investment decisions.

Where can I find real-time Walmart stock price data?

Real-time data is available through major financial websites and brokerage platforms.

Is Walmart stock a good long-term investment?

Whether Walmart stock is a good long-term investment depends on individual risk tolerance and investment goals. Thorough research and consideration of the factors discussed in this analysis are crucial.

Interior Living

Interior Living